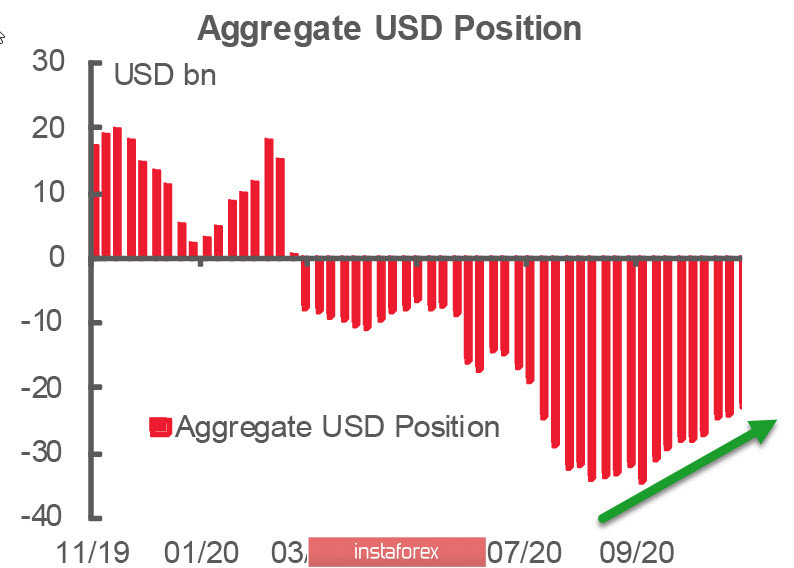

The recent CFTC report gave more details on how long-term investors reacted to the result of the US presidential election. It should be noted that there were a lot of forecasts on that day that the US currency will decline if Biden wins, since his economic program involves the implementation of a significantly larger stimulus package, which will lead to an increase in liquidity and, at the same time, to a decline in tension, which will reduce the demand for protective assets.

In reality, it was not quite so. The short position on the dollar has fallen again, this time by 1.409 billion to -22.948 billion, and the trend is clear, but the speed of reduction is too slow. The dollar has won back barely a third of the collapse for 12 weeks. This does not add optimsm and the dynamics are more like a prolonged correction.

On Friday, US Treasury Secretary Mr. Mnuchin announced the end of the Fed's concessional lending program, which led to a growth in demand for defensive assets. He just wanted to redirect these funds for other purposes, but the Fed announced that it would prefer to continue to implement its plans. Apparently, we are witnessing the first phase of a clash between the Fed and the outgoing Trump government.

Against this background, the demand for risky assets is likely to slow down in the next few days.

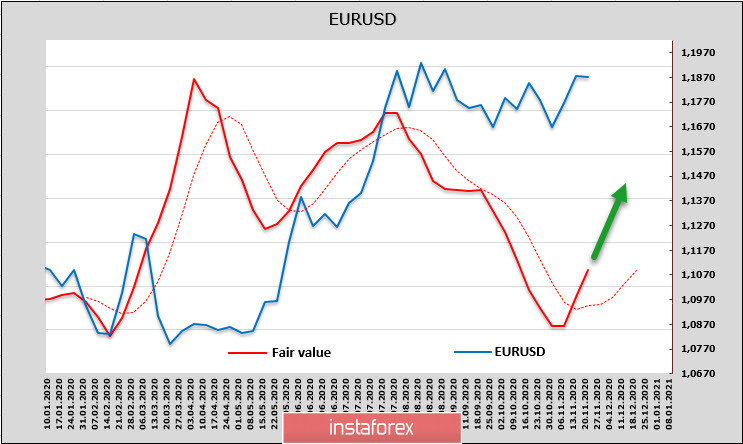

EUR/USD

Euro's net long position declined again, but this time by 117 million. It is likely that the euro sell-off is ending soon. A comparison of the dynamics of 10-year German and US bond yields shows that the exceeding growth of Treasury yields is coming to an end, which indicates an increase in risks for the dollar against the euro. Moreover, European stock indexes have significantly better dynamics against the US, which indicates the preferences of investors. As a result, the estimated fair price reversed up, and the chances of resuming growth increased.

The unexpected political crisis associated with the unwillingness of Poland and Hungary to link the distribution of money from the reconstruction Fund to the legal category of the rule of law (which is directly linked to the unwillingness of these countries to accept migrants from Africa) did not allow us to find a solution at the final summit. The pressure on these countries will certainly increase, as the next deadline will be on December 10, when the meeting will be held as usual.

Technically, the euro looks neutral. This morning, the price is near the upper limit of the channel, and a pullback looks reasonable, but the target price points to strong upside potential. The resistance zone 1.1900/20 has held out so far, but its passage is more likely than a downward pullback, after which a movement to 1.20 should be expected.

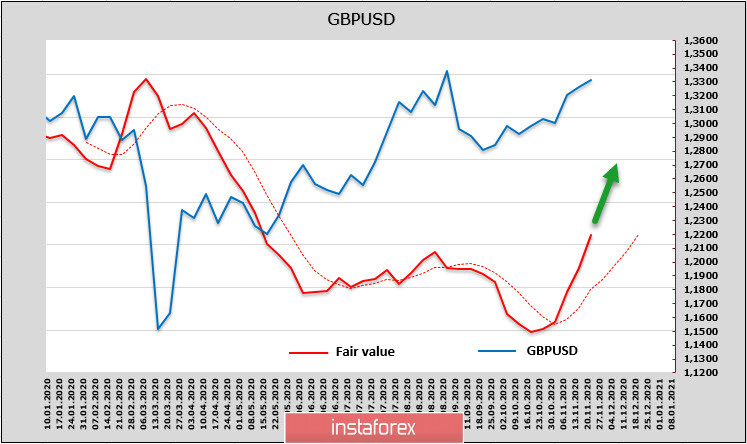

GBP/USD

The pound's net short position slightly rose to -1.635 billion at the end of the reporting week. The margin is minimal and there is still no single dynamics. At the same time, there are noticeable changes in investors' mood, which is indicated by a steady increase in the estimated price.

There are two reasons why the pound has a good chance of continuing growth. First, the October retail sales report came out better than expected, strengthening the positive inflation data, which allows counting on stable consumer demand and reduces the probability of unexpected measures from the Bank of England at the same time. Secondly, the Brexit negotiations may not have ended last week with the expected breakthrough, but it became clear that both sides are eagerly looking for a way to prevent chaos in relations – the UK government is preparing a plan to ratify the agreement that has not yet been signed, and the EU leadership is considering the option of accepting a trade agreement on a temporary basis to buy time.

As a result, the pound is preparing for positivity; therefore, a breakout from the channel up becomes the most likely scenario. The resistance 1.3340/60 is very near and the goals are the recent highs of 1.3480 and 1.3512. A consolidation above will give us a bullish picture.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română