The euro is like a steadfast tin soldier - it does not bend and goes forward, despite strong headwinds. EURUSD bulls are not afraid of the growing number of COVID infections, hospitalizations, and deaths in the eurozone, nor the restrictions imposed by the governments, the high risks of a double recession of the currency bloc's economy, and the ECB's intention to loosen monetary policy. It would seem that the euro needs to be sold, but investors are so confident in the long-term bearish prospects of the US dollar that they use any opportunity to buy the main currency pair.

According to Citi, the current situation has much in common with the events of the 2000s, when under the influence of the rapid growth of the Chinese economy and the commodity market, assets of developing countries were particularly popular. Global risk appetite was off the scale, and the USD index sank by 33% due to this. The introduction of the vaccine can lead to a repeat of the history of 20 years ago. Morgan Stanley recommends buying commodity currencies, including the Australian and New Zealand dollars, and believes that the EURUSD pair will reach 1.25 in 2021. Goldman Sachs believes that even if the US economy performs better than the rest, it will not save the trade-weighted dollar from falling 6% over the next 12 months.

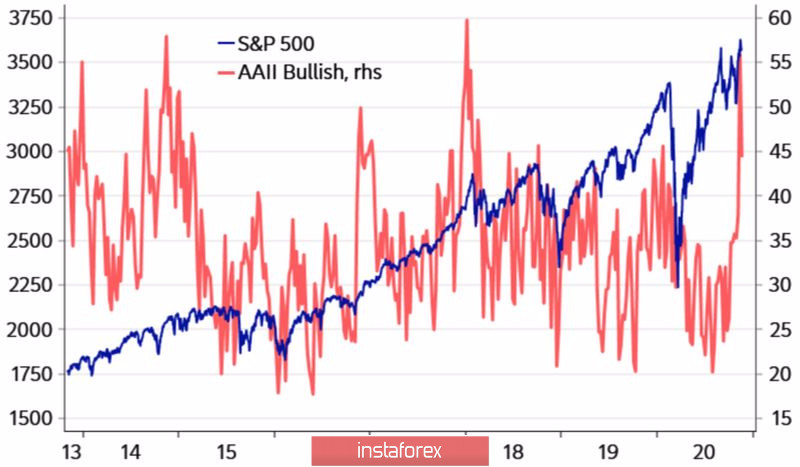

Looking at such forecasts, willy-nilly you become a bull for EURUSD. Even the S&P 500 correction signaled by The BofA Merrill Lynch positioning indicator, which indicates that there are too many buyers in the US stock market, is no longer perceived with the same fear as before. The stock index and the dollar go in the opposite direction during shocks, such as those related to the presidential election, but if the market calms down, they can go down the same road.

Dynamics of the S&P 500 and the ratio of bulls/bears:

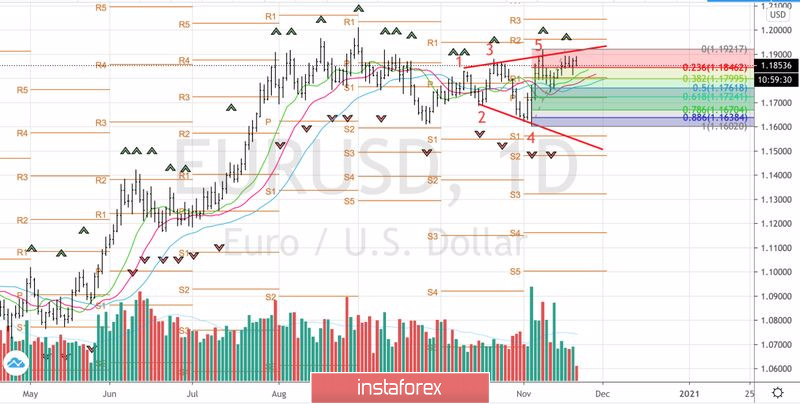

In my previous articles, I have repeatedly expressed the idea of a medium-term consolidation of EURUSD in the range of 1.16-1.2 with the subsequent growth of the pair to 1.25 in 2021. The upper limit of the trading channel on Forex is often called the Philip Lane Line, knowing the ECB chief economist's intolerance to the strengthening of the euro. He actively uses verbal interventions, provoking other members of the Governing Council to do the same. The problem is that the European Central Bank is not able to break the upward trend or stop the rally of the main currency pair.

Given the pronounced bearish outlook for the US dollar, it is possible that 1.16 a month ago is the same as 1.175 or 1.18 currently. The medium-term consolidation range may move higher to 1.175-1.215 or even to 1.18-1.22, and I would not be surprised if the EURUSD quotes exceeded the 1.2 mark this year.

Technically, the Broadening Wedge pattern continues to be implemented on the daily chart of the main currency pair. If the US stock indexes undergo correction, I expect EURUSD to pull back to the 23.6%, 38.2%, and 50% Fibonacci levels from wave 4-5, which will allow us to form long positions on the euro on the rebound from the supports at $1.1845, $1.18, and $1.176.

EURUSD daily chart:

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română