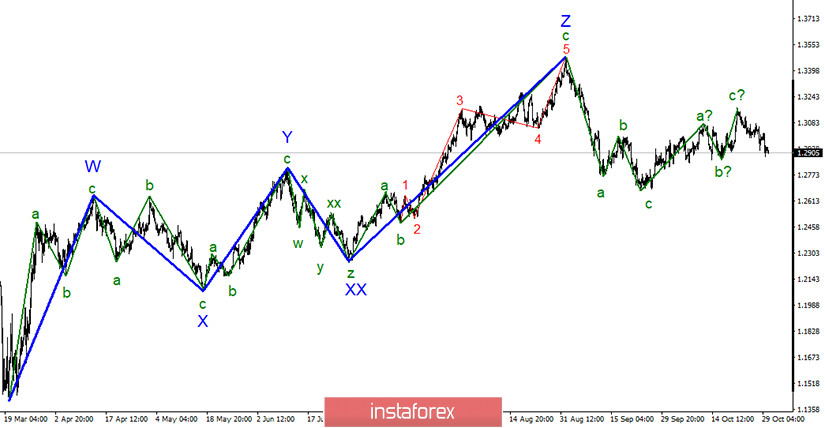

In most global terms, the construction of the expected new upward section of the trend continues. The internal wave layout continues to get confused, as the third wave takes on a rather non-standard appearance, and under certain layouts, it may even be completed. Thus, the wave marking of this instrument becomes similar to the wave marking of the EUR/USD instrument. Starting from September 1, both can have two three-wave structures built, after which the construction of a new downward structure, also three-wave, can begin.

The wave markup on the lower chart does not look too convincing and clear. The rising wave 3 or C looks as if it has already completed its construction or, on the contrary, will take a very extended form. At the same time, an unsuccessful attempt to break through the 38.2% Fibonacci level suggests that the increase in the instrument's quotes will resume. The entire section of the trend that starts on September 1 can take the form a-b-c. Thus, you need to be prepared for the complexity of the wave structure.

There is still little good news for the British currency. More precisely, there is no news for the pound right now. Negotiations in London seem to be continuing, while markets continue to wait for information. The British pound has fallen slightly in the last few days, which does not correspond to the current wave marking, but it can easily jump up by 100 or 200 points if there is real progress in the negotiations. Thus, now we can conclude that the markets are just waiting for information and that's it. Today, there were no important economic reports in either the UK or America. Therefore, the markets spent most of the day trading fairly calmly with a slight upward bias. Now I hope for the weekend. On the fact that on Saturday or Sunday there will be information from London.

From the point of view of wave marking, there must be progress in the negotiations. If not, the demand for the British pound will fall again, and the instrument's quotes may update the minimum of wave 2 or b, which will complicate the entire wave picture. Thus, the outcome of the negotiations depends not only on the fate of the pound but also on the wave pattern of the instrument.

General conclusions and recommendations:

The pound/dollar instrument has presumably completed the construction of a downward trend section. A successful attempt to break through the minimum of wave 2 or b will indicate that the markets are not ready for new purchases of the British, and the entire wave marking can be transformed into a more complex one. Thus, if the mark of 1.2860 is broken, the option of building an upward wave will be canceled. While this has not happened, the increase in quotes may still resume with targets located near the calculated marks of 1.3189 and 1.3480, which corresponds to 23.6% and 0.0% for Fibonacci.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română