EUR / USD

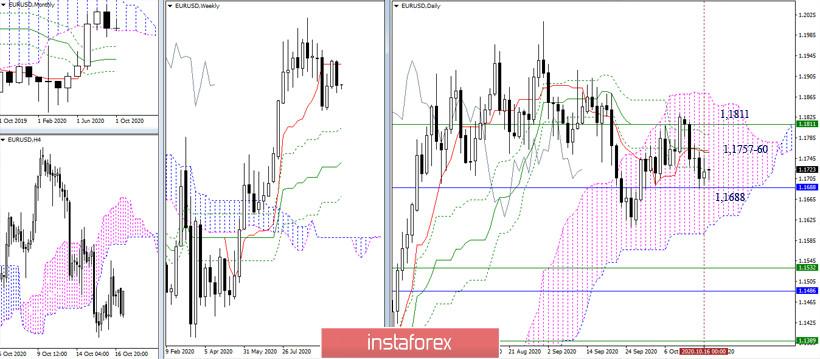

The retest of the short-term trend of Ichimoku (1.1811) ended with a rebound. However, the support of the lower limit of the monthly cloud (1.1688) continues to protect the bulls' interest. Now, only a reliable breakthrough will allow us to hope for an increase in bearish sentiment. In this case, the main task for the bearish players will be to exit the daily bullish cloud (1.1615-33) and consolidate in the bearish zone relative to the cloud. On the other hand, if the bullish players manage to stay within the daily and monthly clouds (1.1688), then the pair will first return to the middle of this area in the form of a day cross (1.1757-60), and then it will be possible to move to the weekly short-term trend (1.1811).

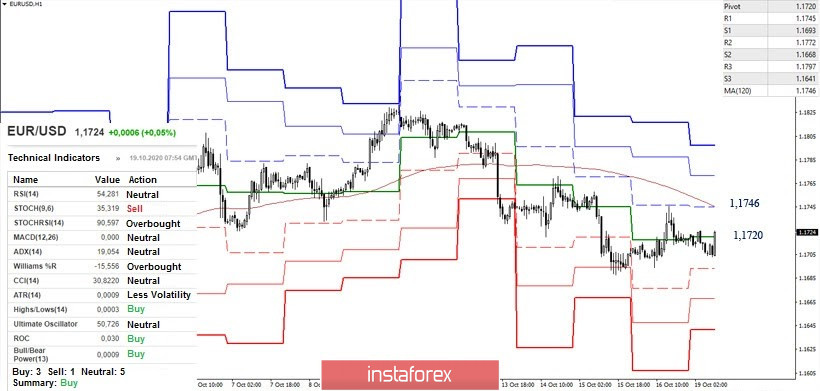

The euro is in the correction zone in the smaller time frames. The key resistances are now located at 1.1720-46 (central pivot level + weekly long-term trend) and are strengthened by resistances of the upper time frames (1.1757-60). After consolidating above and turning the moving average, it will be possible to talk about the bullish' advantages not only on the hourly TF, but also in the daily TF. Moreover, there will be new upward targets. If the bears maintain their positions in the near future and restore the downward trend (1.1688), the low will coincide with the main support level (1.1688 monthly Senkou Span A), which will be followed by further plans towards 1.1668 (S2) - 1.1641 (S3) on the hourly chart, and daily targets 1.1615-33 on the upper time frame.

GBP / USD

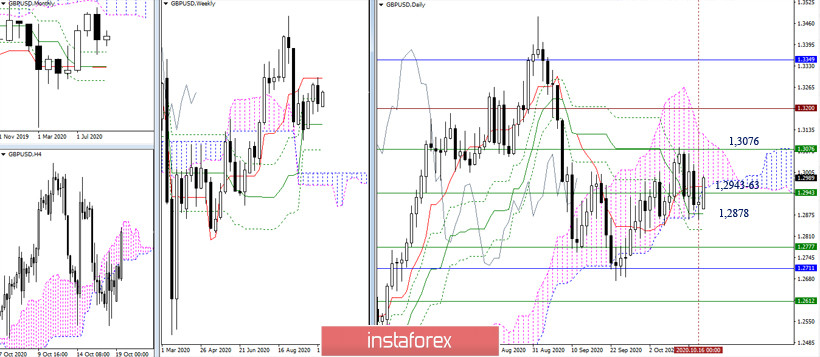

The bears are done testing the weekly short-term trend (1.3076) with a rebound, but they failed to break through the accumulation of daily supports around 1.2878 (daily cross + lower limit of the cloud). As a result, the opponent chose a strategy to restore positions today. A return to the daily time frame in the Ichimoku cloud and closing the day above 1.2943-63 (weekly Fibo Kijun + daily Tenkan) will further strengthen the bulls. The most significant upward pivot point continues to be 1.3076 (weekly Tenkan).

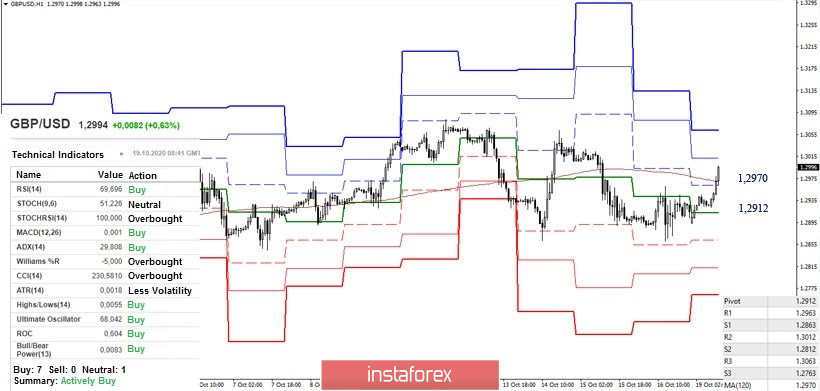

At the moment, there is a struggle for key levels and a bullish advantage in the smaller time frames. A consolidation above the weekly long-term trend (1.2970) and the reversal of the moving average will allow the bulls to make new plans to capture the important level of 1.3076 (weekly Tenkan). Moreover, the resistances of the classic pivot levels within the day are located today at 1.3012 and 1.3063. In this situation, it will be possible to talk about any plans and opportunities of the bears only after consolidating under the level of 1.2912 (the central pivot level).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română