In today's article, we will summarize the results of October trading, the last trading week, and also try to determine the prospects for the price movement of the main currency pair of the Forex market.

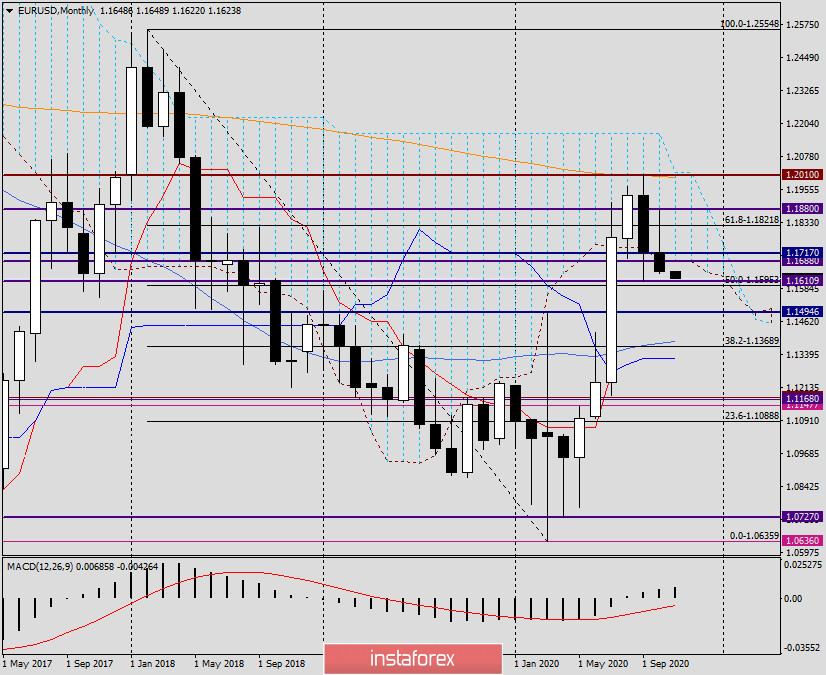

Monthly

Since the market closed October trading last Friday, let's look at the monthly chart. Usually, this timeframe is considered after the end of the next month. Thus, as can be seen on this chart, the EUR/USD pair made a deep correction to the level of 61.8 Fibo from the global decline of 1.2555-1.0636. As a rule, the classic course correction reaches the level of 50.0 Fibo from a particular movement, after which the price reverses towards the main trend. However, it also happens that there is a deeper correction to 61.8 Fibo, but if the rate is fixed above this level, we can safely assume that there has been a trend change. In the situation of the euro/dollar, there were attempts to gain a foothold above 61.8 Fibo from the decline of 1.2555-1.0626, however, they were unsuccessful.

After closing August above 61.8 Fibo, in September, the euro bulls tried to build on their success and continue the rate rise. However, after meeting strong resistance from sellers near the iconic psychological and technical level of 1.2000, they gave control of the pair to their opponents. I believe that, in addition to the key mark of 1.2000, the orange 200 exponential moving average played a significant role as a serious resistance, which contributed to the stop of the rise and the reversal of the euro/dollar in the south direction.

At the October auction, the euro bulls became active again and tried their luck again. At first, everything was fine for them. The pair showed strengthening. However, the arrival of the second wave of the COVID-19 pandemic, first in Europe and then in the United States, significantly increased the demand for the US dollar as a safe asset. From a technical point of view, it can be stated that the euro bulls failed to overcome a sufficiently strong technical zone of 1.1840-1.1880, which this time acted as a resistance. If we sum up the results of October trading, the inability of the main currency pair to resume the upward dynamics and the price coming down from the Ichimoku indicator cloud promises further downward prospects for the euro/dollar.

