2020 proved that digital commerce is an integral part of the global economy, most companies, whether they want to or not, had to evolve, otherwise, they would face bankruptcy.

In this difficult time, digital surrogates were actively rushing forward, conquering more and more new users, perhaps the self-isolation mode has led to increased interest, or perhaps we are experiencing a new round of FOMO * (Lost Profit Syndrome *), which will end as quickly as it appeared on market.

The breakout of the local maximum of 2019 - $ 13,868 - became a lever for most speculators, since that moment the trading forces have changed. The market has been flooded with new blood, the media is actively replete with the new HYIP of Bitcoin, and crypto hamsters like a magnet are drawn to pool buyers.

The most interesting thing is that we are not yet on the brink of FOMO, but only on its outskirts. The main surge in FOMO activity will occur at the time of the breakdown of the historical maximum of 2017 - $ 19,891. At that moment, money will flow like a river, and here there will be a risk of another collapse, where it is necessary to exit long positions in proportion to the working volume. It is worth considering that updating the historical maximum does not guarantee the completion of the upward cycle; before the collapse, another acceleration may occur, that is, + 50/100%.

Let me remind you that since the spring of this year, we have been actively working on long positions, and we already have more than one hundred percent of the income from the crypto market at our disposal.

Our opinion about the super-profitability of crypto assets is similar to the opinion of the eminent publication Bloomberg, which analyzed the profitability of gold and Bitcoin, eventually proving that in 2020 it was most profitable to invest money, not in traditional assets, but in digital ones, for example - Bitcoin.

Since March 2020, the growth in the value of Bitcoin has been more than 250%.

The following the growing Bitcoin quotes, Altcoins are crawling, which are also considered one of the most profitable instruments in 2020.

Against such a positive background, one should not lose sight of the fact that institutional investors, as well as funds, have changed their minds towards Bitcoin and have significantly expanded investments in crypto assets. Thus, it is not entirely appropriate to compare the HYIP of 2017 and 2020, since there are fewer unqualified market participants, and the understanding of the crypto environment has increased.

The point will be information that a close associate of George Soros, dollar billionaire Stanley Druckenmiller in an interview with CNBC said that he had invested part of the capital under his management in Bitcoin. In his opinion, the first cryptocurrency is a more profitable asset than gold or US Treasury bonds.

Trade prospects

The Bitcoin quote has recently touched the important coordinates of $ 16,000, which reflects the last frontier before the swing of the historical high of 2017 - $ 19,891. In fact, the $ 16,000 interaction area has floating boundaries from $ 500 to $ 1,000, but even consolidation above $ 16,000 will already indicate the prevailing upward interest in the market.

In terms of corrective movements from the $ 16,000 area, one can consider the local price movement towards $ 13,500 / $ 14,000, but in this case, a slight panic may arise among uncertain market participants.

If you have been following long positions since the spring of this year, then I strongly advise you not to forget to withdraw your profit. Regrouping points of trade positions have already been in the areas: $ 10,000; $ 12,000; $ 13,000; $ 16,000. The next coordinate is in the area of the maximum - $ 19,000.

General background of the crypto market

Analyzing the total market capitalization of the crypto industry, one can see that the Total market has gained more than $ 48 billion in weight since the beginning of November and is currently $ 450 billion, where there is not much left to the psychological level of $ 0.5 trillion.

The upward trend is visible to the naked eye, while maintaining the current rates, the historical maximum of $ 831 billion can be passed in the next few months. Let me remind you that the milestone is $ 1 trillion - whether a myth or reality, we will analyze it in subsequent cryptocurrency reviews.

Market Cap: $ 450 814 079 448

BTC Dominance: 64.2%

The index of emotions (aka fear and greed) of the crypto market is at 86 points, which already speaks of FOMO, but this can give an even greater speed of infusion of funds from new market participants.

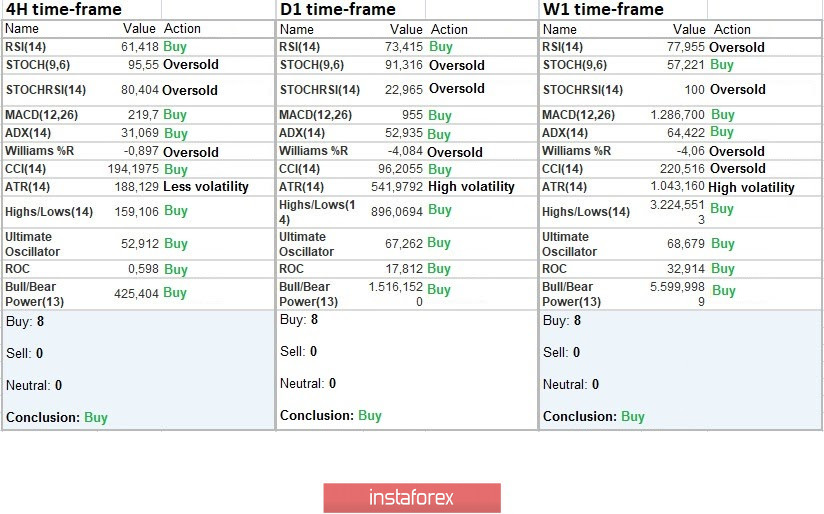

Indicator analysis

Analyzing different sectors of timeframes (TF), it can be seen that the indicators of technical instruments on the four-hour, daily, and weekly periods unanimously signal a buy, which is confirmed by the general market dynamics, as well as its emotional part.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română