The GBP/USD pair rebounded in the last hours but the bias remains bearish. It's trading at the 1.3488 level at the time of writing above 1.3440 today's low. The current rebound is natural as the Dollar Index dropped. Still, the GBP/USD pair maintains a bearish bias despite a temporary growth.

Today, the US and the UK economic data came in worse than expected. The greenback was somehow expected to depreciate a little versus its rivals after the Flash Services PMI dropped unexpectedly lower from 57.6 to 50.9 points far below 54.9 estimates. Furthermore, the Flash manufacturing PMI was reported at 55.0 below 56.9 expected.

On the other hand, the UK Flash Services PMI and the Flash Manufacturing PMI indicators dropped more than expected signaling a slowdown in expansion in both manufacturing and services sectors.

GBP/USD Temporary Rebound!

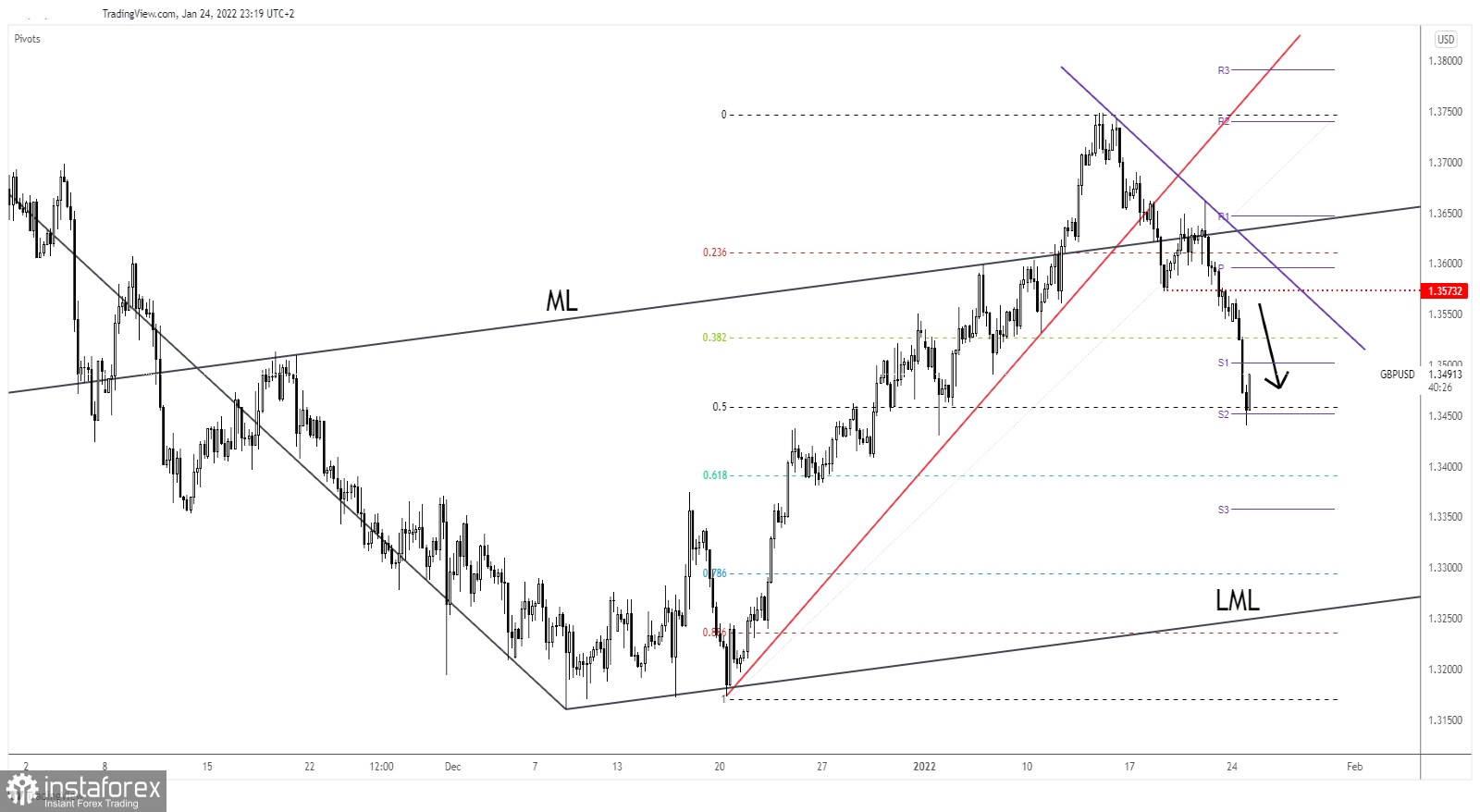

GBP/USD found support below the 50% (1.3458) retracement level failing to close below the weekly S2 (1.3452) downside obsatcle. Still, the rebound could be only a temporary one. The bounce back could help us to catch new short opportunities.

The price could only test and retest the immediate upside obstacles before resuming its downside movement. Techncially, after its failure to stabilize above the median line (ML) in the last attempts, GBP/USD signaled that we may have a downwards movement.

GBP/USD Prediction!

After dropping below 1.3573, GBP/USD was expected to extend its sell-off. As long as it stays under the downtrend line, the pair could drop deeper anytime. Dropping and closing below the weekly S2 (1.3452) could activate further drops and could bring new selling opportunities!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română