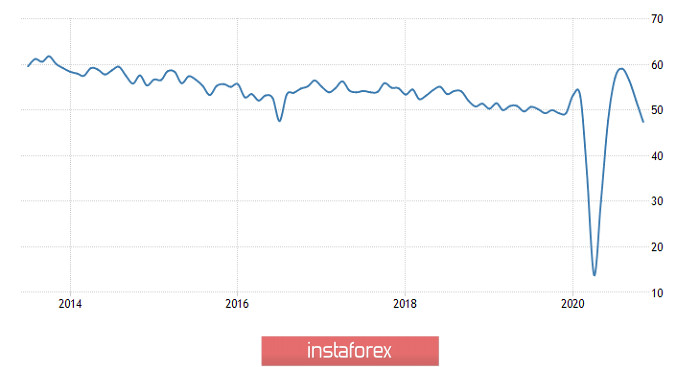

The pound started Monday by sharply rising, prompted by reports of successful trials of the British coronavirus vaccine. And against the backdrop of such optimistic news, although many questions immediately emerged regarding the vaccine, market participants simply ignored the preliminary data on business activity indices in the UK, which turned out to be much better than forecasts. The market was simply standing still when the preliminary data was released. The pound rose literally an hour or two before that. You see, the manufacturing PMI increased from 53.7 to 55.2. Although it was expected to drop to 50.0. The index of business activity in the service sector fell from 51.4 to 45.8. But the fact is that it was predicted to decrease to 42.0. As a result of all this, the composite PMI, which was supposed to decline from 52.1 to 42.2, decreased only to 47.4. Although we must admit that we are still talking about a decline in the main indices, and below the 50.0 point mark, which separates growth from stagnation. Nevertheless, the data came out better than predicted, and the possible appearance of a vaccine has already become the reason for the abolition of the national quarantine.

Composite PMI (UK):

Nevertheless, the pound began to lose all its gains when the US session opened, and as a result, it ended the day at about the same place where it started. On the one hand, this was the result of the publication of preliminary indexes of business activity in the United States, which pleasantly surprised market participants. The index of business activity in the manufacturing sector, instead of falling from 53.4 to 52.9, rose to 56.7. Exactly the same thing happened with the index of business activity in the service sector, which was supposed to decline from 56.9 to 55.1. It turns out that it had grown to 57.7. So it comes as no surprise that the composite PMI rose from 56.3 to 57.9. Although it was expected to decline to 54.5. So apparently, PMIs are increasing in the United States, while they are going down in the UK. Except, of course, the production index. But another factor is that political uncertainty in the United States seems to be waning. The states are gradually certifying the voting results, and Donald Trump has less and less chance of challenging them. So everything goes to the fact that for the next four years, Joseph Biden will become the head of the White House. Most importantly, any outcome reduces uncertainty.

Composite PMI (United States):

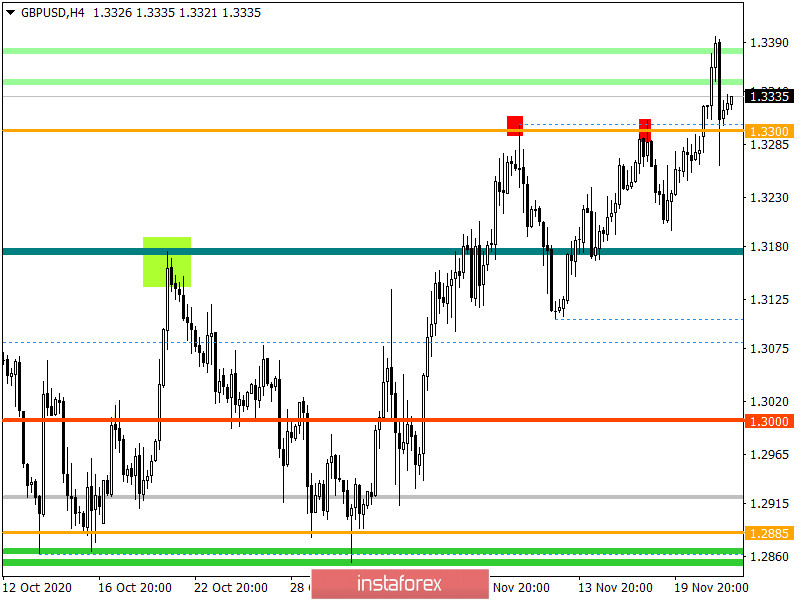

After an intense upward movement, the GBPUSD pair found a resistance point in the 1.3400 area, where after briefly stopping, it reversed.

Based on the quote's current location, we can see a recovery process, where the quote continues to fluctuate above the 1.3300 level.

As for volatility, there is high activity, where dynamics has exceeded the average level for the first time in seven trading days.

Considering the trading chart in general terms, the daily period, it is worth highlighting the upward movement of the price, due to which the pound recovered by almost 100% relative to the decline in September.

We can assume that keeping the price above 1.3350 will increase buyers' chances for a subsequent upward move. At the same time, it is possible that the quote will temporarily pause for a moment, which will lead to jolts between the values of 1.3300/1.3350, relative to which a new path will be set.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments have an unstable signal due to the recent rally, while the quote is still above 1.3300 and the indicators are inclined to signal a buy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română