Great Britain appeared to be some type of a hard-to-get girl, so the European Union had to make unimaginable lengths just to get her to agree to a date. Here, imagine that Brussels was forced to guarantee London its economic sovereignty. It was only after this that the UK confirmed its agreement to resume negotiations. In general, it looked as if this ill-fated trade agreement was needed not by London, but by Brussels. But despite the absurdity of what is happening, the pound increased very well together with the euro, which is possibly under the impression that the EU pretends to be ready to make some concessions. This is as if earlier, Brussels completely refused to recognize the UK as an independent state, and then suddenly took it back and recognized it. In general, it is likely that the issue may move forward. But if both parties do not make a statement, then there will clearly be no progress. Now, we should wait for a new round of negotiations which is expected next week.

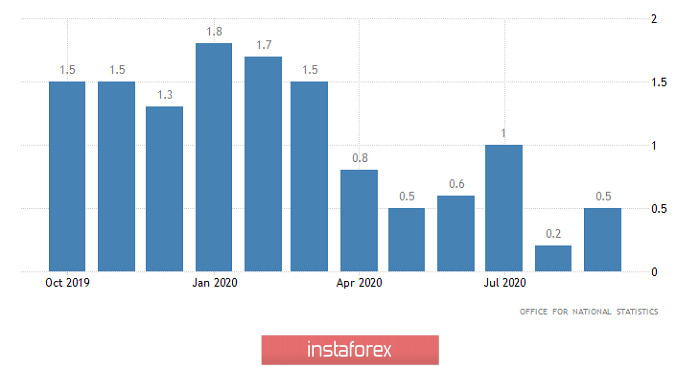

It is noteworthy that as the market closely monitors what is happening between the EU and the UK, it did not notice at all the inflation of the country. But the difference is not much, as the growth rate of consumer price rose from 0.2% to 0.5%. Nevertheless, we should expect the pound to grow, although we are still uncertain what would happen to the euro.

Inflation (UK):

In any case, it is very clear that as this week started, both the pound and euro have sharply risen, which means they are noticeably overbought. At the same time, we don't expect serious information on this issue until the negotiations resume. Thus, this is a great time for local correction. But what will be the reason? This may be due to data on applications for unemployment benefits in the US. In fact, the number of initial applications should increase from 898 thousand to 915 thousand, while repeated applications are much more important. The number of which may decline from 10,018 thousand to 9,750 thousand. In total, the number of applications should decrease by 251 thousand. However, the most important thing is that the number of re-applications for the first time since the pandemic began should decline below 10,000 thousand.

Repetitive Unemployment Insurance Claims (United States):

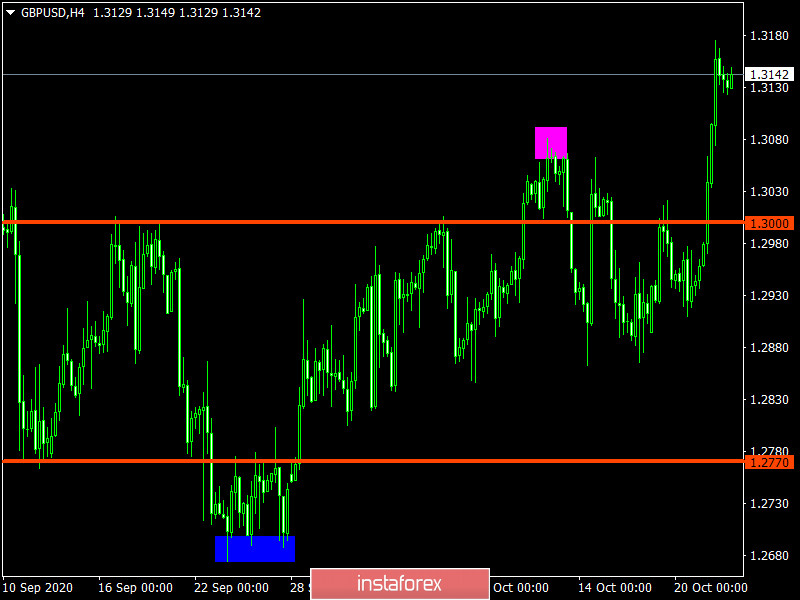

The GBP/USD pair showed high activity. As a result, the quote rushed to the level of 1.3175, where there was a slight stagnation. We can assume that if the price does not clearly consolidate above 1.3180 in the H4 TF, the market will experience a technical correction in the direction of 1.3080.

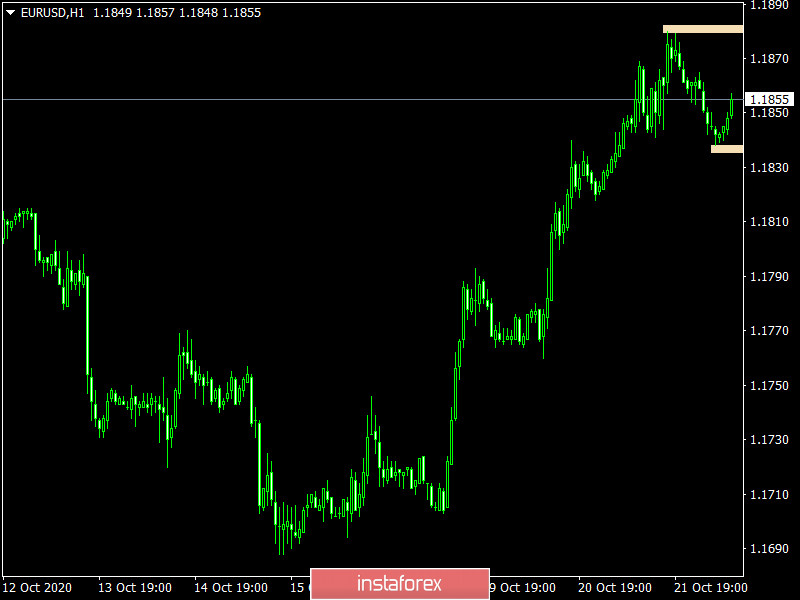

The EUR/USD pair showed an upward interest, which led to an update of the local high and focus within the values of 1.1835/1.1880. We can assume a temporary fluctuation in the values of 1.1835/1.1880, where, depending on the price consolidating points, the next movement in the market will be clear.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română