The news that D. Trump's administration is officially starting to pass over the power to the winner of the last elections, J. Biden helped the stock markets' demand to rise, which, together with recent news about vaccines against COVID-19, lessens uncertainty that has prevented investors from being active.

There were recently two main negative uncertainties on the market – the timing of the COVID-19 pandemic and the results of the US presidential elections. If the first one is already beginning to clear up due to the emergence of effective vaccines, then the second one still remains and holds many investors down with the prospect of a possible collapse of power. But yesterday's news dismissed these concerns, which led to rising demand for company shares and higher prices for crude oil and other commodity assets.

An important signal is the sharp drop in the gold's price, which has been perceived as a safe haven since the pandemic started. However, it began to give up as the prospective pressure of the pandemic began to deteriorate.

On another note, the currency market seems confused, which has been restlessly moving up and down. This behavior is due to the presence of a large number of mutually exclusive factors. For example, the US dollar's weakness is fully compensated by the same weakness of the Euro, which is under the burden of the problems of the eurozone. In particular, the rejection of the EU budget and prolonged discussion on new incentives.

From our viewpoint, a strong signal was provided by the sharp local growth of the USD on Monday amid the publication of good production data, which likely led some investors to consider that talking about new additional stimulus for the US economy will remain just talk, due to the emergence of COVID-19 vaccine. Moreover, the economy is slowly starting to gain momentum, so this financial aid is hardly needed.

In this case, the US dollar is unlikely to clearly weaken, and its dynamics against major currencies will be situational and largely depend on incoming economic data and the general mood to risk on the part of investors.

Forecast of the day:

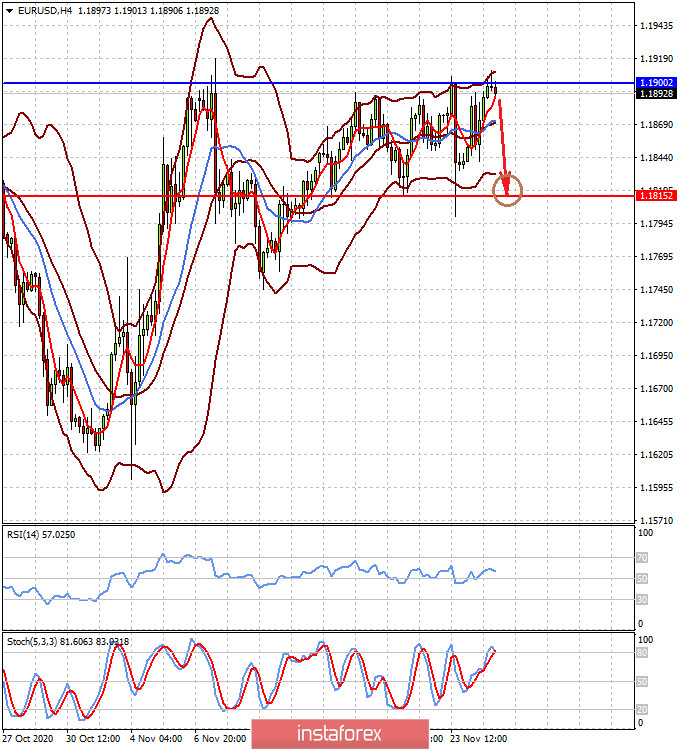

The EUR/USD pair remains in the range of 1.1815-1.1900. If it fails to rise above the upper limit, another local downturn to the level of 1.1815 is likely.

The NZD/USD pair shows an attempt to make a local downward reversal. If the price drops below the level of 0.6955, it will further decline to 0.6900.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română