Hi everyone! Mulling over the situation in the market of precious metals, a lot of investors and traders are wondering whether all this hype is a bubble. Is the market actually overheated? Will they have an opportunity to buy at a lower price? With my vast trading and investment experience, I'll try to shed light on these questions. But let me warn you first that I don't have the last word on the matter and could be wrong.

When we say that a particular asset is cheap or on the contrary expensive, we compare its price with something else. Is it cheap or expensive in relation to what? Let's take Tesla and compare the electric vehicle maker with TOYOTA, the equally popular and beloved brand by many generations. Which company is more valuable? The answer seems to be obvious. TOYOTA is more valuable as its market capitalization is worth $160 billion and any city is flooded with its cars. However, this is wrong. Tesla's market capitalization equals $279 billion which makes it the most valuable car maker in the world.

Now let's compare business efficiency of both companies. TOYOTA has 360,000 employees and its sales are measured at $792,000 per one employee. At the same time, Tesla has 48,000 staffers, 7 times less than at its rival. Moreover, its car sales are measured at $512,000 per one employee. If you were the only owner of the Japanese car manufacturer, you would make a profit of your investment in 17 years due to sales revenue. When it comes to Tesla, you would need mere 296 years to have a good return on your investment. Until then, Tesla would work with losses for long years.

The example with #TSLA proves that investors' behavior is often irrational and lacks logic. They are poised to believe in a dream rather than be pleased about dividends of 3.11% per annum which TOYOTA pays off its shareholders. Bingo! I would say this is nothing but hype which is going on now. What I mean, when people say that gold is overvalued now, I want to remind them that unlike the fashionable electric car, gold has been valued high since the times of Adam and Eve. Gold has survived and outpaced other assets in turbulent times. Now the market of precious metals is going through the hype.

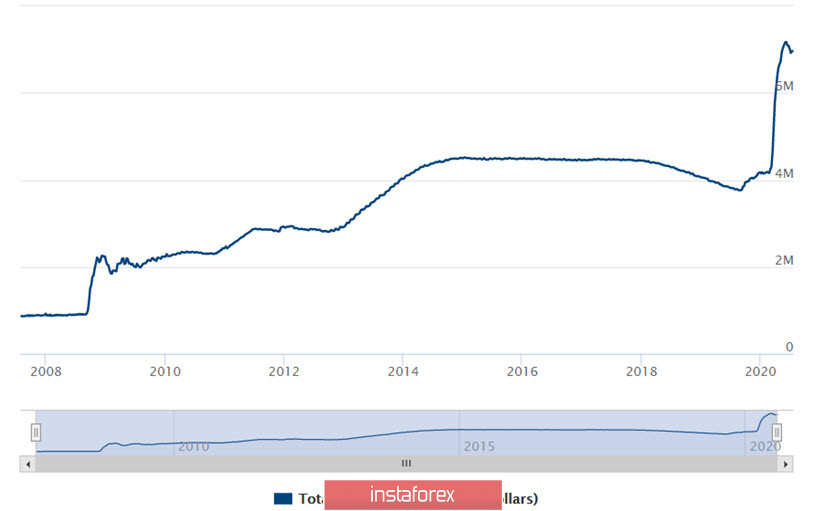

A year ago when the global community was unaware of COVID-19, Donald Trump stepped up pressure on the US Fed, so that the regulator launched a cycle of rate cuts. At present, the official funds rate is a wee bit above zero. It is expected to stay there indefinitely. Besides, the Federal Open Market Committee signals that it will go on buying bonds at the same pace. In other words, the Fed is going to pump up the money supply at the same pace. Over 5 months of this year, the Fed's balance sheet ballooned by the staggering $3 trillion (see picture 1). I'm impressed. And you?

Picture 1. US Fed Balance Sheet from June 2007 until July 2008

Let's suggest that the US Fed keeps on printing cash at the same pace as they say, its balance sheet will swell to $10 trillion until the year end. To be honest, the Fed's balance sheet contracted by $200 billion since late May on account of excessive reserves. Perhaps the central bank decided to do some maintenance with the printing press =).

The money supply is always used for some purposes. The massive injection of liquidity revived the equity market and propelled a rally of US stocks. However, the lack of alternative values and the search for shelter assets created new bullish momentum of gold and other precious metals. In a nutshell, speculators are wondering where to invest their savings amid the havoc in the US economy. Many kinds of business have survived at all worldwide. No one dares to predict when exactly the pandemic will come to an end. The stock market is overvalued. The bond market yields minor profits. The risks of holding sovereign debt are rising. No wonder, amid such conditions investors shift focus towards eternal safe haven assets, including gold, silver, and platinum.

Back to the crucial question. Can gold extend its stellar rally? I suppose yes, it can. If investors are ready to buy like they are going nuts now, gold is set to extend its climb despite out speculations on what is expensive and what is cheap. Tesla is a good example.

Thus, if you have an opportunity to buy precious metals today, then you should do it. I expanded on gold and silver in my previous articles. As for platinum #PLF, it slipped out of my attention. So, today I'd like to consider it in detail. Indeed, platinum has good prospects for further growth.

Relative to other precious metals, investors downplay platinum because of its industrial nature. The main field of its application is a catalyst agent in diesel engines. In addition, platinum is used in medicine as well as in production of higher octane gasoline and jewelry. Nevertheless, its application in jewelry is not so popular as gold and silver. The principle difference of platinum from gold is that the former is not an investment asset. Nevertheless, a balance between supply and demand determines any price. Curiously enough, the main source of demand is commodity speculators especially on North American exchange floors. These bulls are betting on a further increase. They have plenty of money. How can we judge what speculators are doing now and want to do? There are legal ways to find out. We should analyze official information about long and short positions on exchanges for any commodity. Yes, I mean the Commitment of Traders Report (COT) which is released by the US Commodity Futures Trading Commission (CFTC). Let's look at this before we make any conclusions.

On the whole, platinum is not a very liquid asset. At the peak of its popularity in January 2020, open interest in platinum reached 106,000 contracts which is modest compared to gold. Open interest for gold was 1 million contracts that time. For silver it was over 300,000 contracts. In May, demand for platinum collapsed to 45,000 contracts to the level of 2012. However, shortly after gold and silver set out on a long upward journey, platinum also aroused interest among investors.

Since May, speculators are buying platinum slowly but surely. At present the number of open long contracts is a bit over 20,000. Interestingly, the platinum market still lacks big money despite the fact that the price has rocketed over 50% from the lows of $600. On the one hand, it means that the ongoing price growth rests on weak fundamentals. On the other hand, there are prospects for a spike in case other precious metals extend their rally. In fact, there are good reasons for that.

Picture 2. Technical analysis of platinum for 1 to 6 months ahead

Well, despite my wish to tell you smart fundamental ideas, the main source of information is a technical chart. Moreover, let me share a secret with you. I never consider fundamental information on any asset unless I see its prospects on the chart. Back to platinum, I'm confident that it has prospects for further growth. Another thing, the ongoing correction can suggest you a decent market entry point.

At present, #PLF is moving inside the rising channel, having surpassed resistance of $874 recently. This opens the door for a further climb. In the lower side, I see strong support at near $820 which consists of moving averages and trendlines. The pivot point is at $750. Thus, in case there is a buy signal, it is possible to open a long position from $800-870 with the first target at $1,050. Stop loss could be set below $750 that ensures the risk/reward ratio at least of 2:1. Please be prudent and careful! Make sure you follow money management rules!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română