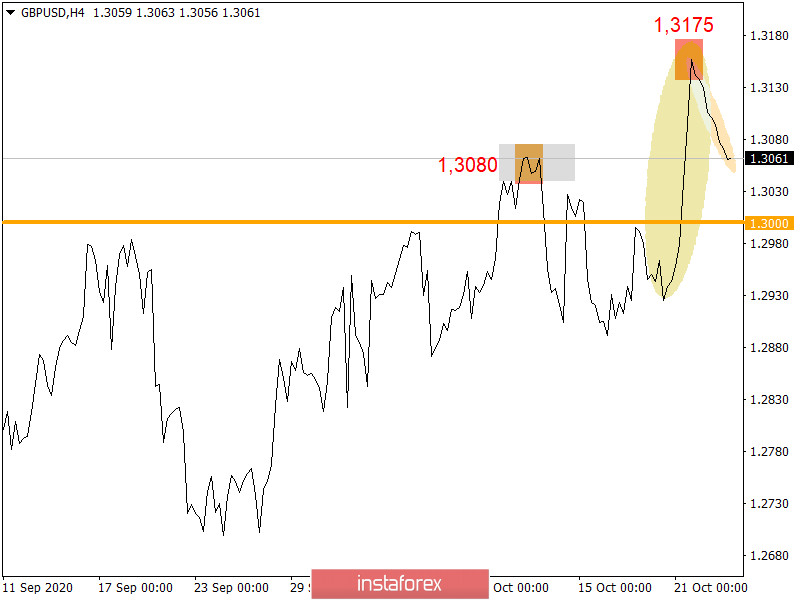

The GBP/USD pair became overbought after an active growth last October 21, which resulted in a technical correction and led to the consolidation of buy deals.

Overbought happens in the market after a strong upward movement, which has led to a significant change in quotes.

Taking a closer look at the dynamics on October 21, you will see that the value of the pound strengthened by 239 points, which is considered very fast and a lot. This led to an overbought status and a corrective movement.

Regarding the quote's current location, you can see that market participants have already managed to pull back the pound's rate below 1.3080, which indicates the prevailing downward interest in the market.

Here, trading forecasts can be drawn from a number of possible market development scenarios.

First scenario: Continuation of the correction

The quote is holding below 1.3080, which was followed by the formation of a corrective move in the direction of the main support level of 1.3000.

Second scenario: Market goes into a side fluctuation mode

The correction is already completed, but the upward move does not return in the market, which leads to a variable turn in the sideways move. So, the values of 1.3000//1.3080 can serve as the fluctuation limits.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română