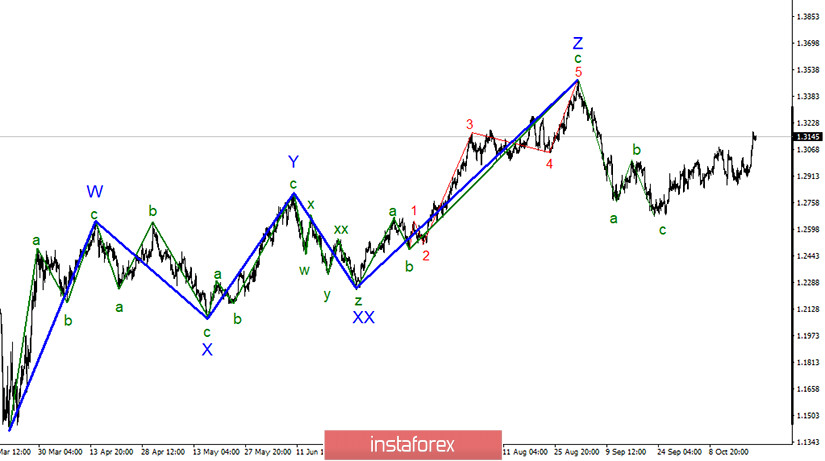

On the global scale, the wave marking seems to be getting even more complex. The formation of the downward structure of the trend stopped and is limited by the a-b-c waves. Thus, a new upward global wave could have begun its formation. It could further lengthen the entire uptrend section that started on March 19, making it even more complex. However, the first waves of the global trend look unusual. Therefore, this scenario is unlikely to unfold. Meanwhile, the information background could lead to a steep fall of the pound sterling.

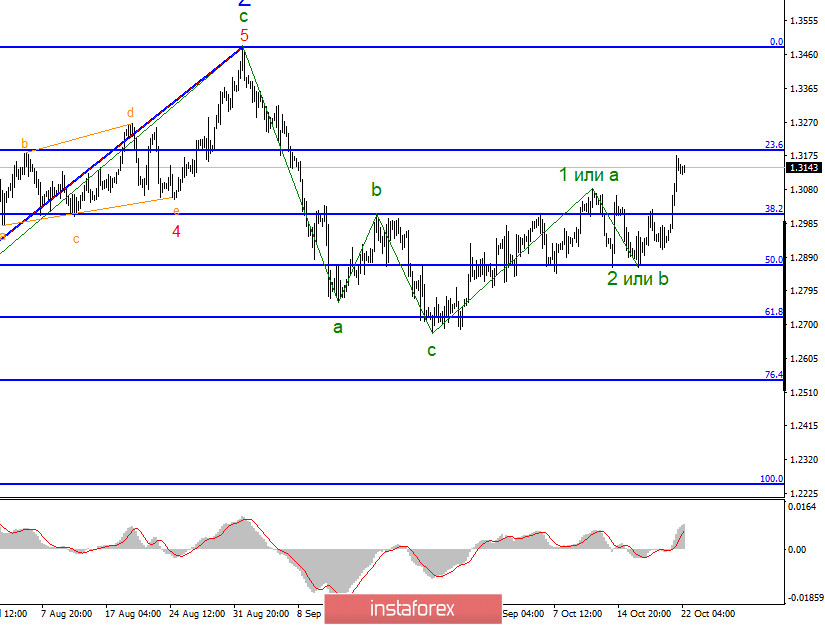

Taking a closer look, we can notice that the wave marking between October 1 and October 23 took a three-wave shape and looks quite normal. An unsuccessful attempt to break through the Fibonacci retracement levels of 61.8% and 50.0% led to an increase in quotes. As I have already mentioned, the information background can play a dirty trick on the British pound. So far, it looks as though the upward structure of the trend has resumed. However, the instrument may also move in three-wave corrective structures.

There is still very little positive news for the pound. However, it does not bother market players who continue buying the pound and selling the greenback at the same time. Interestingly, there were no compelling reasons for a spike in the British pound. Trade negotiations between the United Kingdom and the European Union ended without any agreement multiple times. Surprisingly, it didn't trigger a depreciation of the pound sterling. Yesterday, it became known that the parties were now willing to continue the trade talks. Moreover, they were now preparing to concede. Against this background, the British pound surged by 200 pips. Back in the days of Theresa May, the pound was increasing on hopes and expectations of the market. Similar events could take place again. The desire to concede announced by both parties does not necessarily mean that these concessions will be enough to notice any progress in negotiations. Tomorrow, the parties may report that the tenth round of negotiations failed. Most likey, the British pound will be sent into a tailspin in such a case.

Governor of the Bank of England Andrew Bailey will speak today on the possibility of negative key rates. This is likely to have an adverse impact on the pound sterling. Notably, the pound has been extremely volatile lately, 150-200 basis points.

General conclusions and recommendations:

The pound/dollar pair has supposedly finished the construction of the downtrend section. A successful breakout attempt at the Fibonacci retracement level of 38.2% indicates that the instrument can be bought with the targets at 1.3191 and 1.3480, that is the 23.65 and 0.0% Fibonacci retracement levels. However, against the current information background, the wave chart is likely to become even more complex.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română