Crypto Industry News:

Singapore's Monetary Authority (MAS) has issued a new set of guidelines for Digital Payment Token Providers (DPTs), prohibiting them from marketing their services in public areas.

The guidelines issued today also warned the public about the high risk associated with the cryptocurrency market, and also prohibited DPT companies from advertising their services in public places such as public transport, public transport facilities, public websites, social networks, media platforms, and broadcast and print media .

The new set of guidelines will apply to all registered crypto service providers as well as those in transition:

"MAS emphasizes that DPT service providers should understand that DPT trading is not suitable for the general public. These Guidelines set out MAS's expectation that DPT service providers should not promote their services to the general public in Singapore."

The new set of guidelines also prohibits crypto service providers from opening ATMs in public places. However, DPT companies can still promote or advertise their services on their native websites or mobile apps. MAS's decision comes in the context of the growing popularity of cryptocurrencies with the increase in the number of physical cryptocurrency ads in the country.

Technical Market Outlook

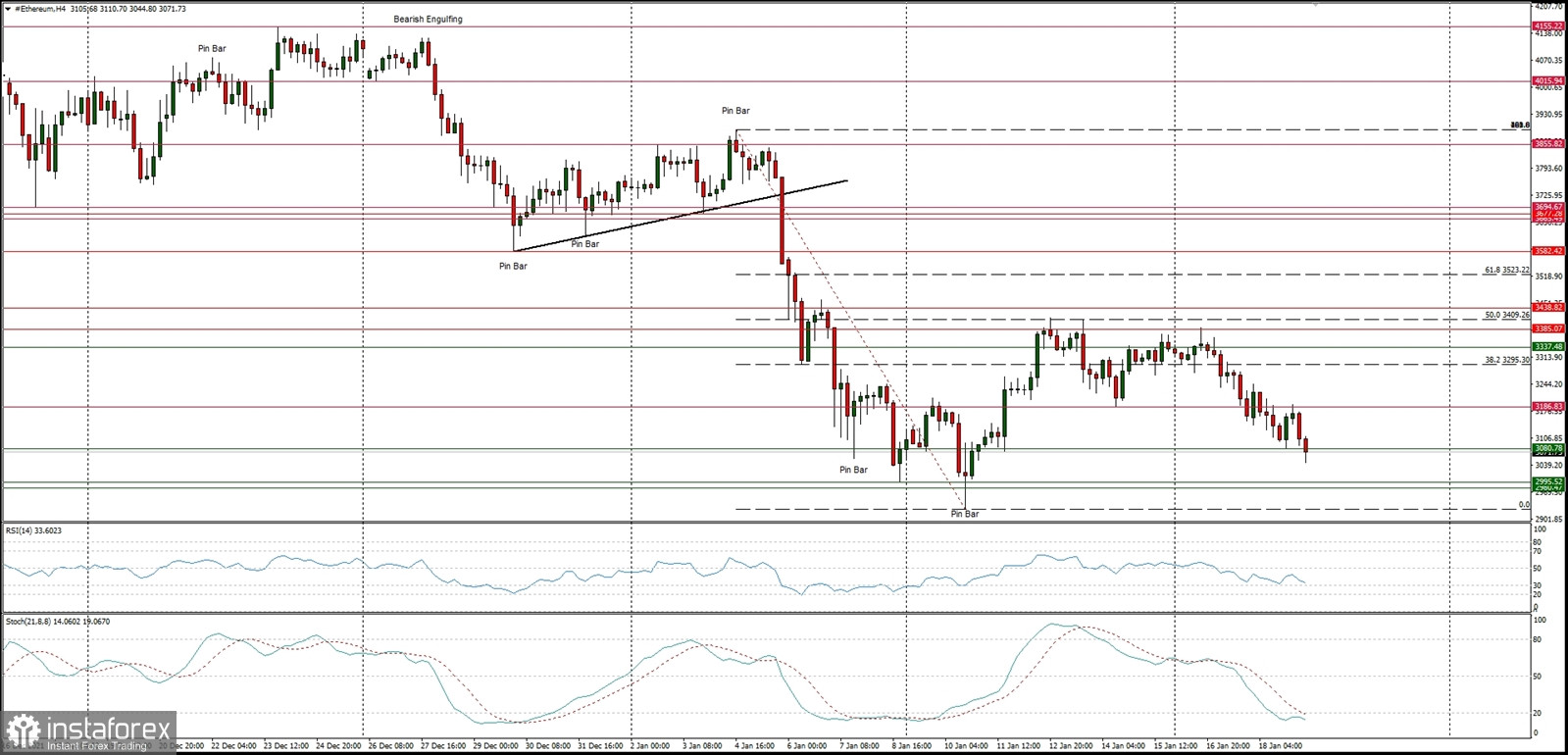

The ETH/USD pair has made another lower low at the level of $3,044 (at the time of writing the article). The momentum is below the level of fifty and the same situation is with the stochastic oscillator - the market is approaching the oversold conditions. The market participants await the event that will trigger the up move again, but the swing low located at the level of $2,926 is dangerously close. The nearest technical support is seen at the level of $3,080 and the key short-term technical resistance is seen at $3,385.

Weekly Pivot Points:

WR3 - $4,051

WR2 - $3,728

WR1 - $3,566

Weekly Pivot - $3,237

WS1 - $3,077

WS2 - $2,765

WS3 - $2,585

Trading Outlook:

The WXYXZ complex corrective cycle might soon be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,644. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română