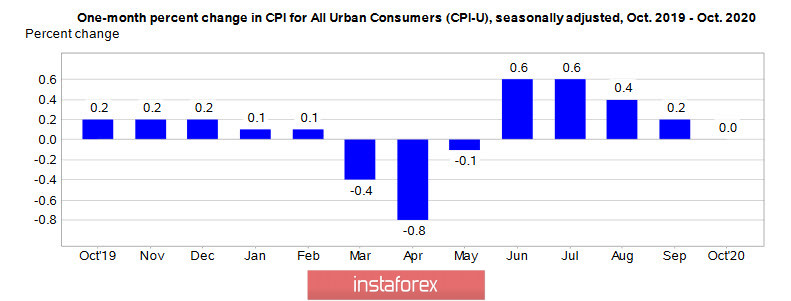

The positive effect of reports of a successful COVID-19 vaccine trial was only temporary. Mr. J. Powell, Fed's chief, said at the ECB's virtual conference that the main problem is clearly about COVID-19 further spreading in the US. At the same time, economic indicators do not also add positivity yet – inflation demonstrated zero growth last month, which was worse than expected.

The number of initial applications for unemployment benefits continues to decline, although at a slight pace (more than 700 thousand per week only). Thus, a very weak labor market remains.

Perhaps, the real reason for the mood change was not economic, but political news. Our first concern is the new stimulus package being discussed in Congress. If Democrats and Republicans agreed on the need to introduce a new package before the election, then yesterday, it was rumored that the White House refused to negotiate a new package of incentives. This means that hopes for a new stimulus now depend on the ability of Senate majority leader Mitch McConnell and House Speaker Nancy Pelosi to find common ground. As a result, the development of the situation is negative for the markets – hopes for new stimulus are fading, while the US economic recovery will lose momentum as tighter social restrictions are introduced.

It is possible that Mr. Trump refusing to recognize the election results, which is a much bigger problem than all the other news put together, can be the reason why the White House turned down negotiations. Yesterday, Trump tweeted that Dominion, which was used to count votes in several states, had removed 2.7 million votes in his favor. In connection to this, 221,000 votes in Pennsylvania were inverted – votes cast for D. Trump were counted for J. Biden. If this information is confirmed, Biden will lose the advantage, and Trump, in turn, will get grounds not to transfer power to the elected Biden through fraudulent manipulation.

The question here is whether the Republican party will support its President or collude behind the scenes with the Democrats. In the first case, the election is almost guaranteed to be declared invalid with unpredictable consequences for the entire political configuration of the United States, while for the second one, Trump will be eradicate in court proceedings, and Democrats and Republicans will approve Biden as President, using the backup options laid down in the Constitution, through a vote in Congress.

In any case, the temporary optimism is coming to an end, so the demand for defensive assets will grow.

EUR/USD

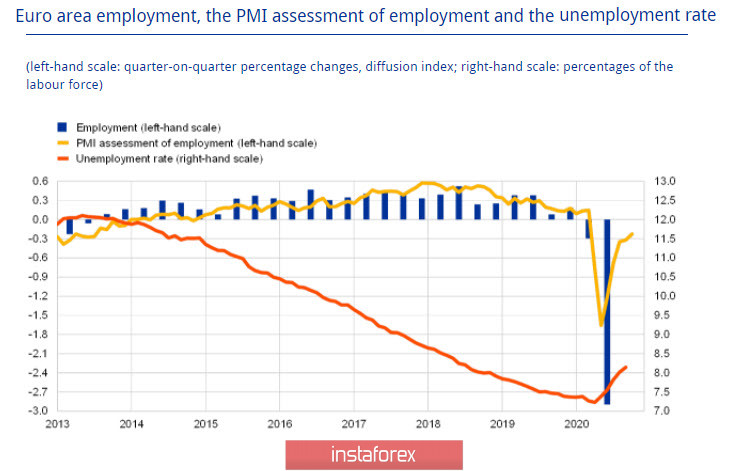

The ECB's economic Bulletin, published yesterday, is clearly negative. According to the Central Bank, the GDP recovery is incomplete, measures to support employment have limited effect, consumer spending growth has stalled, consumer confidence has declined in October, and households report a deterioration in their financial situation.

Similar results are provided by independent research. The ZEW index in Germany declined from -59.5p to -64.3p in November, and from 52.3p to 32.8p for the eurozone as a whole.

In addition, Ms. Lagarde's speech yesterday drew attention to the fact that the recovery of the service sector is slower than production. In her opinion, the ECB must continue to use existing instruments. In short, the ECB will have to expand the stimulus package at the next meeting.

Technically, the EUR/USD pair is currently trading in a range, but there is a growing bearish pressure. So the most likely scenario for the following days will be a movement to the support level of 1.1612 with a decline towards the goal of 1.15.

GBP/USD

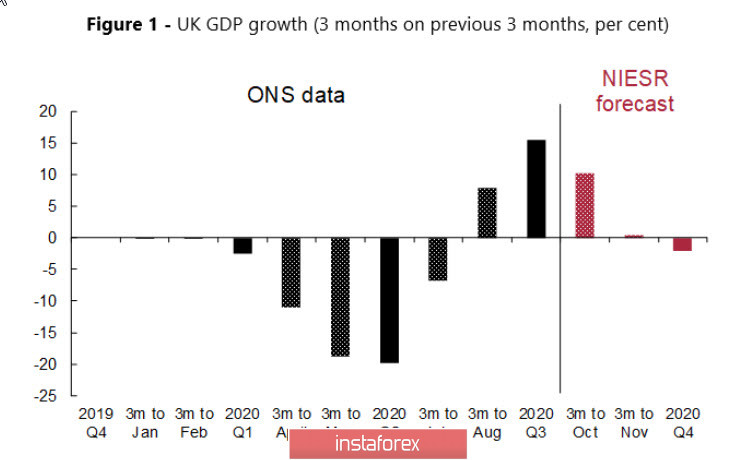

The economy is 10% lower than before the pandemic, even though the growth of UK GDP in Q3 is in line with expectations. Moreover, this growth will stop with the introduction of a new wave of restrictions. However, the conclusion of the NIESR study is ambiguous. A 2.2% decline in GDP will be recorded for the Q4, with a 12% expected drop in November due to new restrictions.

So far, the market is assuming that a trade deal between the EU and the UK will still take place. These expectations support the pound, which looks better than the Euro. This situation will continue until at least the end of the week. The support is located at the middle of the rising channel 1.3100/20. If a negative mood rises, a correction to 1.2950/80 is possible, with the goal of 1.3304.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română