The USD/CHF pair extended its downside movement and now it has escaped from a major range pattern. The downside breakout could announce a potential deeper drop. Surprisingly or not, USD resumed its depreciation even if the US reported better than expected data. The Unemployment Claims and the Chicago PMI beat expectations, but the US dollar resumed its sell-off.

The Dollar Index's deeper drop could force the pair to approach and reach new lows. We have a strong positive correlation between these two. Fundamentally, CHF received a helping hand from the Switzerland KOF Economic Barometer which was reported at 107.0 above 106.2 expected.

USD/CHF dragged lower by the Dollar Index

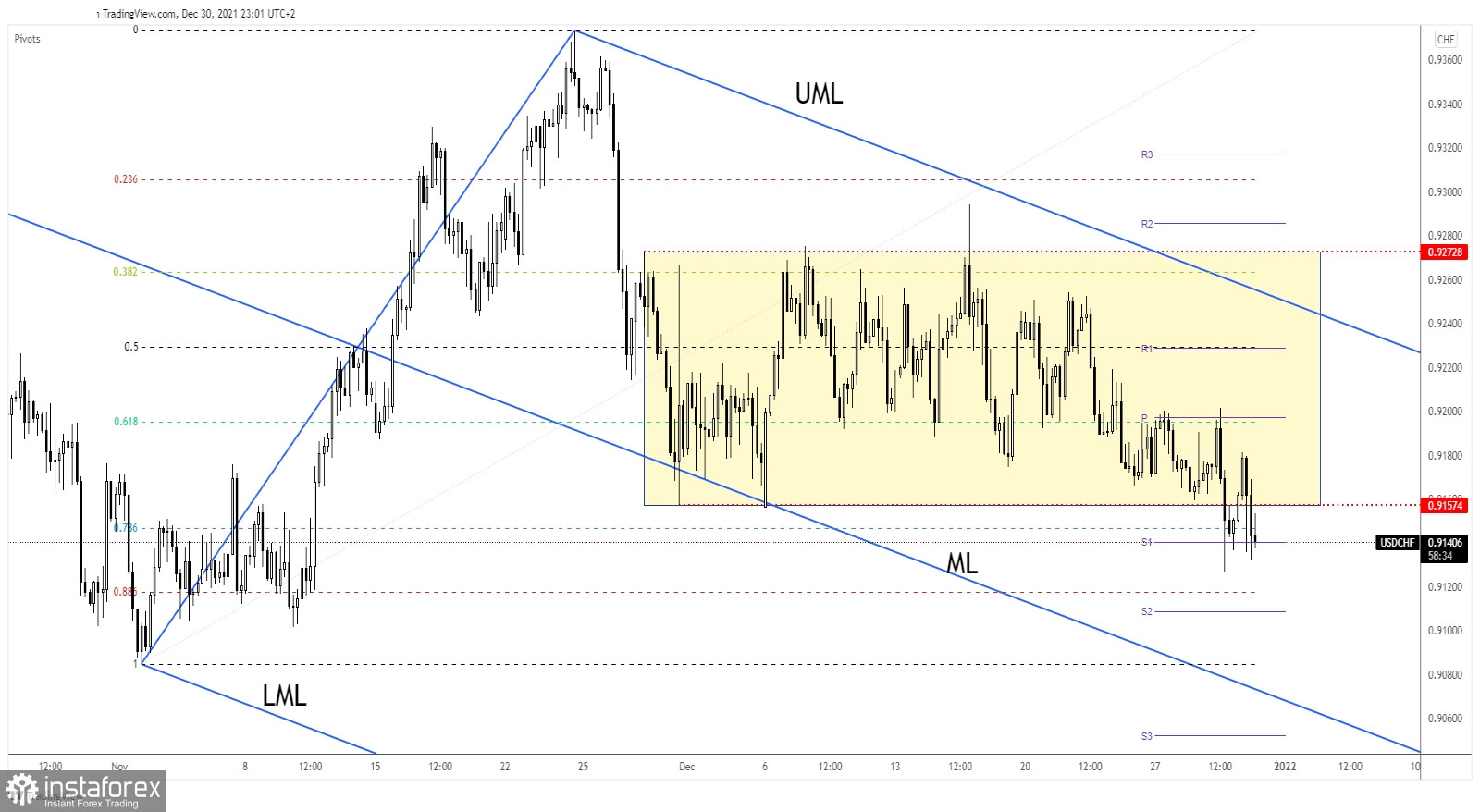

USD/CHF was trapped between 0.9272 and 0.9157 levels. As you can see on the H4 chart, the pair registered a valid breakdown from this pattern signaling more declines. Its failure to close above the 61.8% retracement level and above the weekly pivot point (0.9197) signaled an imminent downside breakout.

Now, it challenges the weekly S1 (0.9140) static support. Closing and staying below it could announce a potential deeper drop towards 0.9108 weekly S2. Technically, after its failure to approach and reach the descending pitchfork's upper median line (UML), the USD/CHF could be attracted by the median line (ML).

USD/CHF prediction

Dropping and closing below the range support of 0.9157 activated potential deeper drop. The weekly S2 and the median line (ML) could be used as potential downside targets and obstacles if the USD/CHF extends its downside movement. When the price escapes from a range pattern, it could resume its movement in the breakout direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română