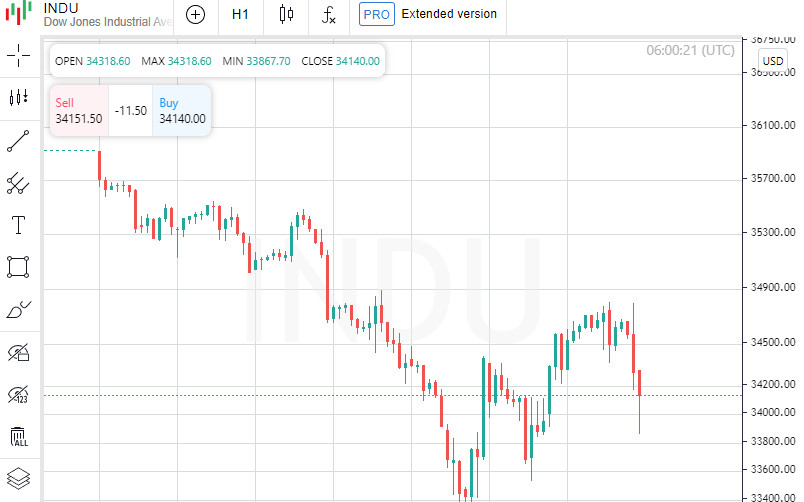

The Dow Jones Industrial Average fell 129.64 points (0.38%) by the close of trading to 34,168.09 points.

The Standard & Poor's 500 lost 6.52 points (0.15%) to 4349.93 points.

The Nasdaq Composite increased 2.82 points (0.02%) to 13542.12.

The Fed kept the interest rate on federal funds (federal funds rate) in the range from 0% to 0.25% per annum. The decision coincided with the forecasts of economists and market participants.

The Federal Open Market Committee (FOMC) of the Fed aims to achieve maximum employment and inflation at 2% in the long term. To support this goal, the committee decided to maintain the target range for the federal funds rate at 0-0.25%.

At the same time, since inflation is well above 2% per annum with a strong labor market situation, committee members expect that it will soon be appropriate to raise the target rate range. At the same time, the head of the Fed, Jerome Powell, during a press conference following the meeting, noted that FOMC members intend to raise interest rates already at the March meeting.

The American Central Bank also announced that it plans to continue reducing the volume of the asset buyback program and intends to curtail it in March.

Meanwhile, traders followed the ongoing reporting season of US companies.

Boeing Co. shares lost 4.8% in price on the news that the company's revenue fell by 3.3% and turned out to be worse than the market forecast, which was waiting for its growth.

Exchange operator Nasdaq Inc. in October-December increased profit by 16%, revenue - by 12%, and the latter figure and adjusted profit were higher than experts' expectations. Nasdaq shares fell 3.1%.

Telecommunications and media company AT&T Inc. returned to profitability last quarter, with adjusted earnings and revenue above forecasts. Capitalization of AT&T, however, decreased by 8.4%.

Freeport-McMoRan Inc. share price fell by 3%, although the producer of copper and gold in the last quarter of 2021 increased its net profit by 57%, revenue by 37%.

Automatic Data Processing lost 9% despite the HR software and services provider posting better-than-expected earnings and revenue in the second quarter of fiscal 2022.

Consumer goods manufacturer Kimberly-Clark Corp. in October-December of the year reduced net profit by a third, despite the growth in revenue, due to increased costs. The value of the company fell by 3.4%.

Meanwhile, US new home sales jumped 11.9% in December from the previous month to 811,000 annualized, the country's Commerce Department said. According to the revised data, 725,000 houses were sold in November (an increase of 11.7% MoM), while previously the figure was 744,000 (a jump of 12.4%).

Analysts, on average, expected a 1.8% increase in new home sales last month from the previously announced November level to 757,000.

Stock quotes of large American construction companies Lennar Corp. and KB Home were down 4.5% and 4.8%, respectively.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română