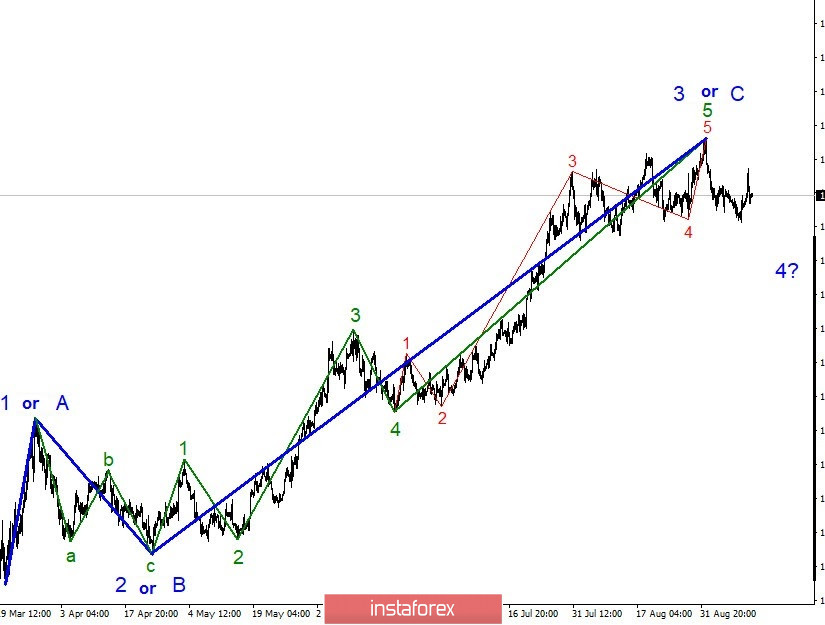

Globally, the wave pattern of the EUR/USD pair looks quite convincing. The quotes leaving the highs reached recently confirms the assumption that the construction of wave 3 or C is completed. On the other hand, the presumed wave 4 takes on a three-wave form, and waves 1 and 2 or a and b are clearly visible in it. Thus, after the quotes leave the lows reached, the quotes may now decline again within the third wave of a new downward trend or wave 4 as part of an upward trend.

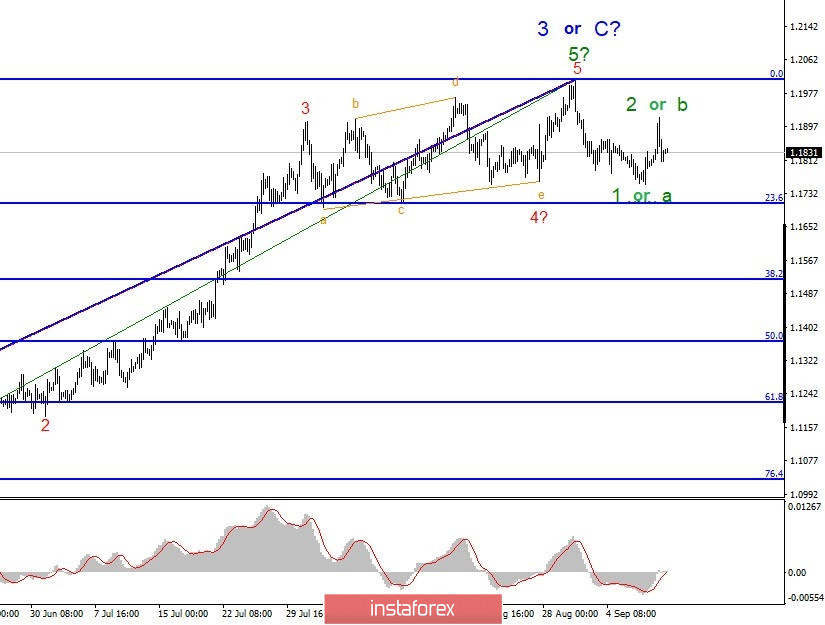

The wave pattern in smaller scale shows that the formation of supposed wave 5 in 5 in 3 or C has completed. If this is true, then the quotes' decline will continue with targets located around the 23.6% Fibonacci level within the declining wave 4 or, possibly, even a new declining set of waves. At the moment, we see the first and second waves as part of a new global wave, so we expect the quotes of the pair to decline.

Yesterday, all the attention of the currency market was focused on the results of the ECB meeting. And although there were no important decisions, the rates and volumes of the QE and PEPP programs were not expanded. But still, the markets were quite active. The euro first gained about 100 basis points, and lost the same 100 points overnight. A specific reason for such price surges is difficult to find. At the same time, Christine Lagarde's speech at the press conference did not provide any particular optimism or pessimism. She noted that business activity levels remain lower than before the pandemic, but overall the pace of economic recovery is good enough, higher than expected a few months ago. The ECB even raised its GDP forecast for 2020 to -8%, although it had previously expected a loss of -8.7%. Here, Christine Lagarde linked inflation problems with low energy prices and low demand for many goods and services, caused by the same pandemic crisis. In addition, she also noted that the eurozone economy will take time to recover. And it will be possible to talk about an increase in interest rates not earlier than the return of inflation to the target level of 2%, at which it has not been for the last 4 years. Thus, the problem of inflation for the eurozone remains very urgent and complicated.

Lagarde's speech is neither optimistic nor pessimistic. However, the quotes have returned to their original positions, thus forming a correctional wave. Thus, we can assume that everything went according to the wave scenario and now, the pair is ready for a new decline.

General conclusions and recommendations:

Since the euro/dollar pair has presumably completed forming the global wave 3 or C and the second corrective wave as part of the trend section starting on September 1, I recommend selling the pair with targets located near the calculated levels of 1.1706 and 1.1520, equating to 23.6% and 38.2% Fibonacci. If wave 4 is really being built at this time, then it can take a three-wave form.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română