US dollar loses ground amid news of formal transfer of power from incumbent US President, Donald Trump, to newly-elected President, Joe Biden. Janet Yellen's nomination for the post of finance minister also did not add optimism to dollar bulls, and the news about the COVID-19 vaccine, which has been circulating these recent weeks, only fuel the demand for risky assets.

Yesterday, news emerged that Joe Biden nominated Janet Yellen for the post of Treasury Secretary of the United States. Clearly, Biden plans to act more aggressively on monetary and fiscal policy in order to return the US economy to its pre-crisis levels as soon as possible. Yellen is the former chairman of the US Federal Reserve System, and in her post she has established herself as a supporter of a number of stimulus measures, which she intends to introduce to fuel the pace of economic growth, as it has been weakening recently due to the second wave of coronavirus.

The second wave of the pandemic has already seriously affected the situation on the US housing market, and according to some experts, some changes are already irreversible. Usually, during a crisis, the housing market drops dramatically, which cannot be said during the current recession. Low interest rates and the availability of credit, along with government support measures, allow Americans to use cheap money to improve their living conditions, which only heats up the real estate market, leading to a sharp jump in prices. A report from Redfin said that house prices in the US already rose 14.2% in October, as compared to the same period last year.

The latest data from S&P CoreLogic and Case-Shiller also indicated a sharp growth in the national house price index. According to the report, price jumped by 1.2% in September as compared to August, and grew 7.0% as compared to the same period in 2019. This is the highest rate seen since May 2014. It was the sales in the secondary housing market which increased immediately by 9.4%. However, this rapid growth may be followed by a sharp slowdown, which will negatively affect the economy. Another problem is the inevitable decline in income after the end of various financial assistance programs, as it will affect the solvency and also harm the real estate market.

In another note, reports emerged that despite the change in cabinet, the US continues to actively work on new sanctions against China. Sources say the administration of the current US President, Donald Trump, is preparing a package of measures that will deal a new blow to the Chinese economy. They said that an informal alliance of Western countries may be formed, however, which specific countries were not mentioned. Such an alliance though will be created precisely to jointly resist economic pressure from China.

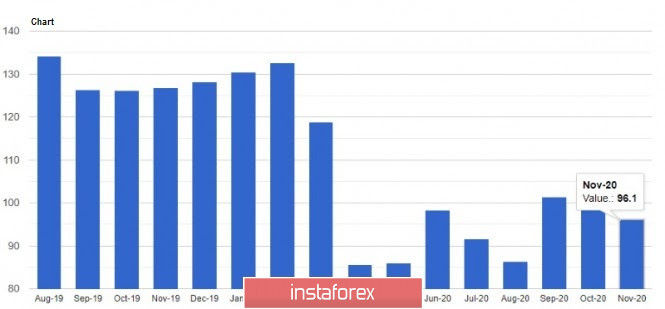

Going back to economic reports, the latest data on US consumer confidence indicated a sharp drop in the November index. The Conference Board said the indicator fell significantly from 101.4 points to 96.1 points, amid the persistent rise of COVID-19 infections in the country. Economists had expected the index to come out 98.0 points. The worst hit was the sub-index of expectations for short-term income, business and labor market conditions, which declined to 89.5 points.

With regards to the technical picture of the EUR/USD pair, the bulls continue to open long positions in the euro, maintaining hope for a resumption of the upward trend and the renewal of the 20th figure. However, only a real consolidation at the level of 1.1900 will bring the quotes to the highs 1.1960 and 1.2010. If the quotes return to the level of 1.1850, the EUR/USD pair will fall to the lows 1.1800 and 1.1750.

GBP/USD

Recent reports say the UK will increase government spending up to £ 4.3 billion. Help will be provided to those who have lost their jobs and to those who are already looking for it, but are experiencing problems.

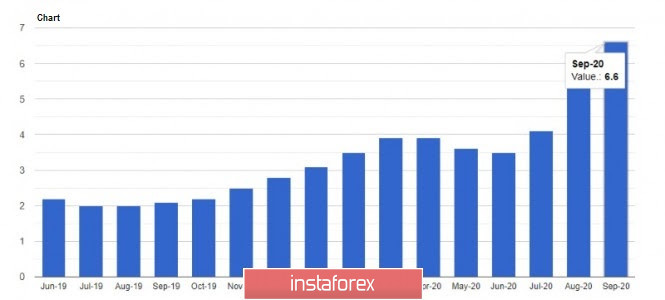

UK's Treasury Secretary, Rishi Sunak, will detail the new spending plan today, and it is set to include a three-year program worth £ 2.9 billion aimed to help over a million unemployed people. Another £ 1.4 billion will go to support employment centers, since according to earlier reports, unemployment in the country rose 4.8% in September, while the number of employees fell by 782,000 in October.

With regards to the technical picture of the GBP/USD pair, the bulls are still aiming at the level of 1.3390, since a breakout from which will result in a sharp rise towards 1.3470 and 1.3530. But if the pressure on the pound returns, the quotes will likely return to the level of 1.3270, and then fall to the lows 1.3170 and 1.3100.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română