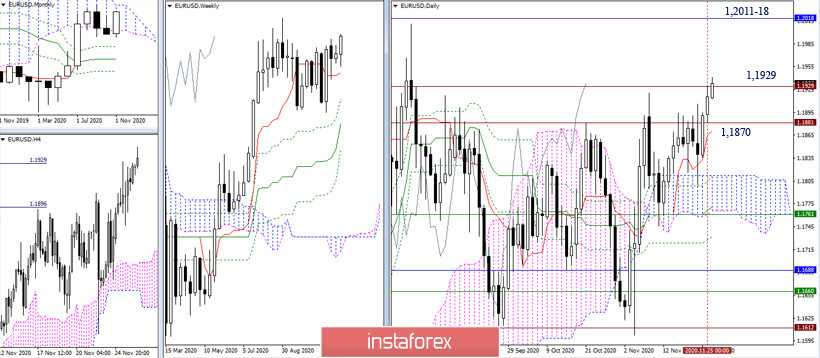

EUR / USD

The euro continued its growth yesterday. Interaction with the resistance zone of 1.1881 - 1.1929 (historical level + 100% target development for the breakout of the four-hour TF cloud) continues. Thus, there should be a weekly result in the next two days.

It was mentioned that a consolidation above the reached resistances will allow us to rely on the further growth and the restoration of the upward trend (1.2011) in the weekly and monthly time frames, while the pair will start struggling to exit the bullish zone relative to the monthly cloud (1.2018). A failure to break through the encountered resistance zone and the loss of the daily short term (1.1870) will return bearish prospects and sentiment to the market.

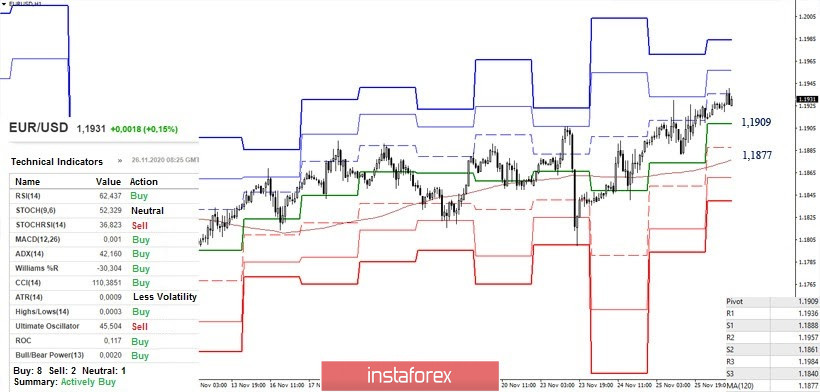

The bulls, which are supported in the smaller time frames, remain to be in favor. At the moment, the resistance of the first pivot point (1.1936) is being tested. The next resistance levels can be considered at 1.1957 (R2) and 1.1984 (R3). On the other hand, the key levels for the one-hour time frame will likely form supports at 1.1909 (central pivot level) and 1.1877 (weekly long-term trend) in case of a correction.

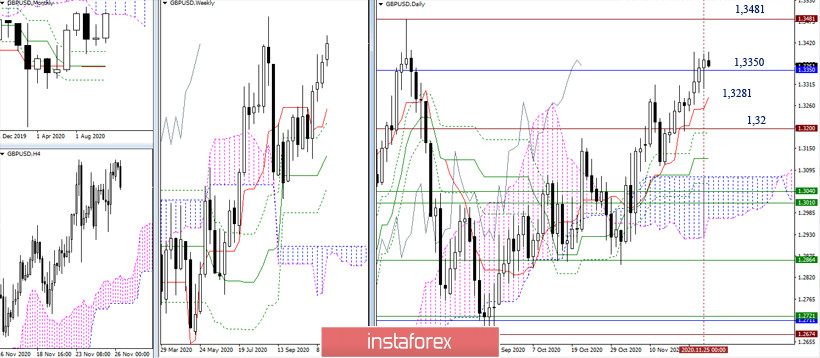

GBP / USD

The situation has not undergone significant changes yesterday. Therefore, the pair remains in the zone of the lower limit of the monthly cloud (1.3350). The result of interaction can influence further preferences and opportunities. The nearest resistance is the high extremum (1.3481), while other support levels are located today at 1.3281 (daily Tenkan) and 1.32 (all-time level).

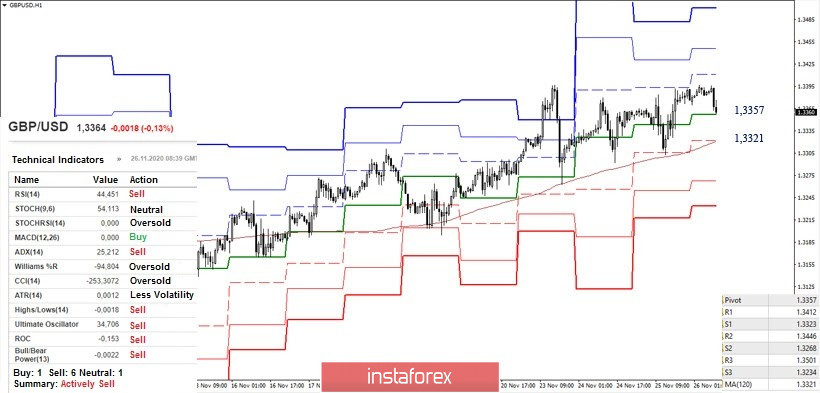

The daily testing of key supports in the smaller time frames continues to confirm bulls' weakness. Now, the pair is already approaching the central pivot level (1.3357), while further support is located at the weekly long-term trend (1.3321). A consolidation below will change the balance of power, giving priority to strengthen the bearish mood. The next downside goals for the intraday can be noted at 1.3268 (S2) and 1.3234 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română