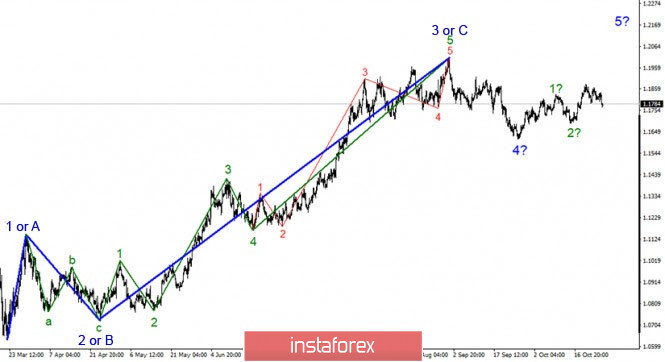

On the global scale, the wave marking of the EUR/USD instrument still looks quite convincing and has not changed recently. Thus, the formation of a global wave 5 of the upward section of the trend, which dates back to March, is still expected. At the moment, waves 1 and 2 can be seen inside this wave. Since waves of a smaller order can be seen inside wave 3, this wave can be quite extended.

The wave marking on a smaller scale still shows that the intended wave 4 has assumed a three-wave form and is complete. If this is true, then the price increase will continue within the 3-in-5 wave. At the same time, a not-too-active increase in quotes suggests that the entire section of the trend that begins on September 25 may take a three-wave form, and the entire section of the trend that begins on September 1 will take a corrective form. In this case, after the completion of the triplet up, the formation of the triplet downward may begin. However, this is a fallback for now.

The US presidential election will officially commence next Tuesday, and the results are expected to be announced next Wednesday. However, a lot of experts are beginning to doubt such a smooth process. Because of the coronavirus pandemic, some election mechanisms have been changed, including the introduction of mail-in voting, and ballots are sent to all Americans who are eligible to vote. But not all of them will vote, which opens up certain opportunities for various manipulations and fraud. Moreover, postal ballots can be counted for a longer period than regular ballots that will be sent to election commissions, just because it will take some time for them to reach the commissions by mail. After all the votes are counted, political analysts expect lengthy court proceedings, since it is unlikely that any losing party will agree with the election results. No one doubts this anymore. Court proceedings can drag on for several weeks, as both sides can file endless protests against a particular decision on the results in a particular state. There may even be a situation when January 20—the day of the transfer of power to the new president—comes, and by that time, the courts will not be completed yet. However, the courts themselves will already mean that the country is engulfed in a constitutional crisis. This will mean that Democrats and Republicans are going to continue fighting for power, rather than solve the economic and epidemiological problems that America faces in 2020. Well, if the trials continue after January 20, then the President will not be in the country at all at this time formally. Of course, such a scenario will not increase the demand for the US currency in the foreign exchange market.

General conclusions and recommendations:

Since the euro-dollar pair is presumably continuing to build a 3-in-5 wave, it is advisable to buy with targets located near the estimated 1.2012 mark, which corresponds to 0.0% Fibonacci, for each MACD signal up, in the expectation of building an upward wave. The variant with a possible complication of the internal wave structure of wave 4 has not yet been confirmed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română