Outlook on October 30:

Analytical overview of major pairs on the H1 scale:

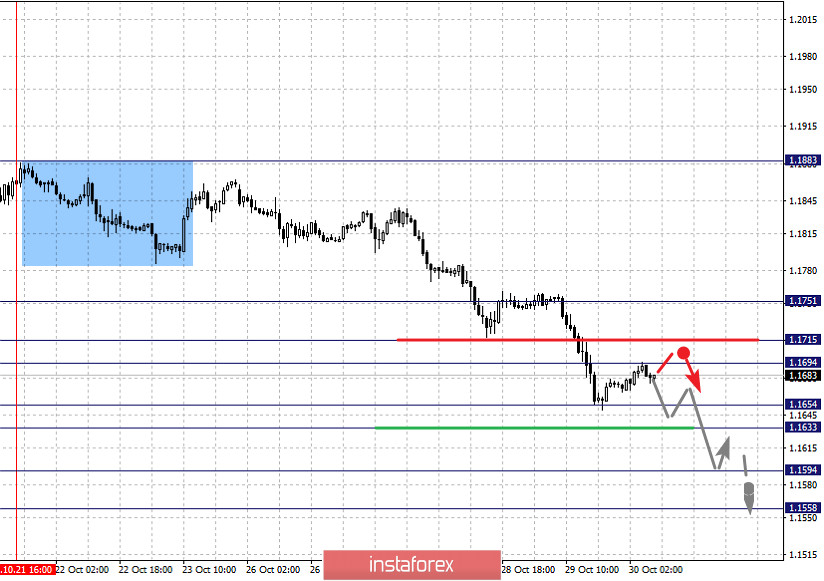

The key levels for the euro/dollar pair are 1.1751, 1.1715, 1.1694, 1.1654, 1.1633, 1.1594 and 1.1558. The development of the downward trend cycle from October 21 is being followed here. Now, a short-term decline is expected in the range of 1.1654 - 1.1633. If the last value breaks down, it will lead to a strong movement. In this case, the goal is 1.1594. On the other hand, we consider the level 1.1558 as a potential value for the bottom. Upon reaching which, an upward pullback is expected.

A short-term growth is expected in the range of 1.1694 - 1.1715. Breaking through the last value will lead to a deep correction. The potential goal here is 1.1751, which is the key support for the downward structure.

The main trend is the downward cycle from October 21

Trading recommendations:

