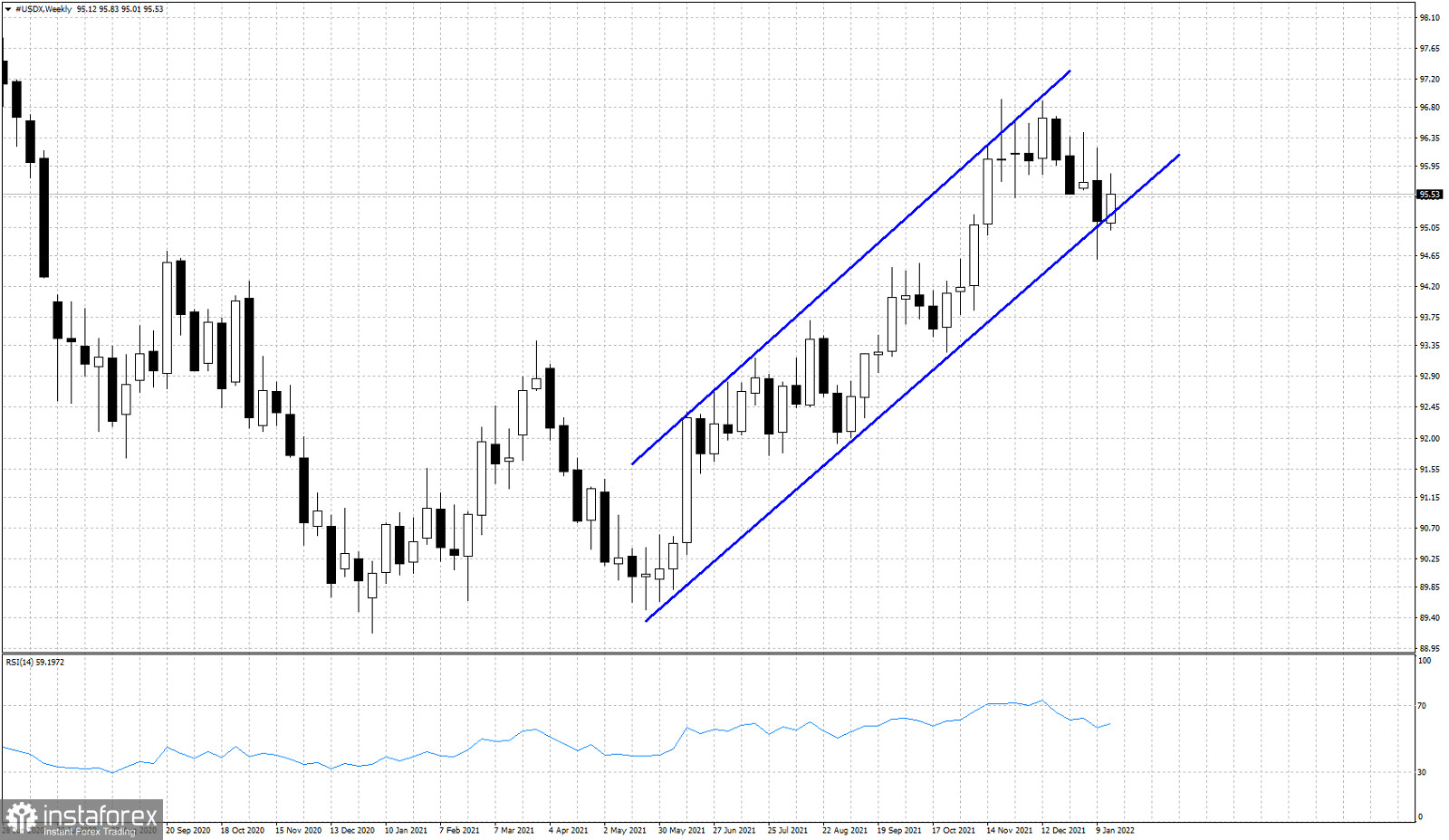

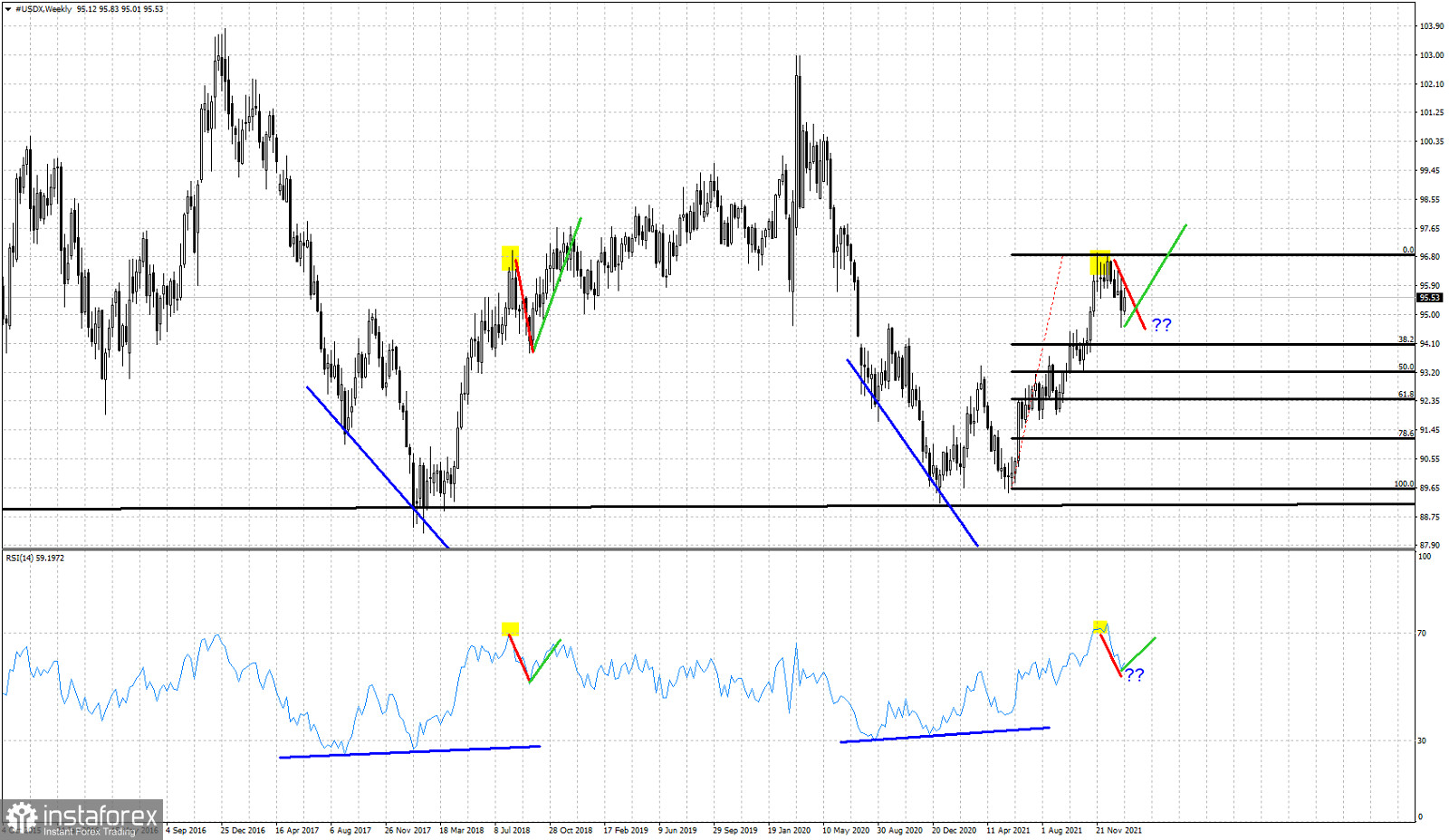

The Dollar index is in a bullish weekly trend. Despite price briefly breaking out of the bullish channel, on a weekly basis we have not seen a break down out of the bullish channel. Price continues to follow our analogy to 2017 that we have talked about many times before.

Last week price almost exited the channel. This week price is bouncing off the channel boundary. What next? Bulls do not want to see price break below this week's lows. That would be a sign of weakness.

Red line- similar declines

Yellow rectangle- similar RSI tops and short-term reversals

Green lines- expected rise similar to 2018

Will the Dollar index resume its up trend like it did back in 2018 after the red corrective pull back? The Dollar index has so far retraced only a little bit more than the 23.6% of the entire rise from 89.60. The 38% Fibonacci level has not been met. It is not necessary to reach the 38% level in order to say that the pull back is complete, but for now we should keep this scenario open, as there are still chances of a deeper correction towards that Fibonacci level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română