To open long positions on GBPUSD, you need:

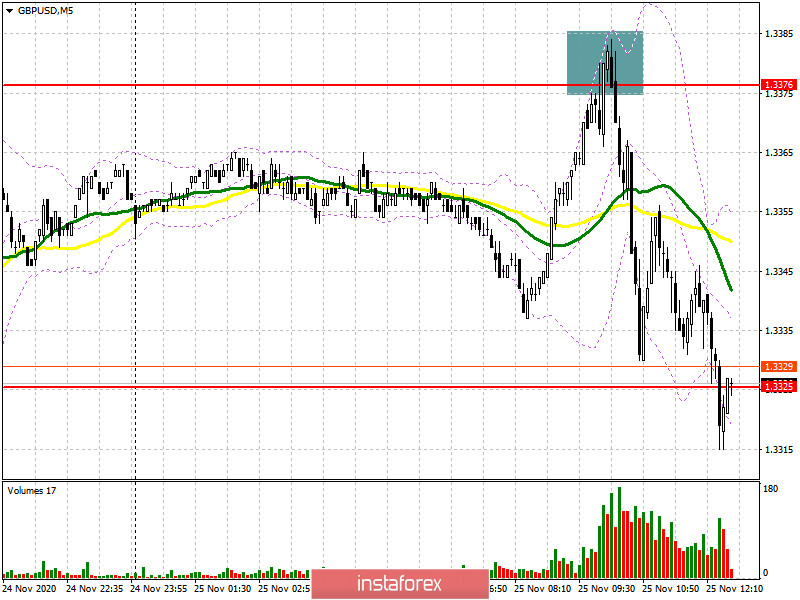

In my morning forecast, I recommended opening short positions when a false breakout is formed in the resistance area of 1.3376, which happened. And if yesterday the pound caused a lot of trouble, today, the first sale from 1.3376 made it possible to compensate for all losses, as the downward movement was more than 40 points. Let's look at a 5-minute chart. On it, I marked the point where a false breakout was formed after an unsuccessful attempt by the bulls to resume the growth of the pound. A return under 1.3376 quickly pushed the pair to the morning support of 1.3325, for which the main fight will unfold in the second half of the day.

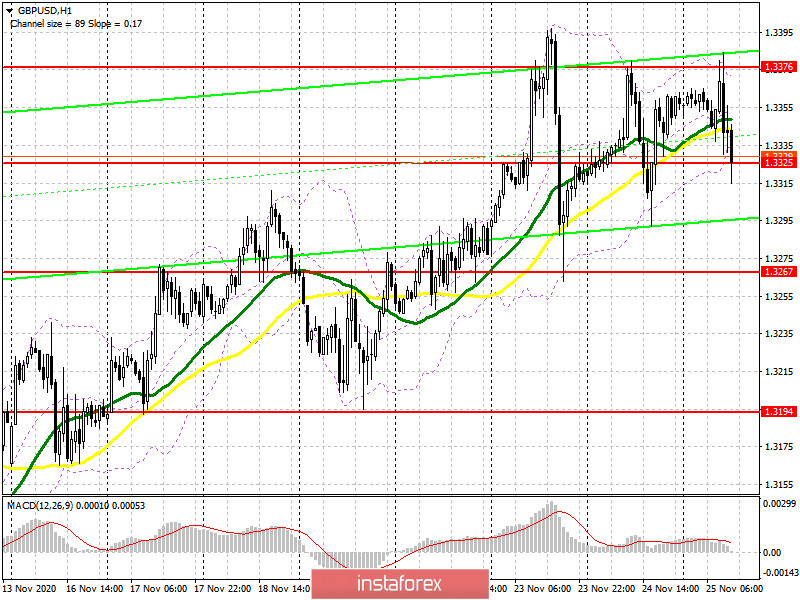

As a result of all the movements, the technical picture remained completely unchanged. The entire focus in the second half of the day will be shifted to a fairly large number of fundamental statistics on the American economy. Today, important US GDP reports and Federal Reserve minutes are published, which may lead to a slight strengthening of the dollar. If the data turns out to be worse than economists' forecasts, and we are also interested in the income and expenses of Americans, then demand for the pound will quickly increase. Only if a false breakout is formed in the support area of 1.3325, by analogy, as it was yesterday, buyers will be able to form a signal to open long positions in the expectation of resuming the bull market. In this case, the goal will be to re-update the maximum of 1.3376, which now determines the further movement of the pair. Fixing above 1.3376 will open up a real prospect for GBP/USD to update the highs of 1.3453 and 1.3523, where I recommend fixing the profits. However, such a large increase will occur only if there is good news on Brexit, or if the fundamentals of the US economy are very weak. If the bulls do not show any activity in the area of 1.3325, then I recommend returning to buying the pound only for a rebound from the minimum of 1.3267, based on a correction of 20-30 points within the day.

To open short positions on GBP / USD, you need to:

Breaking the level of 1.3325 is the primary task of the bears for the second half of the day. Only fixing below this area with its test from the bottom up, similar to yesterday's entry point into short positions, will return new large sellers to the market, which will quickly push GBP/USD to the area of the minimum of 1.3267, where I recommend fixing the profits. It will be possible to talk about the resumption of the bear market only after the breakdown of 1.3267, which will lead to the demolition of several stop orders from buyers and a rapid movement of the pair down to the area of 1.3194. If in the second half of the day the bulls again manage to defend the area of 1.3325, then it is better not to rush with sales. Only another return with the formation of a false breakout in the resistance area of 1.3376 will be a signal to open short positions. If there is no noticeable activity of sellers, it is best to abandon short positions until the new high is updated in the area of 1.3453, where you can sell the pound immediately on the rebound with the expectation of a correction of 20-30 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for November 17, there was a reduction in long positions and a sharp influx of short positions. Long non-commercial positions declined from 27,872 to 27,454. At the same time, short non-commercial positions rose from 45,567 to 47,200. As a result, the negative non-commercial net position was -19,746, against -17,695 weeks earlier, which indicates that the sellers of the British pound retain control and their preponderance in the current situation. Lack of clarity on the trade agreement, together with the lockdown of the British economy in November this year, clearly does not add optimism and confidence to the buyers of the pound.

Signals of indicators:

Moving averages

Trading is below 30 and 50 daily averages, which indicates a likely resumption of the downward correction for the pound.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the lower limit of the indicator around 1.3320 will lead to a new wave of falling of the pound. A break of the upper limit in the area of 1.3376 will form a new upward trend.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română