Buy: 1.1694 Take profit: 1.1715

Buy: 1.1717 Take profit: 1.1750

Sell: 1.1654 Take profit: 1.1634

Sell: 1.1631 Take profit: 1.1595

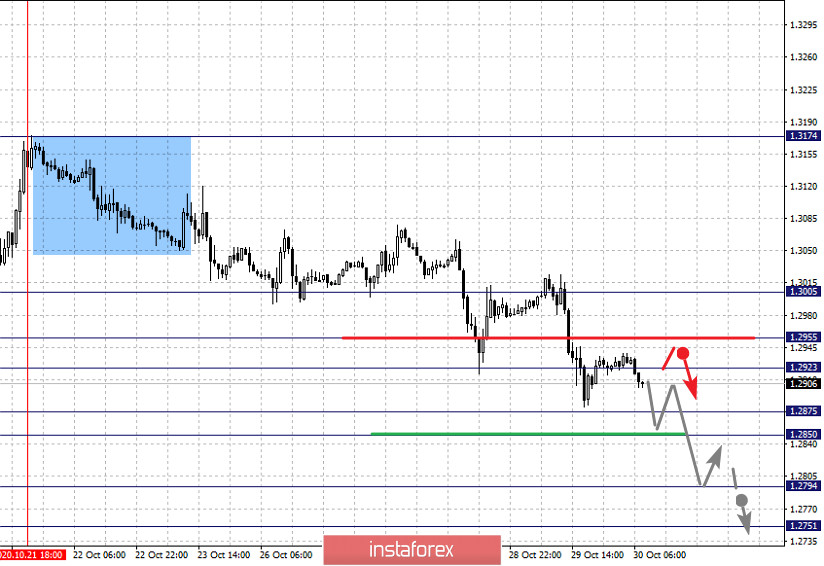

The key levels for the pound/dollar pair are 1.3005, 1.2955, 1.2923, 1.2875, 1.2850, 1.2794 and 1.2751. Here, we are following the development of the downward pattern from October 21st. A short-term decline is expected in the range of 1.2875 - 1.2850. If the last value breaks down, it should be accompanied by a strong decline. The goal here will be 1.2794. For the potential value for the bottom, we consider the level 1.2751. Upon reaching which, an upward pullback can be expected.

A short-term growth is possible in the range of 1.2923 - 1.2955. If the last value breaks down, it will lead to a deep correction. Here, the potential target is 1.3005, which is the key support for the downward structure.

The main trend is the downward cycle from October 21

Trading recommendations:

Buy: 1.2923 Take profit: 1.2953

Buy: 1.2956 Take profit: 1.3005

Sell: 1.2875 Take profit: 1.2850

Sell: 1.2848 Take profit: 1.2796

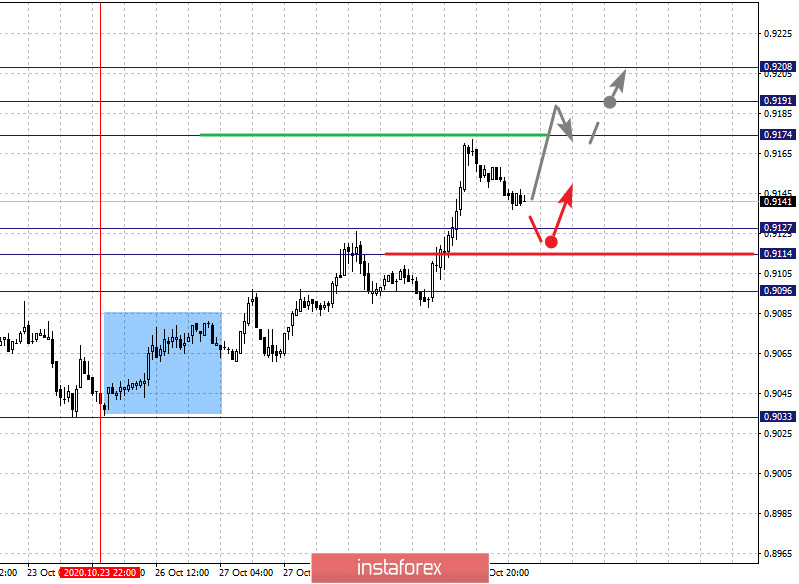

The key levels for the dollar/franc pair are 0.9208, 0.9191, 0.9174, 0.9127, 0.9114 and 0.9096. The development of the upward pattern from October 23 is followed. Now, growth is expected to continue after the level of 0.9174 breaks down. In this case, the target is 0.9191. Price consolidation is near this level. If the target breaks down, it will lead us to the potential target of 0.9208. Upon reaching which, a downward pullback is expected.

A short-term decline, in turn, is possible in the range of 0.9127 - 0.9114. In case of breaking through the last value, it will lead to a deep correction. The goal is 0.9096, which is the key support for the top.

