In anticipation of the main events of this week, the USD/JPY currency pair is strengthening its positions and is trading near 106.27. Let me remind you that today US President Donald Trump is expected to speak at the congress of fellow Republicans. As a rule, the statements of the American leader are very unpredictable, so it is very difficult to determine the rhetoric of his speeches.

Also in the focus of market participants is the speech of the Chairman of the US Federal Reserve System (FRS) at the economic symposium in Jackson Hole, which will be held in virtual mode due to COVID-19. The speech of the head of the Federal Reserve will be devoted to monetary policy, where the topics of inflation and the yield curve of US government bonds will be touched upon.

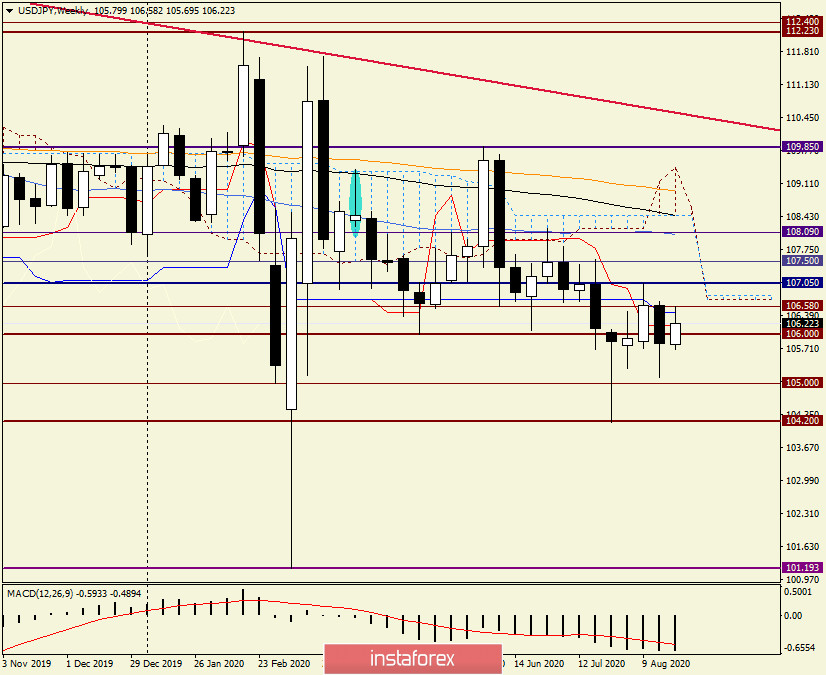

Weekly

In the meantime, we will move on to the price charts of the dollar/yen currency pair and start with the results of last week. At the trading on August 17-21, the pair declined to 105.10. However, near the most important psychological and technical level of 105 yen per dollar, it gained support and began to recover. As a result, the last weekly candle had a long lower shadow, which could indicate the subsequent growth of the quote with a high probability. As we can see, this is exactly what is happening at the moment.

However, the Kijun and Tenkan lines of the Ichimoku indicator provide active resistance to growth attempts, as well as the level of 106.58. In my opinion, players should not only pass the Kijun and Tenkan lines to increase the exchange rate, but also secure trades for USD/JPY above the important technical level of 107.00. Only in this case, it is possible to further move the quote in the north direction, where the nearest targets will be 107.50 and a strong technical resistance zone of 108.00-108.20.

Bears have no easier tasks. In order for the market for USD/JPY to come under their control, a true breakout of the landmark level of 105.00 is necessary, after which the road to the support of 104.20 will open and it will be possible to test this level again for a breakout.

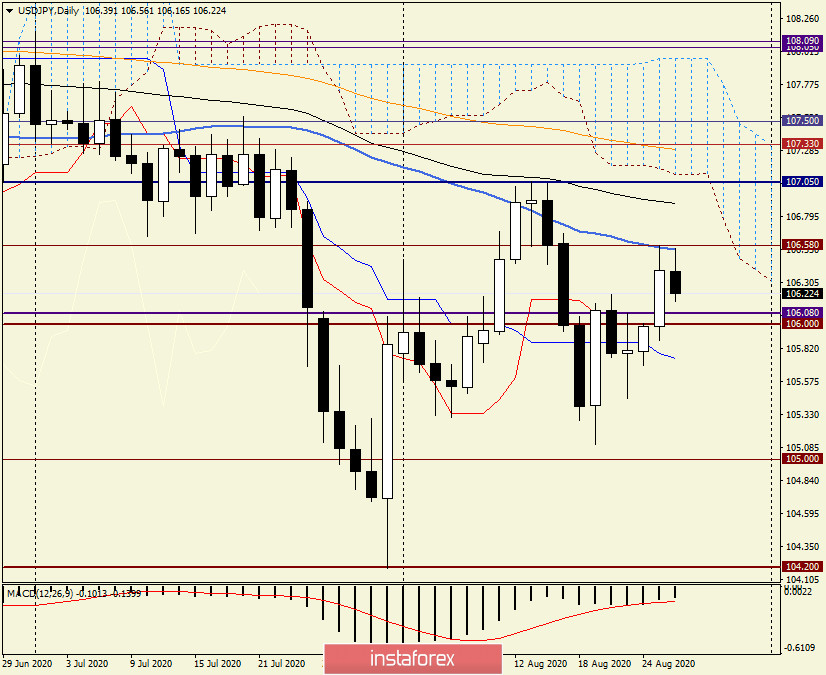

Daily

As can be clearly seen on this timeframe, the pair's further upward path is blocked by a 50 simple moving average, which was not broken yesterday, and today the pair has completely moved to a downward trend from 50 MA.

If the current decline continues, its nearest target will be the area of 106.10-106.00, where the daily Tenkan line passes and the significant technical level of 106.00. If the last mark is broken, the further goals of the players to lower the rate will be 105.74 (Kijun), and then the levels of 105.45 (lows on August 21), 105.11 (lows on August 19) and the key level of 105.00.

If market sentiment changes and yesterday's strengthening resumes, it will first need to pass 50 MA and update the highs on August 25, ending today's trading higher. Only if these conditions are met, serious buyers will return to the market and the pair will be able to rise to higher prices, which were indicated when describing the weekly timeframe.

If you go to the trading recommendations, the most relevant are purchases of USD/JPY after short-term declines in the price zone of 106.20-106.00 and the appearance of bullish candle analysis models there. Do not forget about the upcoming speech of Jerome Powell, which is expected with such interest by market participants. Well, today from the US at 13:30 (London time), a block of data on inventories for durable goods will be released. I believe that these statistics may have some impact on the price dynamics of the instrument.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română