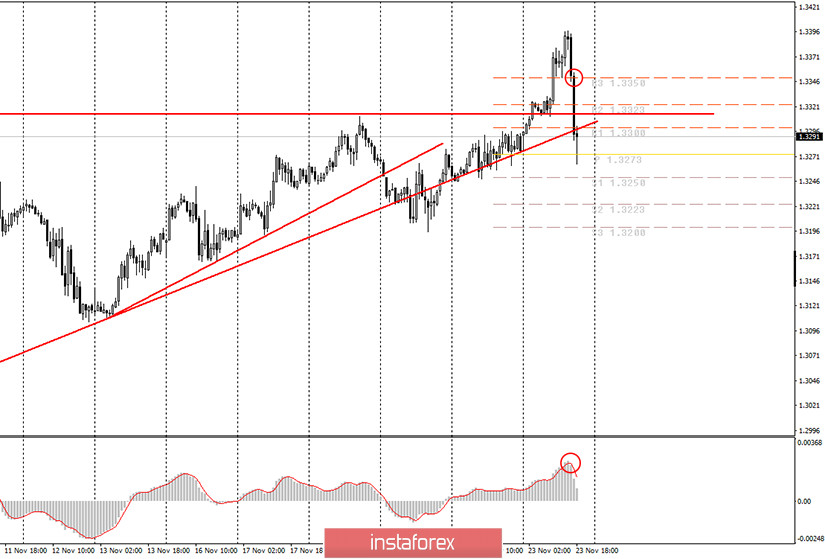

Hourly chart of the GBP/USD pair

Trading the GBP/USD pair on the first trading day of the week was very similar to the EUR/USD pair. The price increased in the first half of the day, however, it fell in the US session and started a rather strong downward movement. Unfortunately, the technical picture for the pound is not as beautiful as for the euro, which greatly complicates the process of trading and processing the signals. For example, the chart clearly shows two trend lines at once, but the price overcame both, afterwards we saw an upward trend. In fact, the upward trend was maintained all this time, however, signals to change the trend regularly appeared. Nevertheless, in our last review on the pound, we advised you to buy the pair if we can go beyond the 1.3313 level by reaching the 1.3377 target. Today this level has been overcome, and the goal was reached. Therefore, novice traders could earn about 60 points. At the same time, you were advised to sell the pound/dollar pair at a new MACD sell signal, and such a signal also appeared today (circled), thus, novice traders could open sell positions today, and you could have gained 60 points. Even if traders only opened one trade, they still remained in profit.

Today's fundamental component was rather ambiguous for the British pound. Service PMI in the UK was slightly above the forecasted values, but was still below the level of 50.0. Thus, the service sector is also shrinking in Britain, which is negative for the economy. Nevertheless, the pound continued to rise in the first half of the day, and only began to fall in the afternoon. Of course, US PMIs could have made such an impression on market participants. After all, these indicators mean that the British economy will contract thanks to a new lockdown at the end of 2021, but the US one will not. However, we still believe that the dollar grew due to technical reasons, although not without the influence of the macroeconomic background.

No major reports scheduled for release tomorrow in both the UK and the US. Nevertheless, traders may continue to await information regarding trade talks between London and Brussels, since this topic is really important for the pound. If we receive information that the negotiations have reached a deadlock again, this could pull down the pound again. Moreover, the technical picture is now ambiguous and does not provide serious support to either buyers or sellers.

Possible scenarios for November 24

1) The important and strong level of 1.3313 was overcome today, however, not a single trend line supports the upward trend. Moreover, we continue to expect that the pound will begin to sharply fall, which is supported by the fundamental background. Therefore, from our point of view, it is not safe to open buy positions now.

2) From our point of view, sell positions are more convenient, and for a large number of reasons. Both upward trend lines have been overcome, the pair has settled below the 1.3313 level. And so we would recommend selling the pair, but after a round of upward correction, since it is unlikely that the quotes will continue to fall after the pair has already gone down by about 100 points. And even if it continues, novice traders will have to follow the deal at night, which is not very convenient.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română