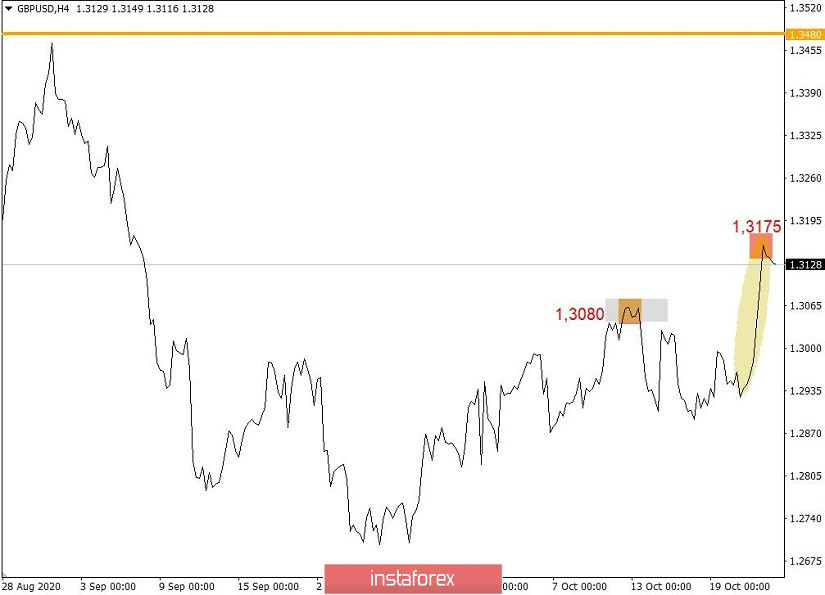

Very high activity was recorded in the GBP / USD pair yesterday, which resulted in a strong upward movement, past the local high of October 12 (1.3080). The quote moved up by more than 239 pips, which is a rare occurrence in the market.

What was the reason for such an impressive price change?

The main factor was the news regarding Brexit, when the UK and the EU officially agreed to resume negotiations over a trade agreement. (Recall that last week, UK Prime Minister Boris Johnson suspended negotiations, which signaled a "hard Brexit" - Britain's exit from the EU without a trade deal).

This resumption of negotiations increased the chance of seeing a positive outcome, which raised speculative activity, on which long positions were opened in the market.

Meanwhile, from the point of view of technical analysis, the breakdown of the local high (1.3080) became a leverage for buying the pound, which triggered many orders and, as a result, a strong upward movement.

With regards to the current location of the quote, a slight pullback has occurred from 1.3175, however, it looks more like a stagnation than a recovery in dollar positions.

The clear overbought signal of the British pound could also lead in a decrease in long positions, which would result in a technical correction towards the level of 1.3080.

Nonetheless, attention should be given on all news about Brexit, as any update related to the topic could provoke speculative leaps in the market, depending on the rhetoric and the outcome of the negotiations. Positive news will lead to an increase in the British pound, while negative news, that is, the lack of common ground in negotiations, will lead to a decline in the pound's value.

So, based on the factors presented above, here are possible scenarios that could occur in the GBP / USD pair:

First scenario: price correction

A decrease in long positions will lead in a technical correction towards the price level 1.3080.

Second scenario:

Speculative activity amid news on Brexit will lead to the breakdown of local high 1.3175, which will result in a further upward move towards 1.3250.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română