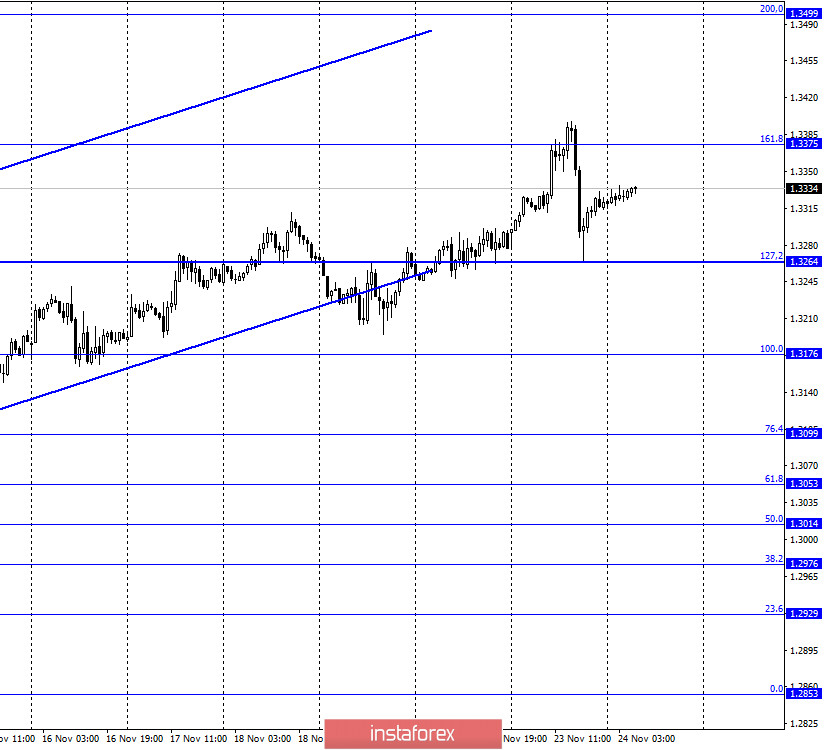

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair performed a sharp reversal in favor of the British currency yesterday and fell to the Fibo level of 127.2% (1.3264). However, the rebound from this level has already worked in favor of the British and the resumption of the growth process in the direction of the corrective level of 161.8% (1.3375). The rebound of quotes from this level will allow traders to expect a new fall in the direction of the corrective level of 127.2% (1.3264). Yesterday, it became known that negotiations on a trade agreement have resumed. Resumed in video mode, as at the end of last week, one of the members of the EU delegation was infected with the coronavirus. However, Michel Barnier noted that differences on key issues remain and there is still a lot of work to be done to try to catch up before the end of the "transition period". Michel Barnier did not say anything about the timing of the negotiations, from which it can be concluded that the negotiations will continue for as long as necessary. It is noted that the most difficult issue remains the issue of fishing. Britain does not want to allow any of the EU countries into its waters, and the EU, and especially France, are opposed to such a decision by London. According to some sources, there was a proposal that EU access to British waters for fishing would be reviewed every few years, but Brussels insists on a strict binding of this point in the general agreement. In other words, if this clause changes, the entire agreement will also change. Thus, the parties may not be far from signing an agreement, but really difficult issues remain. And not the fact that they can be overcome.

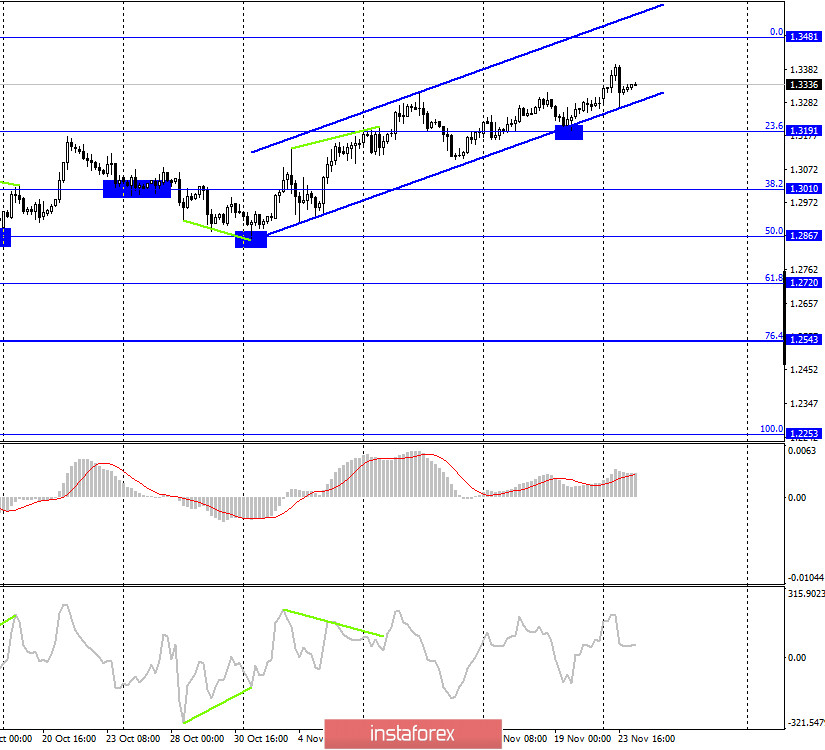

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair generally continues to grow in the direction of the corrective level of 0.0% (1.3481). Yesterday's drop in prices was too short, so it did not affect the general mood of traders. An upward trend corridor was built, which also clearly shows the current mood of traders - "bullish". Fixing the pair's rate under this corridor will work in favor of the US currency and start falling towards the levels of 1.3191 and 1.3010.

