The monetary policy of many central banks has been deliberately cut sharply this year. The leaders of the regulators claim that it is necessary to sustain the global economy amid the coronavirus. On the one hand, this kind of strategy adds a lot of positive things, because it helps to save millions of jobs and a lot of capital. But on the other hand, this policy contributes to the formation of large bubbles in asset value.

This spring, when the first wave of the pandemic raged, stock indexes collapsed and the price of oil fell below zero. Against this background, only gold showed excellent performance. Many investors turned their attention to this asset, providing it with record growth in quotes: a troy ounce was trading for $2,089.

Gold has always been a generally recognized reliable asset favored by retail investors. This is understandable: the depreciation of the currency by governments and Central banks have often caused concern and anxiety. Remember at least the beginning of the 1970s, when the dollar collapsed and there was a devaluation of paper currencies. All this eventually manifested itself in a rapid increase in inflation. Or, for example, in 2008, when consumer prices either remained at the same level or declined. Back then, the financial crisis exposed the only tangible inflation – in the price of stocks and bonds.

During these crises, Central Bank balance sheets rose sharply. For example, since the end of 2019, the Fed's balance sheet has increased by as much as $3 trillion, to $7.17 trillion. At this time, the ECB's balance sheet rose by almost the same amount, reaching the level of 6.98 trillion euros.

On Wednesday, we are seeing another significant slowdown in the global economy. And in these circumstances, the head of the ECB, Christine Lagarde, at a meeting of the Bank's Board of governors on December 10, promised to further expand the production of money. The fed is expected to expand its asset purchases at the December 16 monetary policy meeting.

Against the background of these processes and news, gold traditionally had to respond with unprecedented demand, significantly increasing its quotes. However, it did not respond to market expectations with a positive impulse, falling by almost 9% from August, when there was a real peak. Bitcoin has moved it off its pedestal, rising 130% since the beginning of the year. At the same time, the growth of cryptocurrency over the past month can be safely described as rapid due to several reasons.

First, the decision of the largest debit electronic payment system PayPal to manage bitcoin-denominated wallets played an important role. This kind of step by a well-known brand to take responsibility for storing digital money is truly a real quantum leap of bitcoin, which can now be safely described as a real financial mainstream. Millions of people around the world are ready to rely on reliable PayPal.

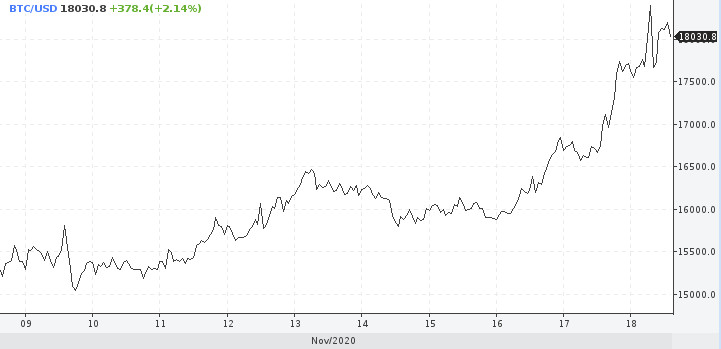

Second, the currently regulated investment mechanism allows access to bitcoins. So, on Tuesday, receipts to the GrayScale bitcoin trust made it possible to accumulate more than 500,000 bitcoins worth more than $8.3 billion. To date, bitcoin is trading at $18,030 per coin.

According to many analysts, this asset may well overcome the $20,000 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română