Trump's refusal to admit loss in the US presidential election due to electoral fraud led to another huge problem.

Democrats and Republicans in Congress failed to reach a compromise on the scale of the next fiscal stimulus package before the elections, and postponed the issue to the discretion of the new administration. However, there is no new administration and now, it is unclear how to resolve the collision. Democrats insist on an immediate package of fiscal stimulus of 2.2 trillion, while Republicans are not ready to provide more than 500 billion. This is happening due to a clear reason. The next administration will receive political dividends from the introduction of a large-scale package, that is, it is very possible that the Democrats can cause unacceptable damage to the image of the Republican party.

Accordingly, Trump does not want to discuss the package before the completion of the election procedure. And since the completion of this procedure is clearly delayed, it is highly likely that fiscal incentives will not be launched in the coming weeks. Hence, an important conclusion – the US dollar will be under pressure due to the deterioration of macroeconomic forecasts.

Two additional negative factors are superimposed on the political standoff: the rapid spread of the second wave of COVID-19 and weak macroeconomic indicators, which narrow the range of opportunities for both the Fed and the government.

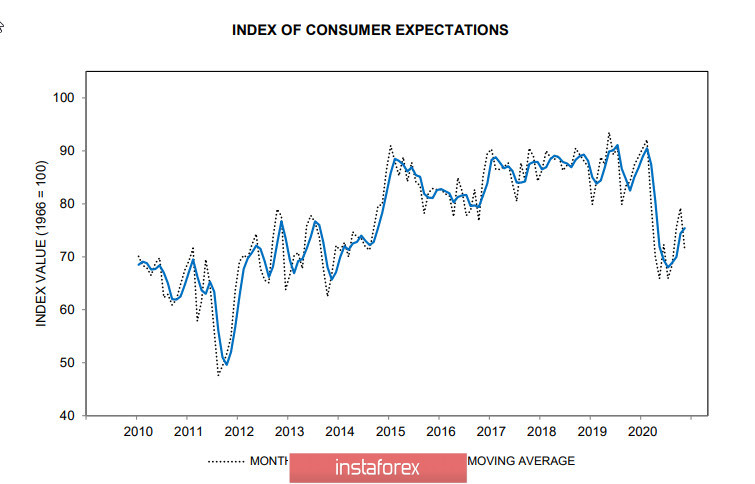

In addition to the lower-than-predicted consumer inflation in October, the production prices are also tending to decline – price growth excluding consumer goods and energy was only 0.1% against 0.4% in September, and the consumer confidence index from the University of Michigan fell from 81.8p to 77p, and is significantly below the average for the last 5 years.

A likely weaker dollar will support commodity prices and stock indices. We assume that Europe will open in the green zone, oil prices will consolidate above $ 40 per barrel, and commodity currencies will have priority over defensive ones.

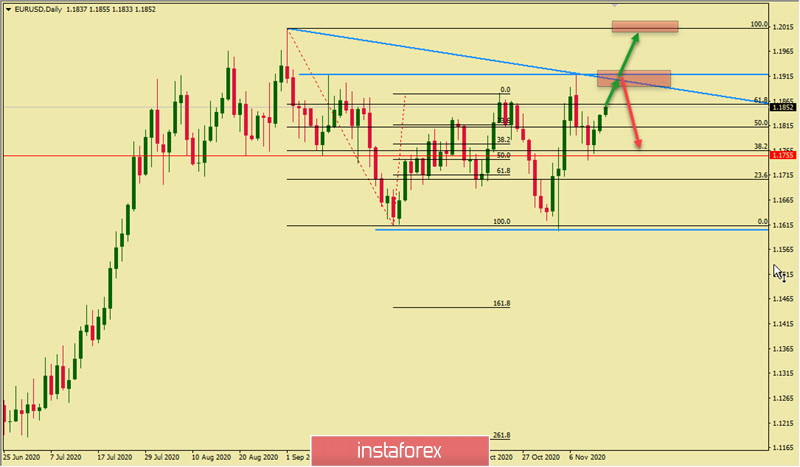

EUR/USD

Euro's outlook has become slightly uncertain after the ECB's head, Ms. Lagarde, announced her intention last week to introduce new stimulus measures, but did not disclose the parameters of possible changes. Most experts are confident that there will be no cutting of rate, and so the changes will be focused on the two programs (PEPP and TLTRO). That is, the ECB will increase the supply and reduce the requirements for borrowers. The likely rejection of the rate cut favors the euro.

The technical euro looks more convincing than the US dollar. The resistance at 1.1610 has held out. At the same time, a horizontal range is forming with a clearly visible attempt to test the upper limit of 1.1920 for strength. If this attempt becomes successful, a rapid growth to 1.20 will be likely, where the second resistance is located.

The chances for growth to 1.1920 and further to 1.20 look preferable, but as long as the price is below these levels, the target at 1.15 remains a priority. Hence, the most probable scenario is rising to the level of 1.1920 only, where there will either be a resistance breakdown or a downward pullback. In the first case, the technical picture will become noticeably more bullish, and then the goal is updating the high 1.20. In the second one, the level of 1.1610 will be retested, with a goal of 1.15.

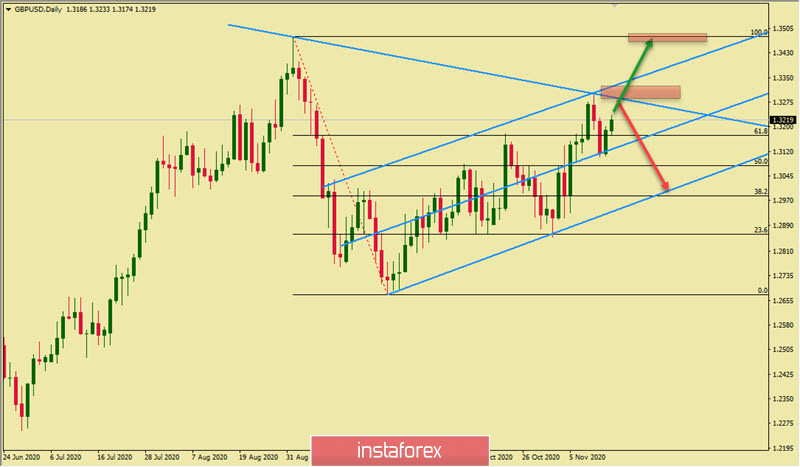

GBP/USD

Today, November 16, marks the continuation of Brexit negotiations, and their successful completion is only possible if political will is shown on both sides. Nevertheless, the pound still remains in the upward channel despite the bad news from the negotiation process and unconvincing macroeconomic indicators.

The key resistance is the zone of 1.3280/3330. An upward exit from the channel is almost inevitable if there is a positive result in the trade negotiations, since the pound does not decline even amid bad news. If the parties do not bring their positions closer in the coming days, then there will be no chance of ratifying the agreement until December 31, which will mean Britain will exit the EU without a deal. In this case, the pound will leave the channel down.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română