To open long positions on GBP/USD, you need:

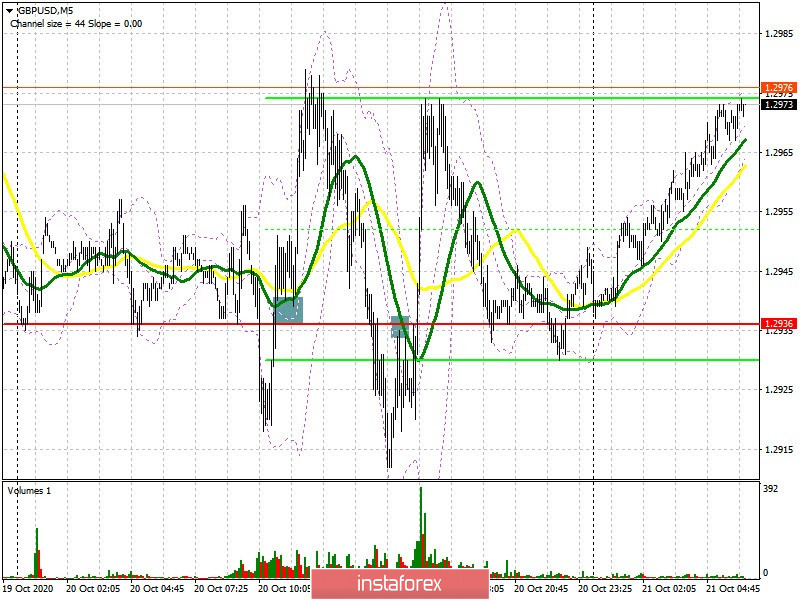

Pound sellers tried to regain control of the market several times yesterday, but nothing good came of it. The bulls managed to seize the initiative each time. Let's take a look at the 5-minute chart and break down the trades. You can see that after forming a breakout and settling below the 1.2936 level in the first half of the day, testing this range on the opposite side produced a good entry point for short positions, but this did not lead to anything good. As a result, after the bulls returned to the 1.2936 level, it was possible and necessary to open long positions in order to continue strengthening the pound. The British currency gained more than 40 points, afterwards the market stopped. Then the same signal appeared for the pound's leverage during the US session, but the movement was down by around 15 points, afterwards the bulls returned the pair to the area above support at 1.2936.

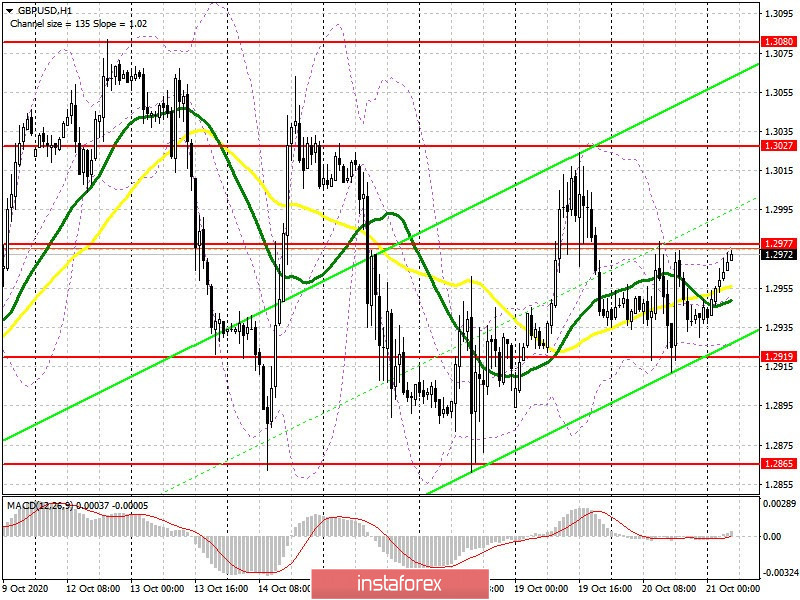

The technical picture has slightly changed due to all these movements. The bulls are now aiming for a breakout and to be able to settle above the resistance of 1.2977, which forms a good signal to buy the pound in order to renew the weekly high in the 1.3027 area, where I recommend taking profits. If the UK inflation data turns out to be better than economists' forecasts, this will sustain the bull market and push the GBP/USD to the 1.3080 high. If the pair falls in the first half of the day, it is best not to rush to buy, but to wait for a false breakout to appear in the area of yesterday's support at 1.2919, from which the pound actively rebounded several times. Pressure on the pair can significantly increase in case bulls are not active at this level. Therefore, I recommend opening long positions immediately on a rebound but only from a large support level in the 1.2865 area, counting on a correction of 30-40 points within the day.

The Commitment of Traders (COT) reports for October 13 showed that both long and short non-commercial positions have decreased. Long non-commercial positions declined from 40,698 to 36,195. At the same time, short non-commercial positions significantly dropped from 51,996 to 45,997. As a result, the negative value of the non-commercial net position slightly increased to -9 802 , against -11,298 a week earlier, which indicates that sellers of the British pound retain control and also shows their slight advantage in the current situation.

To open short positions on GBP/USD, you need:

Sellers clearly do not intend to give up the market and the whole emphasis in the morning will shift to resistance at 1.2977. Forming a false breakout on it, together with weak inflation data in the UK, forms a signal to open short positions in the pound, which, at least, will keep the pair in a narrow horizontal channel, returning GBP/USD to the support area of 1.2919. We can possibly return the bear market using this level. If a breakout appears and settles below 1.2919, you can safely open new short positions in order to return the pair to a large support at 1.2865, where I recommend taking profits. The next target will be the low of 1.2807. If sellers are not active at the 1.2977 level, and the UK inflation data turns out to be better than economists' forecasts, then you can only consider short positions for a rebound from the weekly resistance of 1.3027, counting on a downward correction by 20-30 points within the day.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates market uncertainty with direction.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

A breakout of the upper border of the indicator in the 1.2977 area will lead to a new wave of growth for the pound. A breakout of the lower border of the indicator around 1.2920 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română