The main trend is the upward cycle of October 23

Trading recommendations:

Buy : 0.9174 Take profit: 0.9190

Buy : 0.9192 Take profit: 0.9206

Sell: 0.9127 Take profit: 0.9115

Sell: 0.9112 Take profit: 0.9096

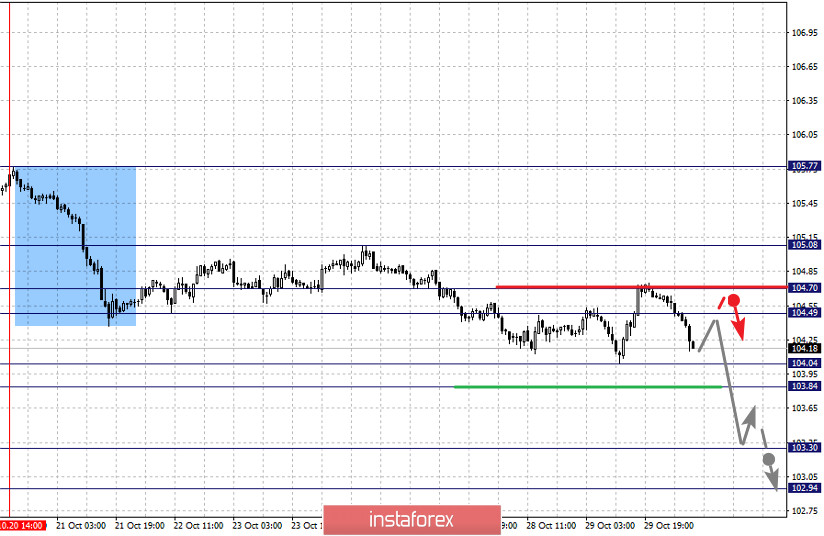

The key levels for the dollar/yen are 105.08, 104.70, 104.49, 104.04, 103.84, 103.30 and 102.94. Here, we are following the development of the downward structure from October 20. The decline is expected to continue after the price passes the noise range 104.04 - 103.84. In this case, the target is 103.30. We consider the level 102.94 as a potential value for the downward trend. Upon reaching which, an upward pullback can be expected.

A short-term growth is possible in the range of 104.49 - 104.70. If the last value breaks down, it will lead to a deep correction. Here, the potential target is 105.08, which is the key support for the downward cycle.

The main trend is the local descending structure from October 20

Trading recommendations:

Buy: 104.50 Take profit: 104.70

Buy : 104.72 Take profit: 105.08

Sell: 103.84 Take profit: 103.33

Sell: 103.29 Take profit: 102.96

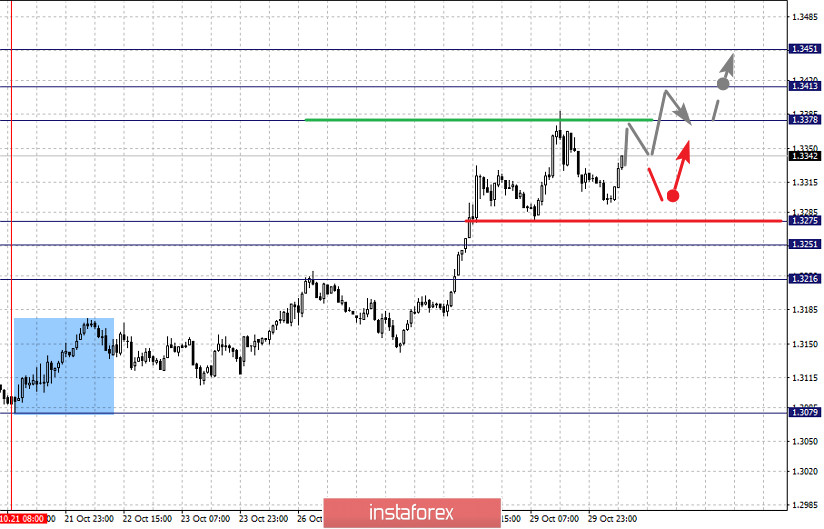

The key levels for the USD/CAD pair are 1.3451, 1.3413, 1.3378, 1.3275, 1.3251 and 1.3216. The development of the upward cycle of October 21 is being monitored here. The growth of the pair is expected to continue after the level of 1.3378 breaks down. In this case, the goal is 1.3413. There is consolidation near this level. As a potential value for the upward trend, we consider the level 1.3451. Upon reaching which, a downward pullback can be expected.

