Growing fears that the same restrictive measures that were in force this spring may soon be reintroduced in Europe are putting constant pressure on the single European currency. This is not surprising, since the epidemiological situation in Europe is getting worse and worse every day. The total number of confirmed cases of coronavirus infection, both in France and in Spain, has already exceeded a million. The Spanish government has already submitted a proposal to parliament to extend the recently introduced restrictive measures, including the curfew, for a period of six months. The Italian authorities have also announced the imminent tightening of restrictive measures. All this will inevitably affect the business, which may not survive the re-closure. So it is not surprising that investors are trying to somewhat reduce their investments in European assets, including the common European currency.

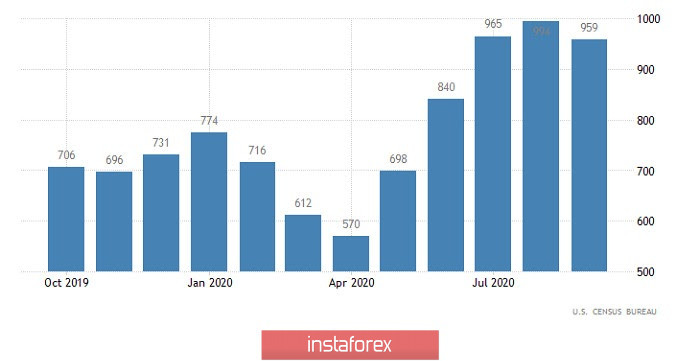

At the same time, even weak data on new home sales in the United States did not prevent the dollar from strengthening. They were predicted to rise 3.5%. But in fact, they decreased by the same 3.5%. Which of course came as a complete surprise. But in many ways, the lack of market response is not due to the coronavirus, but to the fact that these data are not so important for the market.

New Home Sales (United States):

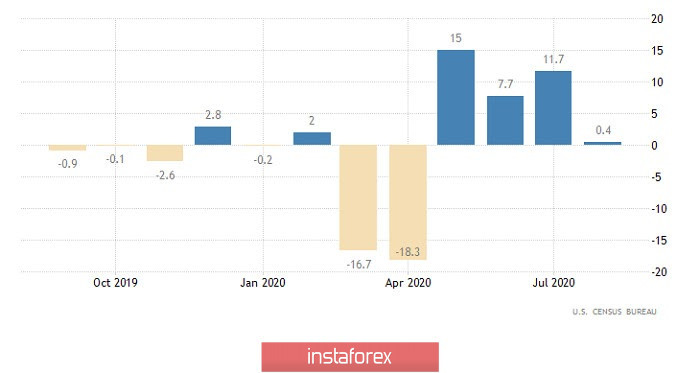

The same cannot be said for durable goods orders, which are a leading indicator for both industrial production and retail sales. And these same orders should grow by 0.4%. If it does not work out like yesterday, when the data turned out to be diametrically opposite to expectations, then the dollar will receive another reason for growth.

Durable Goods Orders (United States):

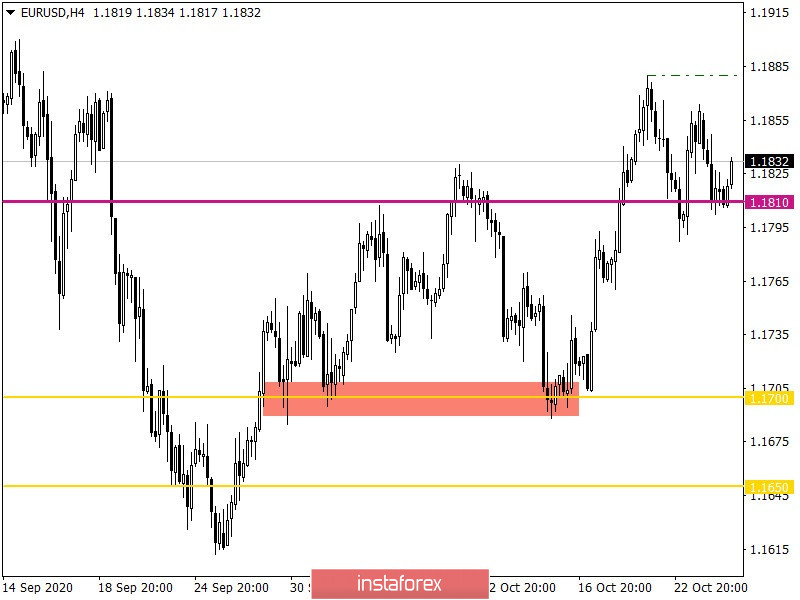

The euro/dollar pair showed downward activity on Monday, as a result, the quote fell to the 1.1810 level, where a rebound occurred on a natural basis, partially repeating the dynamics of October 23. In fact, we are still on the wave of the upward trend set in the market at the end of last month.

Based on the quote's current location, you can see the aforementioned price rebound from the 1.1810 level, where market participants are trying to locally return us to the 1.1850 area. Reaching the 1.1810 level for the second time indicates that sellers are still in the market and soon the 1.1810 level will not resist their volume.

With regard to the market dynamics, the average volatility indicator is fixed, which can play a positive role in the upcoming acceleration.

Looking at the trading chart in general terms (daily period), you can see an upward movement in a four-week period, where the 1.1612 and 1.1880 coordinates are used as local levels.

We can assume that as long as the price has not settled below 1.1800, the risk of a natural rebound will take place in the direction of 1.1850-1.1865. As soon as the price settles below 1.1800 and stays at the 1.1790 coordinate, you can start considering short positions towards 1.1710.

From the point of view of a complex indicator analysis, we see that the indicators of technical instruments on hourly periods signal a sell as soon as we reach the 1.1810 level again. The daily period is still focused on the four-week upward price movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română