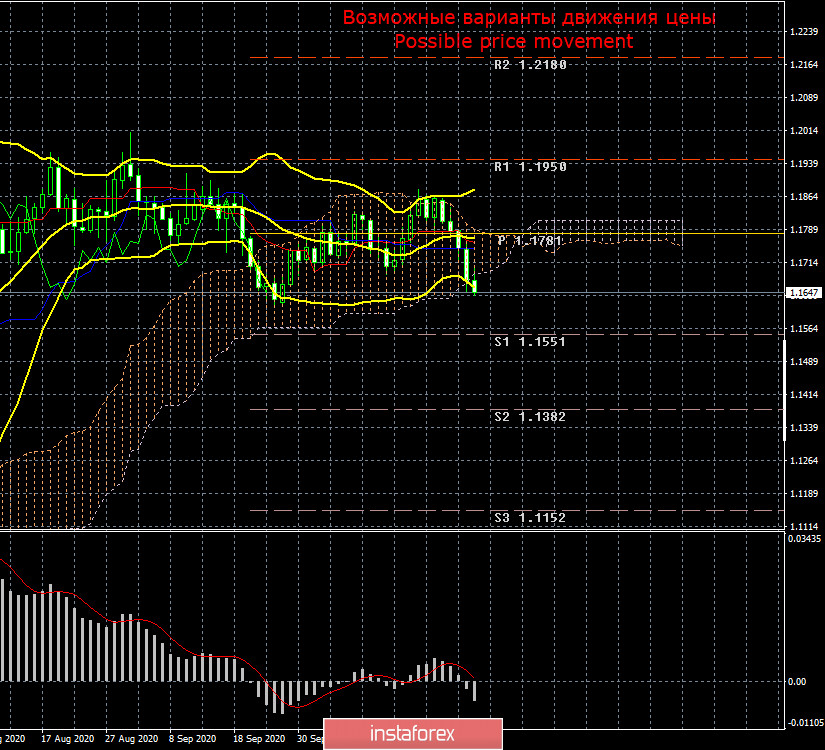

EUR/USD 24H

According to the 24-hour timeframe, EUR/USD eventually made some efforts to quit a sideways trading. The currency pair was closing in the red for 5 days in a row. It looks a bit strange because the presidential election will take place on Tuesday. Nevertheless, market participants decided to buy USD selling EUR. Earlier last week, EUR had just few reasons for weakness. In the middle of the week, EUR came under strong selling pressure. Meanwhile, we can draw a conclusion that the currency pair left the Ishimoku cloud that increases the odds for the development of a new downtrend. If the election in the US does not spring any surprises, the US currency will have a solid excuse for a further reinforcement. The euro has advanced 13% over the recent six months. Interestingly, the euro has not gone through a standard correction afterwards.

COT report

For the week of October 20-26, EUR/USD climbed almost 40 pips. After its rise, the pair sharply reversed downwards and dropped 160 pips in the following 4 days. A new COT report revealed that professional traders rushed to close buy contracts on the reported week. The number of buy-contracts with the non-commercial group decreased by nearly 12,000. At the same time, non-commercial traders closed 1,000 sell-contracts. So, the net position for this group fell instantly by 11,000. Thus, the decrease of the net positions means that market sentiment for the group of large market players is turning bearish. In fact, I told you about this sentiment change analyzing previous COT reports. Besides, I told you that the level of 1.2000 is likely to remain the high for EUR/USD. After this level had been reached, non-commercial traders decided to close buy-contracts. This is clearly seen with the first indicator in the picture (the green line). Actually, this is what is happening for two months. The green and red lines which are the net positions of both commercial and non-commercial traders are getting narrower. So, I still believe that the uptrend is over. For this reason, professional traders pushed EUR down last week. EUR is set to extend its weakness in the long term.

What about the fundamental background this trading week? First, traders got to know GDP data for the US and the EU. The US national output rebounded 33.1% sequentially in Q3 2020 following a 31.4% slump. Thus, the US economy incurred total losses of nearly 10% in Q2 and Q3. When it comes to the EU, the European economy tumbled 11.8% in Q2 and recovered 12.7% in Q3 2020. Hence, the eurozone's economy losses are measured at 1-2%. Nevertheless, traders were not impressed with the European resilience, so the US dollar carried on with its advance. Perhaps, EUR was hurt by the dovish rhetoric of Christine Lagarde. She said this week that new lockdowns in Europe could again deal a blow to the EU economy. The ECB President pointed out that a recovery in the summer was fragile, incomplete, and uneven. Now economic conditions could worsen again amid the second coronavirus wave. Business activity in the service sector which is especially vulnerable has been already in a tailspin. Meanwhile, the most advanced EU economies such as Germany and France have already imposed restrictions. In other words, the pandemic factor could have knocked down EUR. Indeed, the US is not considering a second lockdown and its economy is still gaining momentum. The US dollar is highly sensitive to developments in the presidential race. So, beware of extreme volatility and price gyrations next week. Let me remind you that the primaries in the US began a few weeks ago. As of now, almost 70 million Americans have voted for their candidates.

Trading plan for week of November 2-6

1)EUR/USD seems to have escapes from a trading range. However, the currency pair will greatly depend on the outcome of the major event next week. No one dares to predict what will happen in the wake of the election. Currently, the technical picture for EUR/USD suggests a further downtrend. So, a good trading idea would be to sell the pair with the target coinciding with support of 1.1551. Nevertheless, we should be ready for any twist next week.

2)If you want to buy EUR/USD, you should wait at least for the price to fix above the Kijun-sen and Senkou span B lines. Meanwhile, neither the technical charts nor the COT report nor the fundamental background indicate the prospects of an uptrend. In this context, we consider a further bearish trend as the most plausible scenario.

Notes for the pictures

The resistance/support levels are the target levels when opening long/short positions. You can place take profit levels next to them.

Indicators Ishimoku, Bollinger bands, MACD

Areas of support and resistance are the ones from where the price has rebounded or has been rejected a few times.

Indicator 1 in the COT charts is a size of net positions for each category of traders.

Indicator 2 in the COT charts is a size of net positions for the non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română