Gold continues to retreat. During the previous global economic crisis, investors bet on the growth of XAU/USD against the backdrop of a large-scale monetary stimulus that could lead to acceleration on inflation. Unfortunately, this did not happen, and the precious metal moved to the territory of the "bears".

It is generally assumed that the price of gold is derived from two factors: the real yield of US Treasury bonds and capital flows in ETFs. The fact that the rates of the US debt market are close to a record bottom, and the process of increasing stocks of specialized exchange-traded funds has never been as fast as this year, allows us to explain the achievement of record highs by XAU/USD quotes. According to the World Gold Council, due to falling demand for jewelry, bullion and coins, the share of ETFs in the structure of global demand for precious metals in the second quarter increased to 40%. For comparison, the figure was 6% a year ago. At the same time, the correlation of gold prices with capital flows to exchange-traded funds is even higher than its relationship with the real yield of US Treasury bonds.

Dynamics of gold correlation with ETF stocks

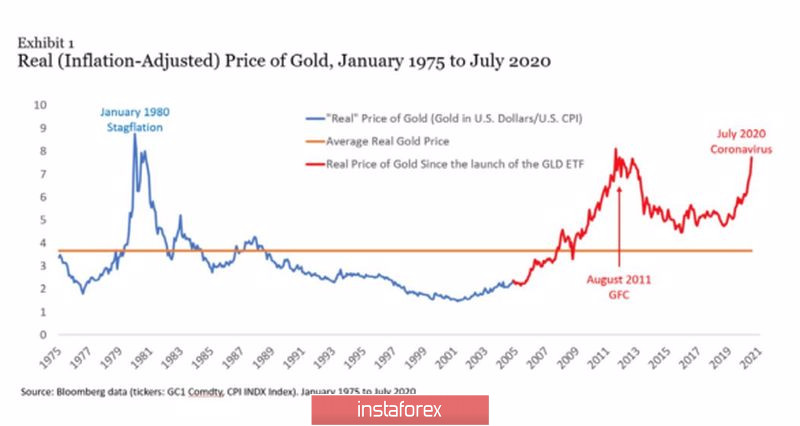

Investment demand adds XAU/USD volatility, however, there is a perception in the market that capital flows in ETFs follow the price, and not the other way around. At the same time, the stability of the US debt market rates makes us look closely at the dynamics of inflation. Consumer prices in the States increased by a modest 1% in 12 months, including July, and the bond market signals that their growth will not exceed 1.7% in the next decade. In addition, if you adjust the price of gold by CPI, the precious metal begins to look unnecessarily expensive. As in 1980 and 2011, when the upward trend was given up.

Dynamics of gold taking into account the consumer price index

Thus, even the departure of gold from the area of historical highs does not make it undervalued. It is unlikely that it will return to them in the near future. Unless the Fed resuscitates the idea of targeting the yield curve, which was abandoned at the July meeting. TD Securities believes that the return to the market of this topic after the speech of Jerome Powell in Jackson Hole will allow you to buy precious metals.

I do not think that the Fed was seriously scared by the surge in bond yields at the beginning of the second week of August. It is unlikely that the head of the Central Bank will talk about controlling the rates of the debt market, which can be interpreted as a "bullish" signal for the US dollar and a "bearish" signal for XAU/USD. The repeated reminder that there is no need to target the yield curve will allow you to hold short positions on gold formed from the levels of $ 2015, $ 1970 and $ 1945 per ounce and increase them on the breakout of support at $ 1905. The initial targets are $ 1,870 and $ 1,835 per ounce.

Gold, the daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română