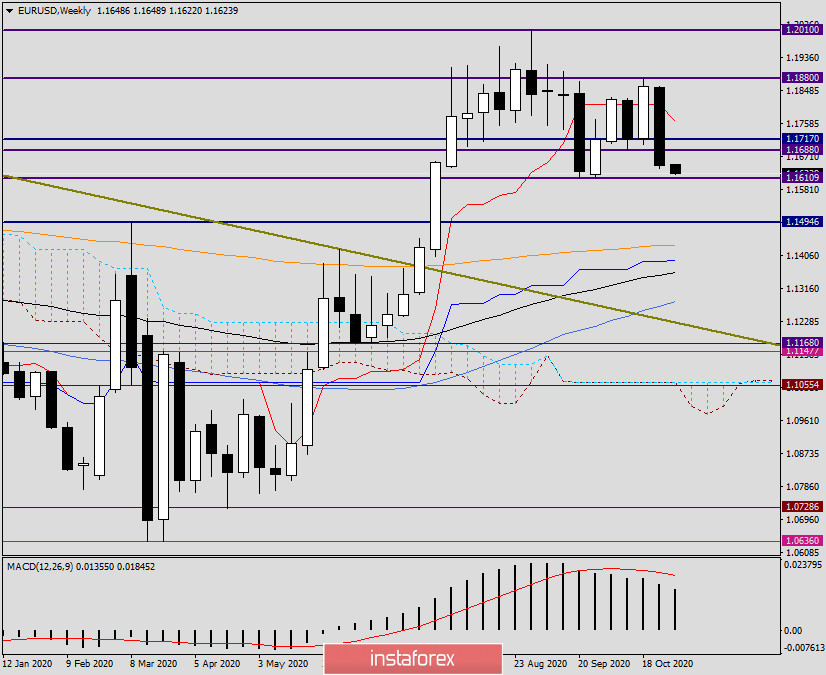

Weekly

At the end of last week, the euro of all major currencies showed the largest decline against the US dollar, which was 1.75%. As a result of a rather impressive fall, the pair fell under the red Tenkan line of the Ichimoku indicator, and after an increased downward momentum, support fell at 1.1717 and 1.1688, and an important technical level of 1.1700 was broken, near which there was a strong support zone for a long time. And now, finally, it is broken.

Trading in the current five-day period began for EUR/USD as a continuation of the direction that the quote showed earlier. At the end of the article, the main currency pair is slightly reduced, and trading is conducted near 1.1630. If the downward trend continues right now, the nearest target will be a strong support level of 1.1611.

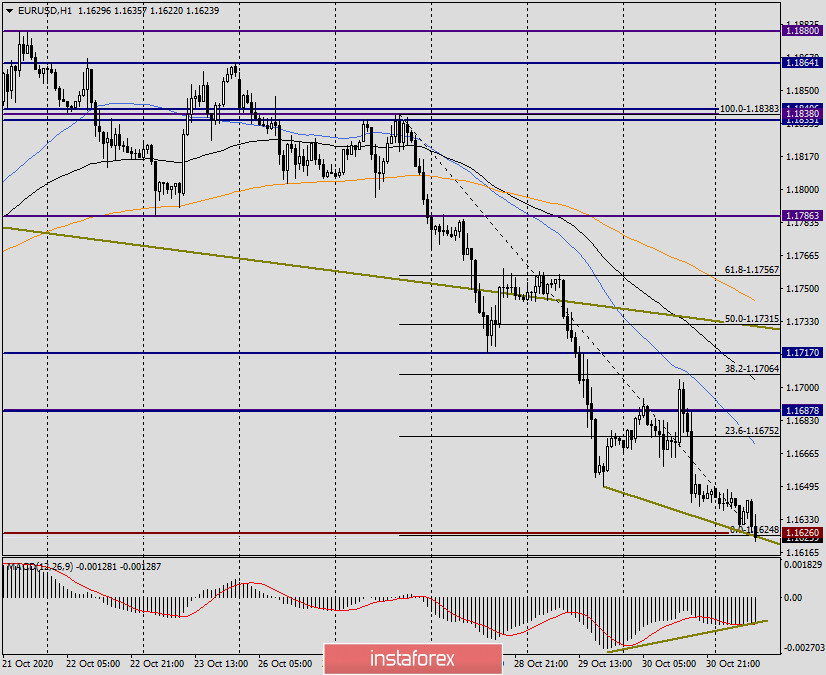

H1

If you go to the trading recommendations, then you need to choose a smaller period. I stopped at the hourly chart, where I stretched the grid of the Fibonacci tool to a decrease of 1.1830-1.1625. Given the previous rather strong decline and the bullish divergence of the MACD indicator, I recommend waiting for a corrective pullback to the price zone of 1.1670-1.1675 and consider selling the euro/dollar from there, which is the main trading idea for this instrument. If there is no pullback now, it may start from a strong support area of 1.1615-1.1600. In any case, to sell at the very bottom of the market without waiting for a corrective pullback is quite risky. As for possible purchases, I recommend that you refrain from them for the time being, since they are against the current bearish trend, and there are no clear signals for opening long positions yet. In conclusion, let me remind you about the main events of the week that started, which will be the presidential elections in the United States of America and data on the US labor market. We will talk about these and other events in more detail in the following articles on the main currency pair of the Forex market. With a high degree of probability, we can assume that trading in the euro/dollar this week will be quite volatile.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română