The first part of the market performance called "Buying on rumors, selling on facts" was swallowed by traders without choking: the GBPUSD pair has grown by 5% since the beginning of November on expectations of a deal in the framework of Brexit. A few days ago, the chief negotiator from Britain, David Frost, said that it should be expected on Tuesday, November 24, and investors will be happy to watch the second part of the presentation - selling on the facts. Which in fact may not be as fascinating as the first one, because the sterling rally can not be associated solely with hopes for a successful Brexit.

The EU has a track record of bargaining with greater powers than itself. The European Union has nerves of steel and a bull's hide, it is not afraid of the edge of the abyss. More than once, when there was only one day left before the end of many years of negotiations, the Europeans said that they had a lot of time – as much as 24 hours. And in the end, the contract was signed. In this regard, the statements of Brussels on agreement on most issues and on "progress on important files" inflated the GBPUSD quotes to the top of the 33rd figure is not accidental. The market waits for a breakout and buys. Will it wait? Let's hope so. At the very least, British Finance Minister Rishi Sunak is confident that the economy of Britain will be strong next year, and this is unlikely to be possible without a successful Brexit.

The 5% rally of the analyzed pair since the beginning of November is based not only on expectations of an agreement between London and Brussels. The US dollar is retreating on all fronts amid a reduction in political risks in the US, expectations of the Fed's announcement about the launch of operations "twist" in December, and the impressive growth of US stock indexes. The S&P 500 has updated its historical high which was encouraged by news of the successful COVID-19 vaccine trial. Especially since the US is going to start getting vaccinated in three weeks. The dominance of bulls in the US stock market indicates a high global appetite for risk and puts pressure on safe-haven assets, including the US dollar.

Dynamics of the S&P 500 and GBPUSD:

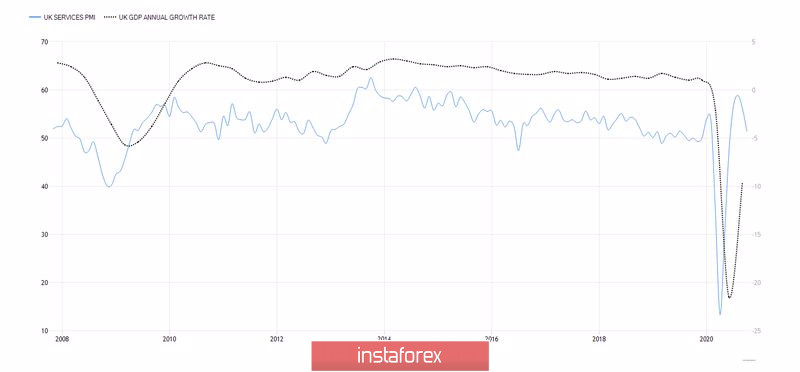

The data on business activity in Britain for October supported the rally of the sterling. The index of purchasing managers in the manufacturing sector rose from 53.7 to 55.2, exceeding the forecast of 50.5, and the PMI in the services sector was also better than Bloomberg experts' initial forecasts, although it went below the critical mark of 50. The economy remains resilient to adverse epidemiological conditions and restrictions. If Britain manages to avoid a double-dip recession, this will be good news not only for the GBPUSD bulls, but also for the bears on EURGBP.

Dynamics of GDP and business activity in Britain:

Technically, the GBPUSD clearly worked out the Broadening Wedge pattern on the daily chart, which allowed us to form positions on a pullback followed by a rebound from support at 1.312. In the previous article, I recommended keeping them until the quotes reach the targets at 1.337 and 1.351. I believe that the sale of sterling on the facts will still take place, so it makes sense to fix the profit on longs. Part or in full – it's up to you.

GBPUSD daily chart:

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română