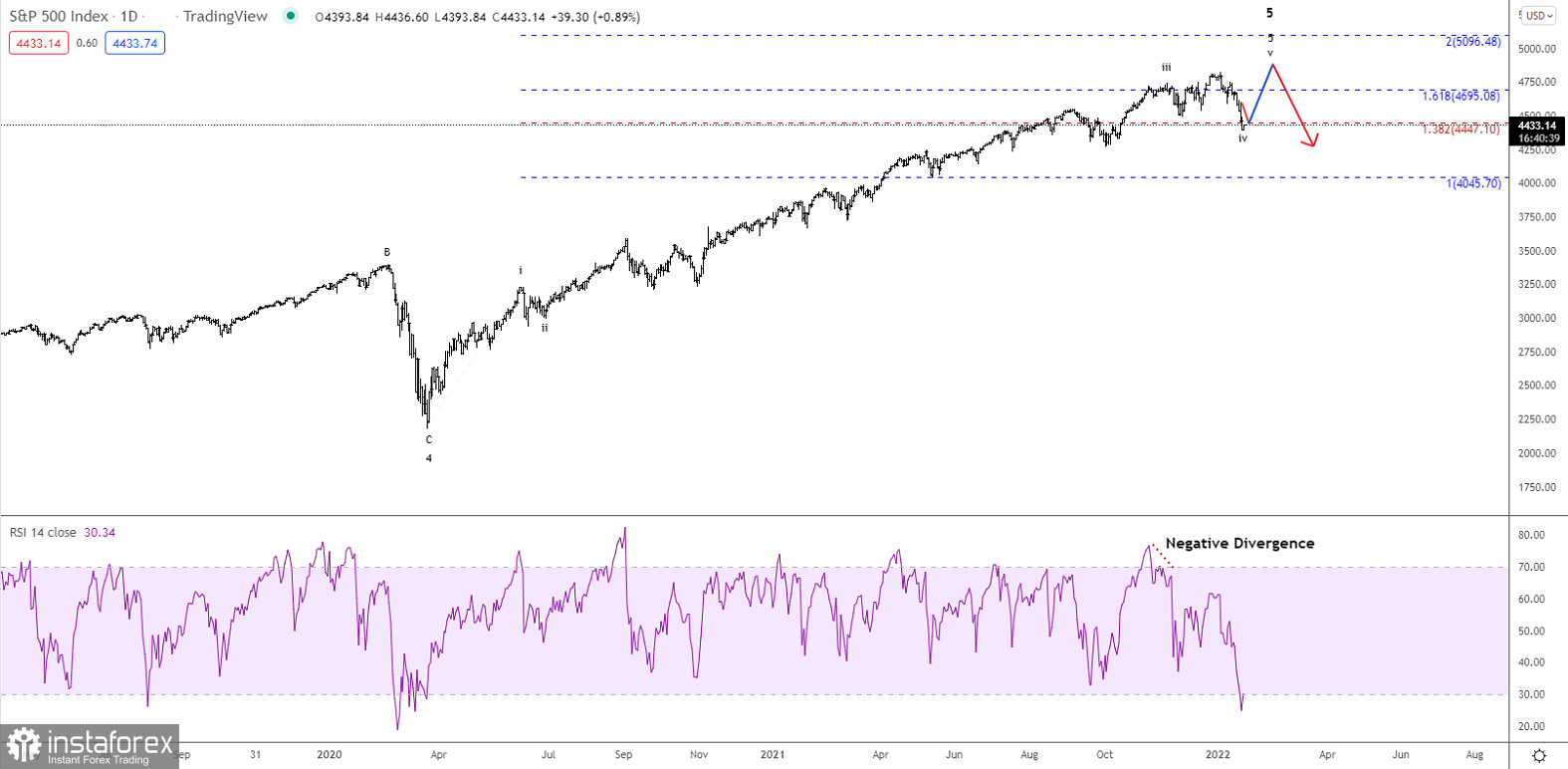

The S&P 500 index is now testing support at 4,447 as expected and we see the possibility of a final rally closer to resistance at 5,000 - 5,100 in the month ahead. Short-term we will need a break above minor resistance at 4,603 to confirm the expected rally towards 5,000.

However, once a new all-time high is made over the former peak at 4,820 it's time to be very cautious as a larger corrective decline should be expected. That said, we also have to stress, that a break below support at 4,272 will indicate that we already have seen the peak of wave 5 and the larger corrective decline already is in motion. So now is not the time to be overly bullish on the S&P 500.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română