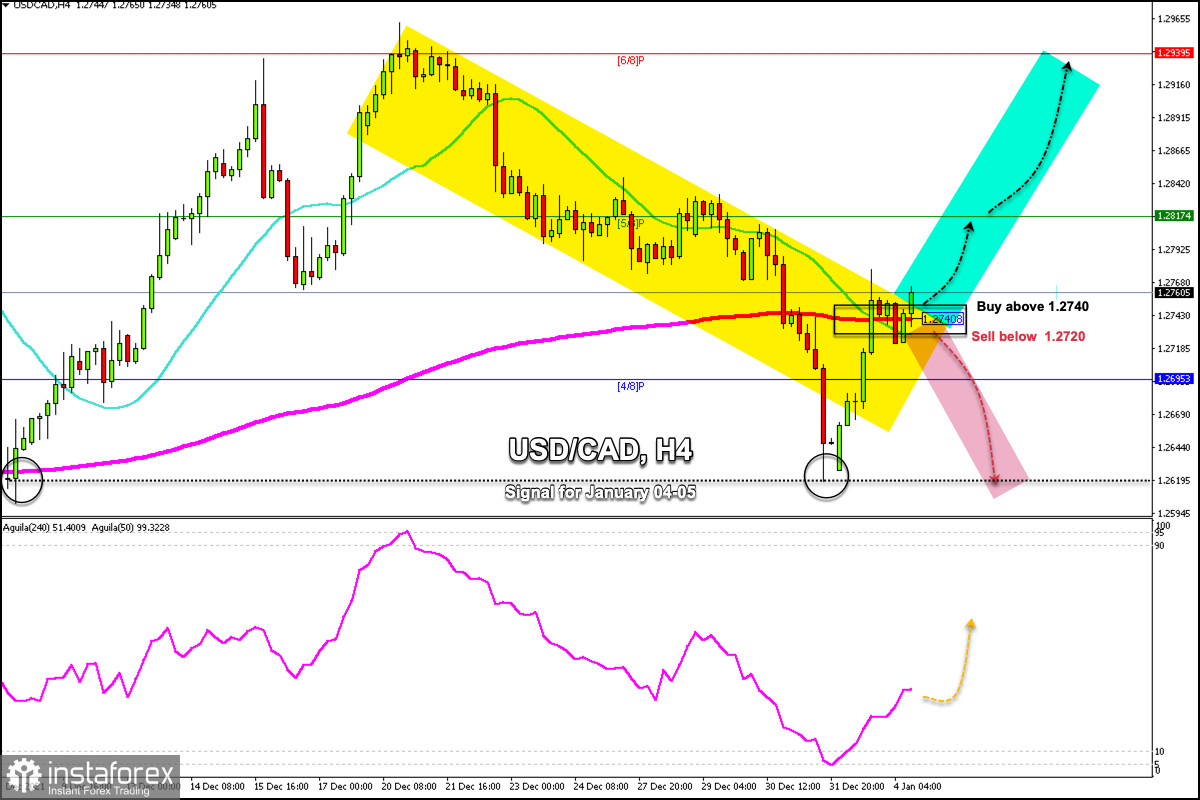

USD / CAD has risen again above the key level 1.2740. The EMA of 200 is located in this area. Having started 2022 at the low of 1.2620, the currency pair continues a technical rebound. Now the outlook for this pair suggests the downside.

As long as USD/CAD remains trading above the key level of 1.2740, the loonie could rise to the zone of resistance 1.2817 where 5/8 of Murray is located and which has been an important balance area in the past.

You can buy and expect the pair to rise to 1.2817 and up to the psychological level of 1.30 according to the positive signal of the eagle indicator.

On the contrary, if in the next few hours, the loonie consolidates below 1.2720 (21 SMA), it could be the beginning of a new downtrend (yellow color) and we could expect the pair to fall back towards the low 1.2610.

The US dollar index (#USDX) managed to consolidate above the EMA 200 area located at 95.80. It now faces strong resistance at the 7/8 Murray reversal line.

If the USDX fails to break above 96.48, it could give the loonie a chance to get stronger again. For this, we should wait for USD/CAD to trade below the 200 EMA on the 4-hour chart. The 200 EMA is located at 1.2840. Then, we could sell with targets towards 4/8 of Murray at 1.2695.

Since December 31, the eagle indicator has been giving a positive signal when it reached the key 5-point level. Therefore, a correction could encourage the bulls to enter the market with long positions around the support of 4/8 of Murray at 1.2695.

Our trading plan for the next few hours is to buy above 1.2740. If the price manages to consolidate below this level, we should sell with targets at 1.2695 and 1.2620.

Scenario

Timeframe | 4-hours |

Recommendation | Buy |

Entry Point | 1.2740 |

Take Profit | 1.2817, 1.2939 |

Stop Loss | 1.2705 |

Murray Levels | 1.2817, 1.2939, 1.3061 |

Alternative scenario

Recommendation | Sell |

Entry Point | 1.2720 |

Take Profit | 1.2695, 1.2610 |

Stop Loss | 1.2755 |

Murray Levels | 1.2695, 1.2573, 1.2451 |

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română