The ECB did not change the main parameters of monetary policy. The regulator left the base interest rate on loans at zero, the rate on deposits - at minus 0.5%. The rate on margin loans was kept at 0.25%.

Meanwhile, in a post-meeting press conference, ECB President Christine Lagarde warned that consumer price growth, which reached historic highs in January and December, could remain elevated for a longer period than previously expected. At the same time, she expressed the hope that inflation will begin to gradually slow down during 2022.

When asked if Lagarde was ready to repeat what she said two months ago about the low probability of a rate hike in 2022, the head of the ECB replied that she does not make promises without certain conditions, and that much will depend on the March revision of the central bank's macroeconomic forecasts.

In turn, the Bank of England raised its key rate for the second time in a row, from 0.25% to 0.5%, against the backdrop of record inflation in the UK in 30 years.

The volume of orders of industrial enterprises in Germany in December increased by 2.8% compared to the previous month, the country's Ministry of Economics reported. Analysts on average had expected a rise of 0.5%.

Retail sales in the euro area in December 2021 decreased by 3% compared to the previous month, data from the European Union Statistical Office (Eurostat) showed. Analysts polled by Bloomberg had expected a decline of 0.9% on average. In annual terms, retail sales increased by 2% instead of the expected growth of 5%.

Retail sales fell the most in Ireland (-3.2%), Spain and Finland (-3%). The most significant growth in retail sales was recorded in Slovenia (+44.1%), Lithuania (+16.2%) and Estonia (+12.6%).

Traders continue to follow the reporting season and analyze the results of European and American companies.

The composite index of the largest enterprises in the Stoxx Europe 600 region by the close of trading fell by 1.38% and amounted to 462.15 points. At the end of the week, the indicator lost 0.73%.

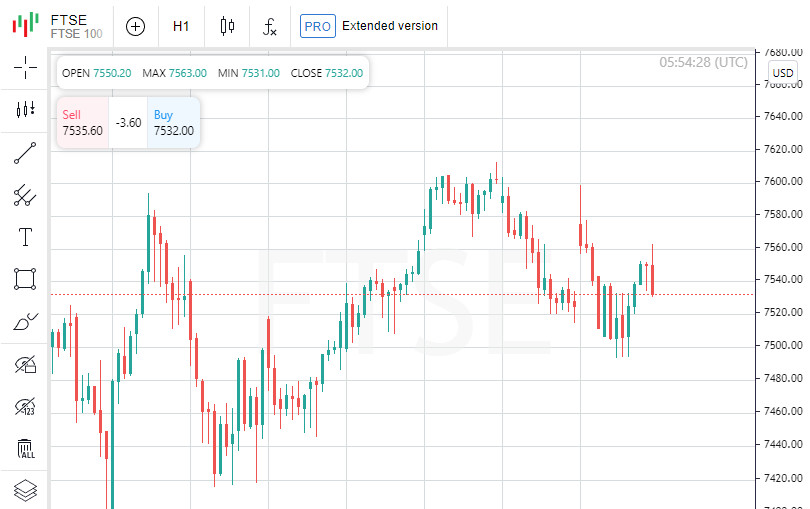

The British FTSE 100 fell on Friday by 0.17%, the French CAC 40 index - by 0.77%, the German DAX - by 1.75%. The Spanish IBEX 35 and the Italian FTSE MIB lost 1.15% and 1.79% respectively.

The French pharmaceutical company Sanofi SA increased its net profit in the fourth quarter of 2021, but the rise in revenue was worse than market forecasts. The company's shares fell 1.1%.

Italian bank Intesa Sanpaolo SpA turned profitable in the fourth quarter of 2021 and plans to return €22 billion to shareholders by 2025 as part of a new business plan. Bank papers, meanwhile, fell 2.2%.

Enel SpA shares lost 2.1%. The Italian energy company boosted revenue in 2021 on the back of better business segment performance, but profit growth slowed.

Capitalization of the Swedish biopharmaceutical AddLife AB collapsed by 26.3%. The company said its CEO Christina Wilgard plans to retire this year.

The value of Swedish door lock maker Assa Abloy AB jumped 7% after the release of the report. The company posted a net profit of SEK 3.04 billion ($334.2 million) in the fourth quarter, which was higher than the market forecast. Assa Abloy also increased its dividend.

Shares in British tech Oxford Nanopore Technologies PLC rose 1% after analysts at Berenberg released a positive report on the company's outlook following the Festival of Genomics 2022 event.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română