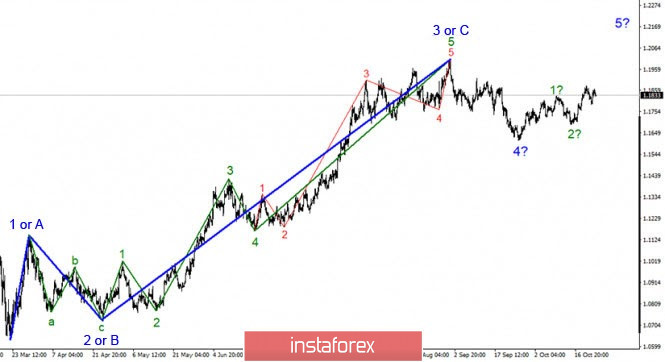

On the global scale, the wave marking of the EUR/USD instrument still looks quite convincing and has not changed recently. Thus, the formation of wave 5 of the upward trend section is still expected, which dates back to March. At the moment, waves 1 and 2 can be seen inside this wave. If the current wave markup is correct, then the price increase will continue from the current values with targets located near the peak of wave 3 or C. Three waves are also visible inside wave 4. There is at least one alternative variant of a wave marking. Let's look at it below:

The wave counting on a smaller scale still shows that the intended wave 4 has assumed a three-wave form and is complete. If this is true, then the price increase will continue within the 3 to 5 wave. At the same time, a not-too-active increase in quotes suggests that the entire section of the trend that begins on September 25 may take a three-wave form, and the entire section of the trend that begins on September 1 will take a corrective form. In this case, after completing the top three, you can start building the bottom three. But for now, this is a fallback option.

In recent weeks, the news background has had a very weak impact on the instrument. First, it should be recognized that the instrument has spent the last few months in a fairly narrow price range: only 200 or 250 basis points. Therefore, I would not talk about the influence of the news background on the wave picture and the movement of the instrument in general. It is unlikely that there have been no important news and economic statistics over the past two months. However, the markets are still avoiding to trade the instrument more actively. There is only one hope now — the US presidential election. It is possible that this event and its consequences will go unnoticed by the markets. After all, this is politics, not Economics. Nevertheless, the end of the election may give the markets a sense of confidence in the future and a sense of certainty. At least for now, there are no other catalysts that can take the instrument out of a very narrow price range.

Another crucial matter is the aid package for the US economy, which is still not agreed and accepted. For now, it is unlikely to be passed by Congress before the election. But there are still no definite answers to these questions: what will happen after the election, how long will the vote count last, and who will become the next President of the United States. It is this uncertainty that can keep the markets from active trading. Nevertheless, the wave pattern continues to be quite convincing and suggests the construction of an upward wave.

General conclusions and recommendations:

Since the euro-dollar pair is presumably continuing to build a 3-in-5 wave, it is recommended to buy with targets located near the estimated 1.2012 mark, which corresponds to 0.0% Fibonacci, for each MACD signal up, in the expectation of building an upward wave. The option with a possible complication of the internal wave structure of wave 4 is not yet confirmed. However, a further decline in quotes may lead to a more complex wave pattern.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română