A short-term decline is possible in the range of 1.3275 - 1.3251. Now, breaking through the last value will lead to a deep correction. Here, the target is 1.3216, which is a key support for the top.

The main trend is the upward cycle of October 21

Trading recommendations:

Buy: 1.3378 Take profit: 1.3413

Buy : 1.3415 Take profit: 1.3450

Sell: 1.3275 Take profit: 1.3251

Sell: 1.3249 Take profit: 1.3216

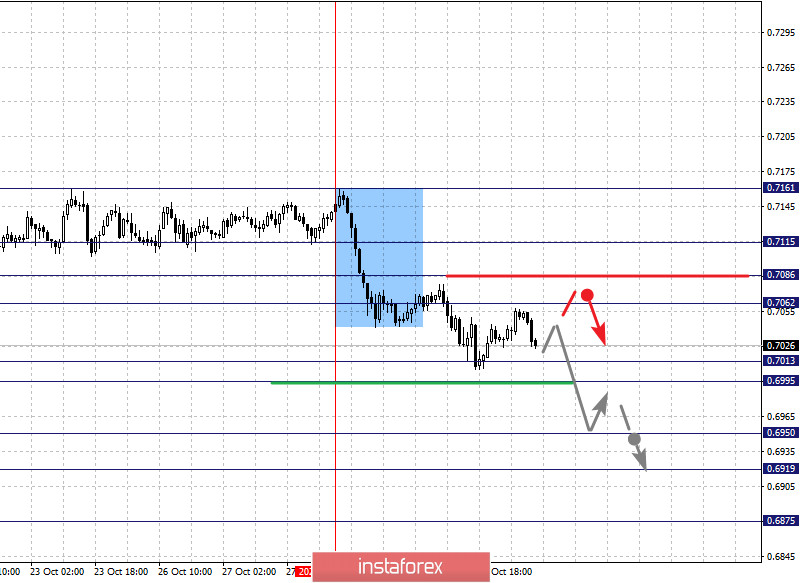

The key levels for the AUD/USD pair are 0.7161, 0.7115, 0.7086, 0.7062, 0.7013, 0.6995, 0.6950, 0.6919 and 0.6875. Here we are watching the formation of potential for the downward cycle of October 28. The price is expected to continue to decline after the price passes the noise range 0.7012 - 0.6995. In this case, the goal is 0.6950. Meanwhile, price consolidation is in the range of 0.6950 - 0.6919. For the potential value for the bottom, we consider the level of 0.6875. Upon reaching which, an upward pullback can be expected.

A short-term growth, in turn, is expected in the range of 0.7062 - 0.7086. If the last value breaks down, it will lead to a deep correction. In this case, the potential target is 0.7115, which is the key support for the bottom.

The main trend is the formation of a descending structure from October 28

Trading recommendations:

