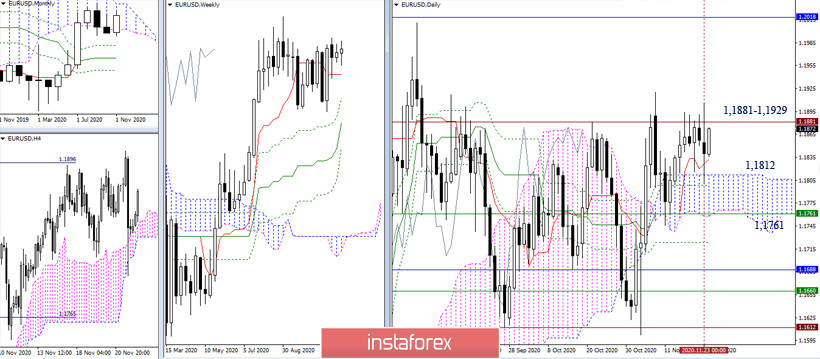

EUR / USD

Fundamental surges that are sudden failed to change the technical outlook. Therefore, the pair remained within the previously indicated limits of 1.1881 - 1.1929 (historical level + 100% target development for the breakdown of the H4 cloud) and 1.1812 (daily cloud). The main tasks and possible options for the development of events remained relevant.

Yesterday's activity expanded the current potentials of the classic pivot levels. However, changing the situation will be hard, as the pair is still tied to the key levels in the lower halves, which combine their efforts today in the area of 1.1849-61 (weekly long-term trend + central pivot level). As long as it is in the zone of these levels, uncertainty will continue to grow. To change the situation, the euro needs to leave the area limited by important supports and resistances (1.1881-1.1929 - 1.1812) of the bigger time frames. The intraday pivot levels are located today at 1.1897 - 1.1955 - 1.2003 (resistance) and 1.1791 - 1.1743 - 1.1685 (support).

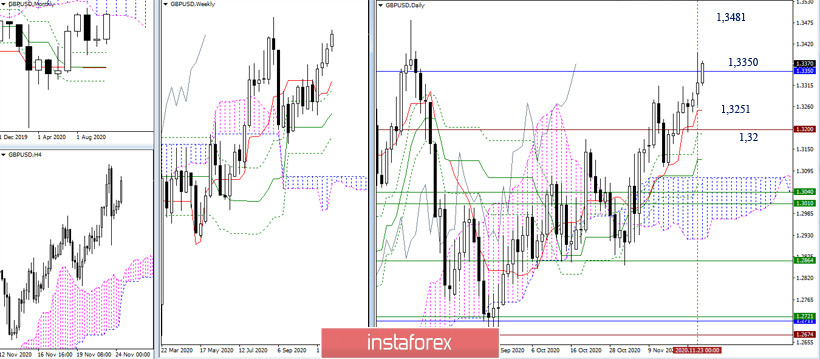

GBP / USD

The lower limit of the monthly cloud (1.3350) which was tested, ended with a daily rebound. However, instead of confirming and developing the rebound, the pair is retesting the important level of 1.3350. Now, the bulls' goal is to close November in the monthly cloud. The nearest supports today can be noted at 1.3251 (daily short-term trend) and 1.32 (all-time level + daily Fibo Kijun).

The support for key levels in the smaller time frames still helps players to improve. Yesterday's movement is a vivid example of this. Due to this, the bulls retain the advantage, despite being in the correction zone. Today, the key levels are located at 1.3327 (central pivot level) and 1.3280 (weekly long-term trend). A consolidation below will change the balance of power on the hourly chart. Now, if you leave the correction zone (1.3397) and continue to rise, the intraday benchmarks can be noted at 1.3461 (R2) and 1.3524 (R3). On the other hand, with the return of bearish mood, support for classic pivot levels is now at 1.3256 - 1.3193 - 1.3122.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română