GBP/USD – Daily.

On the daily chart, the pair's quotes continue to grow in the direction of the corrective level of 100.0% (1.3513). However, when trading a pair, I recommend paying more attention to the lower charts. They are now more informative.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair completed a new close above the lower downward trend line, although a false breakout of this line followed earlier. In recent weeks, the pair has made new attempts to gain a foothold over both trend lines.

Overview of fundamentals:

On Monday, business activity indices in the UK showed the same dynamics as in the EU. The service sector has declined, while the production sector has grown.

US and UK news calendar:

On November 24, the US and UK calendars are empty. Thus, today the information background may not be available for the pair unless unplanned news arrives.

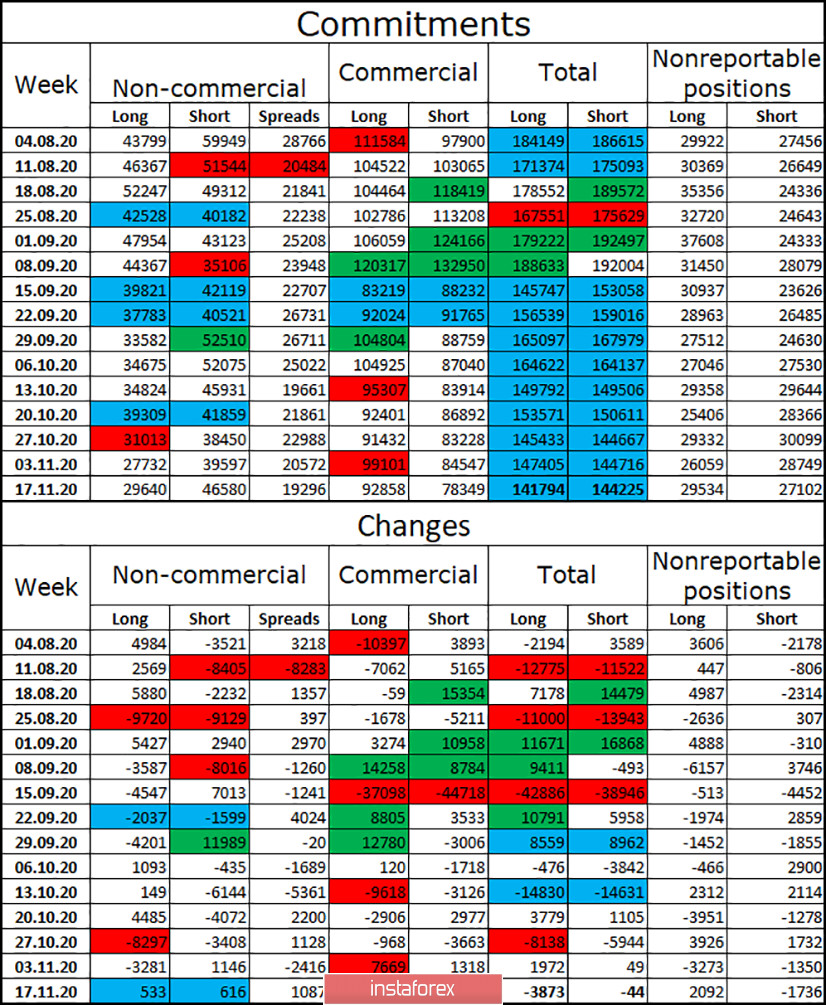

COT (Commitments of Traders) report:

The last two COT reports showed a fairly sharp increase in the number of open short contracts for the "Non-commercial" category of traders. This suggests that speculators continue to believe in the fall of the British dollar in the very near future. Over the past three weeks, speculators have been building up short contracts and closing long ones. In general, major players are more afraid of opening new contracts, so their total number is falling. This is seen in the table above. Thus, conclusion number one: major players are afraid of the uncertainty associated with the trade deal and the British economy, so they do not want to trade the pound more actively. Conclusion number two: speculators believe more in the fall of the pound than in its growth.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend selling the GBP/USD pair with a target of 1.3176 if a close is made under the ascending corridor on the 4-hour chart. I recommend that you be careful with the pair's purchases now, as the quotes have consolidated under the trend corridor on the hourly chart, the COT report shows the faith of major players in the fall of the pound, and there is still no trade deal between London and Brussels.

Terms:

"Non-commercial" - large market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română