The situation with COVID-19 is overshadowing everything in financial markets once again, which is mainly causing a collapse in equity markets with a parallel increase in demand for protective assets.

The decision to impose night time curfews in France, as well as the increasing cases and deaths in Germany and Sweden have already led to a collapse of European stock indices, as investors are starting to worry that the economies of European countries will be entirely closed again, which happened last spring.

In addition, the market is frightened by the uncertainty of the US election results. Although there are a lot of statements regarding this fact, it unfortunately remains as important as the second wave of COVID-19. Therefore, it would be wrong to ignore it.

Amid all these events, the demand for defensive assets has sharply increased, which traditionally include bonds of economically strong countries, primarily the United States and Germany, as well as safe-haven currencies such as the Japanese yen and the US dollar. If the US dollar grows reluctantly, remaining under pressure from large-scale stimulus measures of the Fed and the US Treasury, the yen sharply rose yesterday against the dollar and continues to do so before the European session opens.

On another note, the main currency pair euro/dollar, which has been steadily declining for three consecutive days, has also come under noticeable pressure. This is due to the function of the euro as an indicator of demand for risky assets, acquired during the crisis of 2008-09. It should be recalled that if the demand for shares of companies grows, then the euro/dollar pair also increases, but if it decreases, then the pair is under pressure. This process is currently happening.

Considering the two most important factors – the spread of the second wave of COVID-19 and the uncertainty of the US presidential results, we believe that the demand for risky assets will decline, and the US dollar and especially the Japanese yen will only receive support. At the moment, investors completely ignore all the released economic statistics and fully focus on these two issues.

Forecast of the day:

The EUR/USD pair remains under pressure amid falling demand for risky assets. It is trading below the level of 1.1800 and is likely to recover to 1.1800. However, consolidation below this level, as well as the continuing negativity in relation to the demand for risky assets, will push the pair further below first to 1.1750, and then possibly to 1.1700.

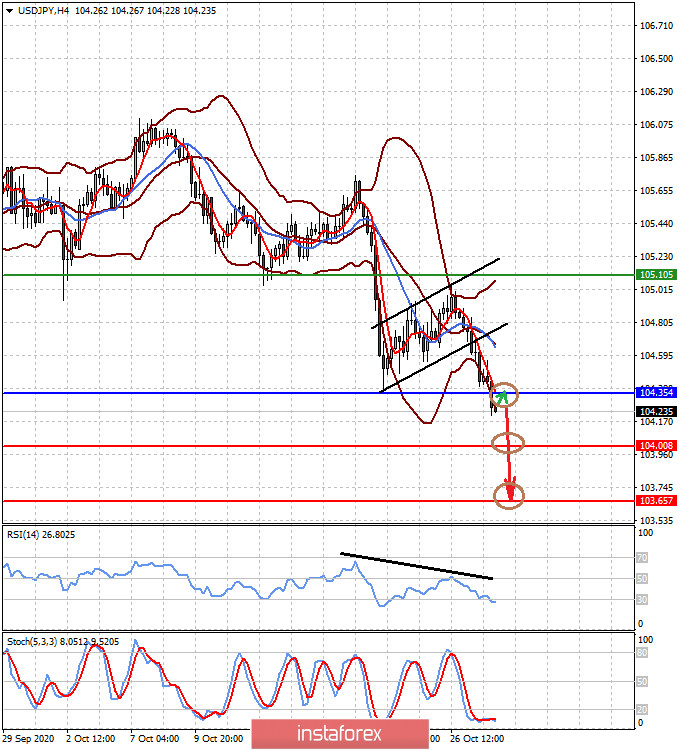

The USD/JPY pair has implemented the "rising flag" trend continuation pattern and may also continue to decline if it does not consolidate above the level of 104.35. In this case, it may first fall to 104.00, and then to 103.65.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română