EUR / USD

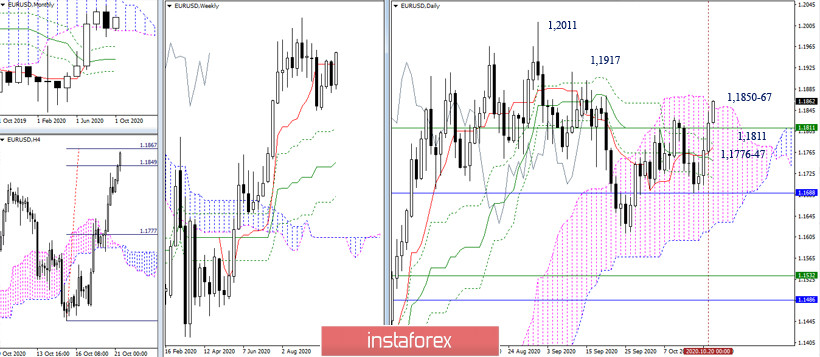

The bulls resumed its upward movement and are now testing an important resistance zone formed by the combined upward benchmarks – the upper limit of the daily cloud (1.1850) and the target for the breakdown of the H4 cloud (1.1849-67). In the case of a reliable consolidation above, the bullish players will be able to build new goals and plans. Meanwhile, the weekly short-term trend (1.1811), which was broken yesterday, acts as the nearest support level for today.

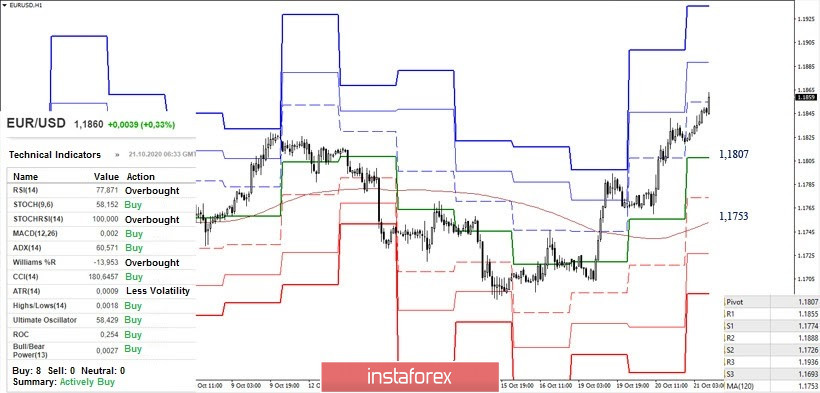

After the euro has consolidated above the key levels, the advantage in the smaller time frames is on the bulls' side, who continue to rise. At the moment, the first resistance of the classic pivot levels 1.1855 (R1) is being tested, after that we can continue further to the levels of 1.1888 (R2) and 1.1936 (R3). Moreover, the key levels are forming support at 1.1807 (central pivot level) and 1.1753 (weekly long-term trend). Today, the nearest support level can be noted at 1.1774 (S1).

GBP / USD

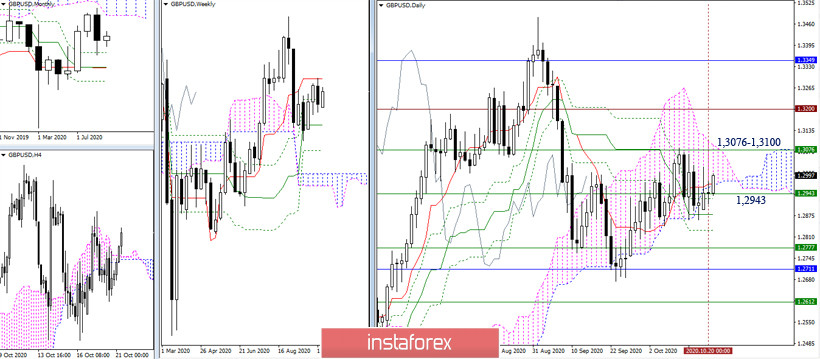

The current uncertainty has formed a daily Doji centered on the weekly Fibo Kijun (1.2943). Yesterday, the bulls failed to return to the daily cloud again or catch the daily short-term (1.2972). Today, they continue to act in this direction. The next upward pivot point is located at 1.3076 - 1.3100 (weekly Tenkan + exit from the daily cloud to the bullish zone). If the bulls failed to break through this and return below the level of 1.2943, the relevance will be taken by the support levels of 1.2878 (daily Kijun) - 1.2830 (daily Fibo Kijun) - 1.2777 (weekly Kijun) - 1.2711 (monthly Fibo Kijun).

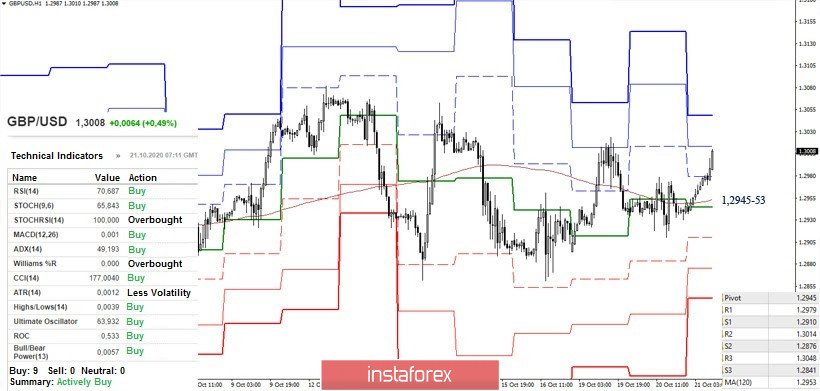

There was a struggle for key levels yesterday in the smaller TFs, which are now strengthened by the weekly Fibo Kijun (1.2943). Today, the bulls have taken the lead and are trying to increase their advantage. At the moment, the second resistance of the classic pivot levels is being tested (1.3014), which will be followed by 1.3048 (R3). A return to the key supports of 1.2945-53 (weekly long-term trend + central pivot level), together with a reliable consolidation below, will swing the scales again in favor of restoring the bearish initiative. Today, the support levels are located at 1.2910 - 1.2876 - 1.2841.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română