The dollar declined at the beginning of the European trading session on Tuesday. This is largely due to the increase in the number of cases of COVID-19 in the United States, which provoked the authorities of some states to introduce even more quarantine restrictions. Anxiety about the smooth transition of presidential power also does not add to optimism.

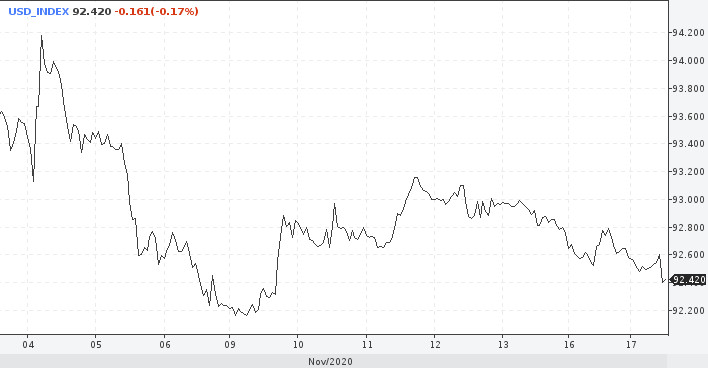

The dollar index, which tracks its exchange rate against a basket of six other currencies, was down 0.1% to 92.420 at 04:42 Eastern time.

The American biotech company Moderna reported positive results of tests of the coronavirus vaccine, on Monday, giving an initial boost to risky currencies. According to their press release, the effectiveness of the new Moderna vaccine is 94%. This forced the US stock markets to close in the green zone. The biggest growth was seen in the shares of those companies that were most affected by the COVID-19 pandemic – airlines, tourism, cinemas, and amusement parks. Last week, Pfizer and BioNTech startled markets with the same encouraging news: the effectiveness of their experimental vaccine exceeds 90%. Against this background, the dollar was able to rise against the yen and the Swiss franc.

According to preliminary data, the vaccine from Moderna is superior to the vaccine from Pfizer and BioNTech: it is more effective and lasts longer. According to their data, the Pfizer vaccine must be stored and transported at a temperature of -80 degrees, while the Moderna vaccine is quite suitable for a temperature of -20 degrees.

Obviously, in light of the rapidly spreading coronavirus, any encouraging progress in testing vaccines can give market players a sense of euphoria. However, the foreign exchange market reacted to this news with restraint, which is understandable. Both vaccines belong to a new type of matrix RNA vaccines that are not currently approved for vaccination against other diseases. It is not possible to test the safety of the drug in such a short period of time, so it may well turn out that the vaccines will not be suitable for use. We can only wait for the full data from the companies to be released, and for this, we need to pass a longer test period – 1-1. 5 years. This period is also important for determining the time period for which the body should form the necessary level of antibodies to fight the virus. Hence the conclusion – the imminent appearance of the vaccine can not be expected.

At the same time, the current situation with the incidence of coronavirus is far from ideal. New cases of COVID-19 infection in the US continue to stay above the mark of 150,000 a day. Last week, more than 1 million new cases of coronavirus were reported in the US. The country is trying to slow its spread – the States of Michigan, North Dakota, and Washington have introduced new restrictions on public gatherings and eating indoors.

In the light of growing anxiety, the mood of business agents is getting worse. For example, the Empire Manufacturing index, which reflects general economic conditions in the state of New York, fell to 6.3 in November (the same indicator in October was 10.5). There is also no noticeable improvement in the European region.

Plus, there is still uncertainty around US policy, which is also hurting the dollar. The early transfer of power in Washington is clearly complicated because Trump still refuses to officially recognize the election results even two weeks after the event. He refrains from working with Biden's transition team.

It is worth noting that analysts of the American Bank Citigroup do not believe in the strong position of the US dollar in the future. The fall in the dollar, in their opinion, will ensure mass vaccination against coronavirus and the subsequent recovery of the global economy. And even though most of the world's population is unlikely to be vaccinated in the next 2021, the authorities will clearly seek to implement a mass vaccination plan in the future. And when progress in the fight against COVID-19 is significant and the global economy begins to recover at a more active pace, investor interest in protective assets will decrease. It is expected that the collapse of the exchange rate against the backdrop of a recovery in world trade and economic growth will be significant by about 20%. The soft monetary policy of the US Federal Reserve will also not play into the hands of the US dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română