GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed the third fall to the corrective level of 100.0% (1.3006), the third rebound from this level, and a reversal in favor of the British currency. The pair's quotes completed the consolidation above the descending trend line corridor, thus the mood of the traders now can be described as "bullish". Traders can now expect growth in the direction of the corrective level of 127.2% (1.3096). The pound/dollar pair has not stood still in recent weeks. However, in general, we can not say that the pair's movements are somehow connected with the information background or its messages. No economic statistics have been coming from the UK for a long time. There is no news about the progress of the negotiations of the next ninth or tenth round of negotiations on a trade agreement. There is only news of the coronavirus that continues to terrorize Britain. According to the latest data, the number of daily illnesses in the country continues to grow and now ranges between 20 and 25 thousand. Thus, it is safe to say that Boris Johnson's three-tier system of quarantine restrictions is not working yet. Doctors and epidemiologists continue to recommend that the country be closed for total quarantine. So far, Johnson is resisting, however, there is no doubt that if the increase in the incidence continues, this government decision is not far off.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a fall to the Fibo level of 38.2% (1.3010) and a kind of rebound from it, which allows traders to count on a reversal in favor of the British currency and new growth in the direction of the corrective level of 23.6% (1.3191). Fixing quotes below the level of 38.2% will increase the probability of continuing to fall in the direction of the next corrective level of 50.0% (1.2867). Today, the divergence is not observed in any indicator.

GBP/USD – Daily.

On the daily chart, the pair's quotes consolidated above the corrective level of 76.4% (1.3016), however, the reversal in favor of the US currency has already been completed and the fall has begun. More important now is the 4-hour chart and the corrective level of 38.2% on it.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. However, in recent weeks, it has made new attempts to gain a foothold over both trend lines.

Overview of fundamentals:

There were no economic reports in the UK on Tuesday. There was also no new information about the progress of negotiations between the UK and the European Union, which are currently ongoing in London and have been extended for several days.

US and UK news calendar:

On October 28, the UK and US news calendar does not contain a single report or event, but at any time there may be important information from London about whether Michel Barnier and David frost have agreed or not this time.

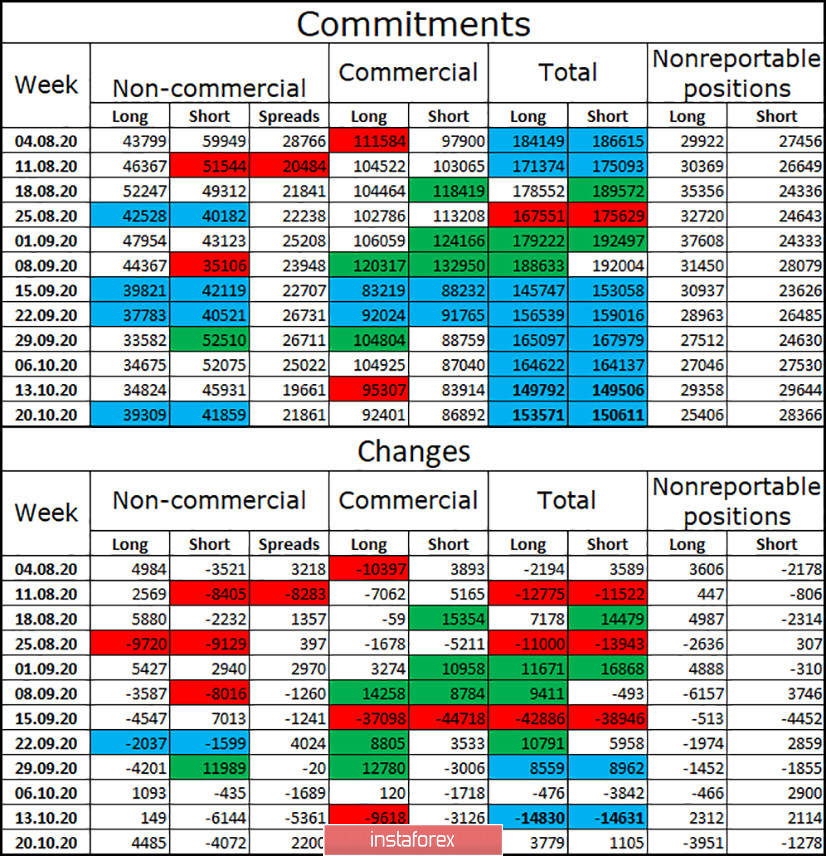

COT (Commitments of Traders) report:

The latest COT report on the British pound that was released last Friday showed that the mood of the "Non-commercial" category of traders has become more "bullish". Speculators immediately increased to 4.5 thousand long-contracts and got rid of 4 thousand short-contracts. Thus, after three weeks of "bearish" advantage, speculators are again inclined to buy the British. However, I believe that such a change in mood does not mean anything specific. In a week or two, major players can start building up short contracts again. And the total number of long and short contracts focused on their hands is almost the same. Thus, I would conclude that the major players are now in disarray.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend selling the GBP/USD pair with a target of 1.2928, if the consolidation is made under the corrective level of 100.0% (1.3009) on the hourly chart. I recommend buying the British dollar with a target of 1.3096, as the rebound from the level of 100.0% on the hourly chart and closing over the descending corridor was performed.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română