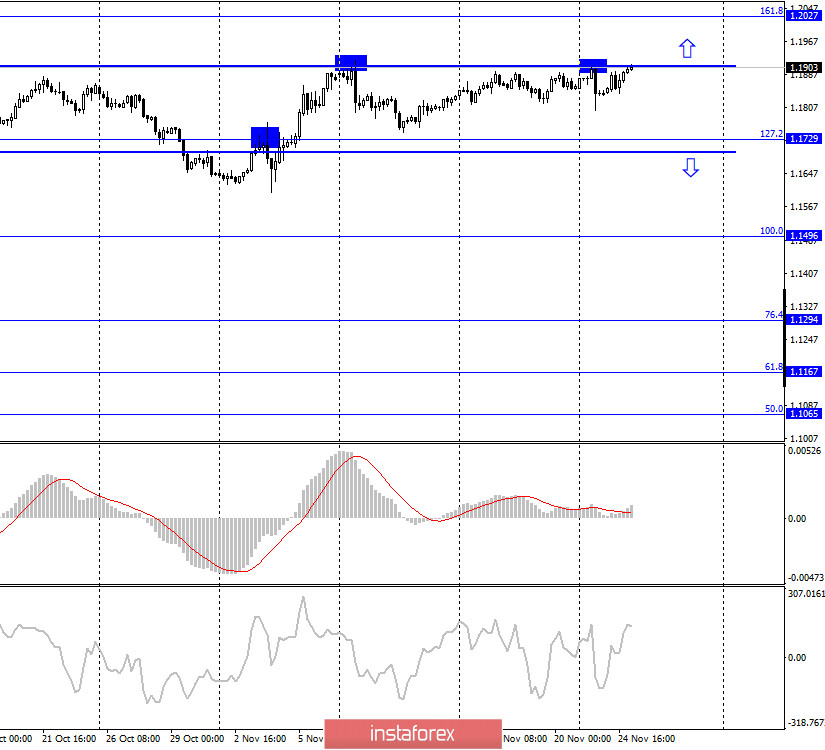

EUR/USD – 1H.

On November 24, the EUR/USD pair continued the growth process that began the day before, in the direction of the corrective level of 0.0% (1.1920). However, the pair's quotes may not reach this level, as the upper border of the side corridor on the 4-hour chart still provides serious resistance to bull traders. Thus, today I recommend monitoring the behavior of traders near this border. Meanwhile, US President Donald Trump made his first statement from the walls of the White House after losing the election. During the 62-second speech, Trump congratulated everyone on reaching the Dow Jones index's all-time high. Naturally, Trump did not forget to mention his merit in achieving this level and generally spoke only about this record. According to the latest data from Johns Hopkins University, the number of diseases every day in the United States is at least 170,000. These are huge numbers. The total number of cases has already exceeded 12.5 million, and the number of deaths is 260,000. However, it is certainly not profitable for Trump to talk about these figures. Although by and large, it doesn't matter now, since Trump lost the election, most of the courts refused to recount the votes or cancel the results of the voting in a particular state, so everything is moving smoothly to the process of transferring power to Joe Biden.

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes returned to the upper border of the side corridor. Thus, a new rebound of the pair's rate from this line will again work in favor of the US currency, and some fall in the direction of the corrective level of 127.2% (1.1729). Fixing quotes above the corridor will increase the probability of further growth towards the next corrective level of 161.8% (1.2027).

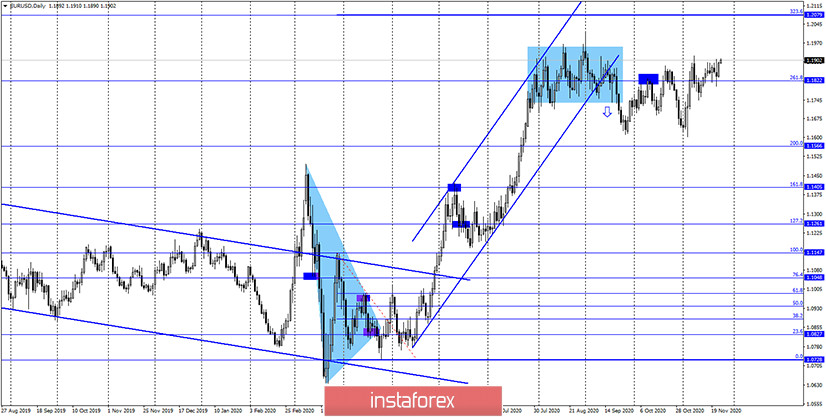

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a new consolidation above the corrective level of 261.8% (1.1822). However, this level remains weak, and the key for the pair remains the side corridor on the 4-hour chart.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair, but in the long term. In the short term, a drop is preferable.