Buy: 0.7062 Take profit: 0.7084

Buy: 0.7087 Take profit: 0.7115

Sell : 0.6993 Take profit : 0.6950

Sell: 0.6948 Take profit: 0.6920

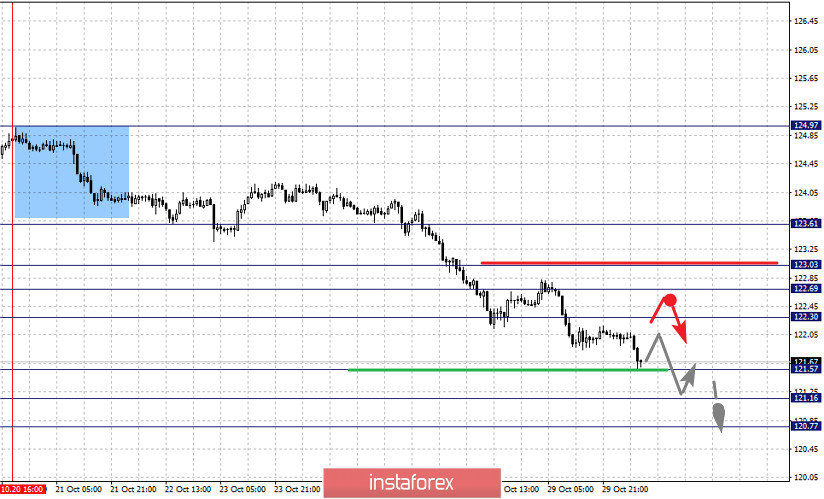

The key levels for the euro/yen pair are 123.61, 123.03, 122.69, 122.30. 121.57, 121.16 and 120.77. The development of the downward trend cycle from October 20 is being followed here. Now, the downward movement is expected to continue after breaking through the level of 121.57. In this case, the target is 121.16. For the potential value for the bottom, we consider the level of 120.77. Upon reaching which, consolidation and upward pullback can be expected.

On the other hand, a short-term growth is possible in the range of 122.30 - 122.69. In case that the last value breaks down, it will lead to a deep correction. Here, the target is 123.03, which is a key support for a downward cycle. The price passing this level will encourage the formation of strong initial conditions for an upward cycle.

The main trend is the downward cycle from October 20

Trading recommendations:

Buy: 122.30 Take profit: 122.67

Buy: 122.70 Take profit: 123.01

Sell: 121.55 Take profit: 121.18

Sell: 121.14 Take profit: 120.80

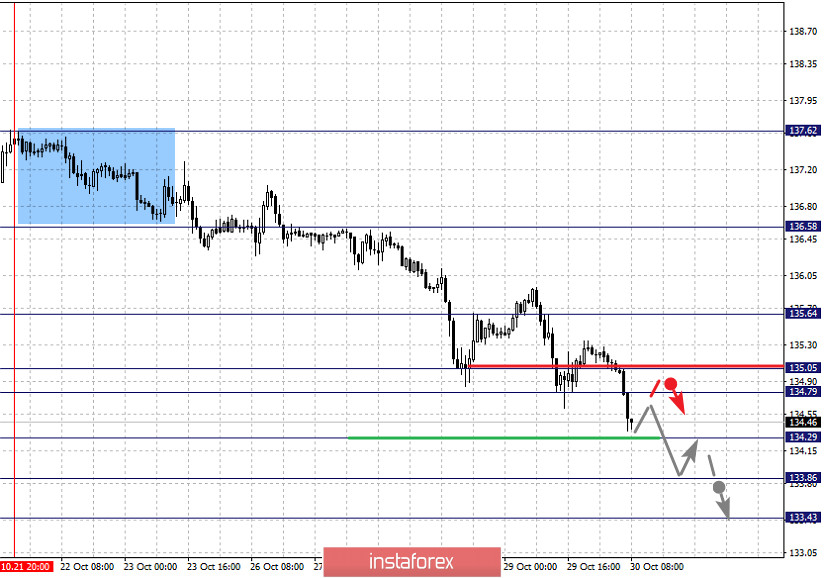

The key levels for the pound/yen pair are 135.64, 135.05, 134.79, 134.29, 133.86 and 133.43. We are currently following the development of the downward structure from October 21. The pair is expected to continue to decline after it breaks down the level of 134.29. In this case, the target is 133.86. For the potential value for the bottom, we consider the level of 133.43. Upon reaching which, an upward pullback can be expected.

A short-term growth is possible in the range of 134.79 - 135.05. If the last value breaks down, it will lead to a deep correction. Here, the potential target is 135.64, which is the key support for the downward trend.

The main trend is the descending structure from October 21

Trading recommendations:

Buy: 134.80 Take profit: 135.05

Buy: 135.07 Take profit: 135.64

Sell: 134.29 Take profit: 133.88

Sell: 133.84 Take profit: 133.45

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română