Overview of fundamentals:

On November 24, ECB President Christine Lagarde delivered a speech in the European Union. However, this time, Lagarde did not tell traders anything important. Thus, the information background was very weak yesterday.

The news calendar for the United States and the European Union:

US - change in GDP per quarter (13:30 GMT).

US - change in the volume of orders for durable goods (13:30 GMT).

US - number of primary and repeated applications for unemployment benefits (13:30 GMT).

US - publication of the FOMC minutes (19:00 GMT).

On November 25, several quite important economic reports will be released in America, so the information background will be strong for the pair today.

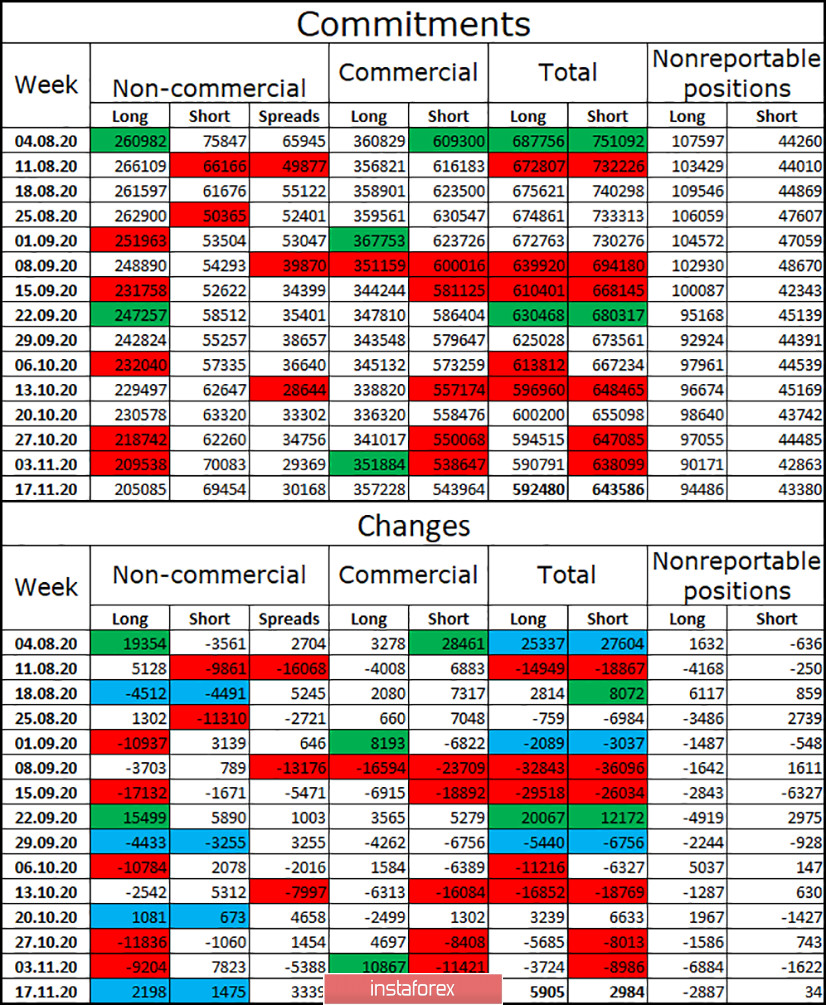

COT (Commitments of Traders) report`:

The penultimate COT report was released with some delay, so here I will analyze the changes in two reports at once. Fortunately, there are almost no changes. As well as the price changes of the euro/dollar pair in the last few months, which is visible on the 4-hour chart. Over the last two reporting weeks, the number of long contracts in the hands of the "Non-commercial" category of traders decreased by 4.5 thousand, and the number of short contracts - by 0.5 thousand. During the last reporting week, speculators opened approximately the same number of long and short contracts. Thus, in general, the changes are insignificant. The mood of speculators became a little more "bearish", but again slightly. There are even fewer changes in other categories of traders. The most important thing I would like to note is that the mood of major players is not becoming more "bullish", which means that there are no prerequisites to expect a resumption of the upward trend now.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with the targets of 1.1845 and 1.1798, if the rebound from the upper limit of the corridor is performed on the 4-hour chart. Purchases of the pair will be possible with a target of 1.2027 if it is fixed above the side corridor on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română