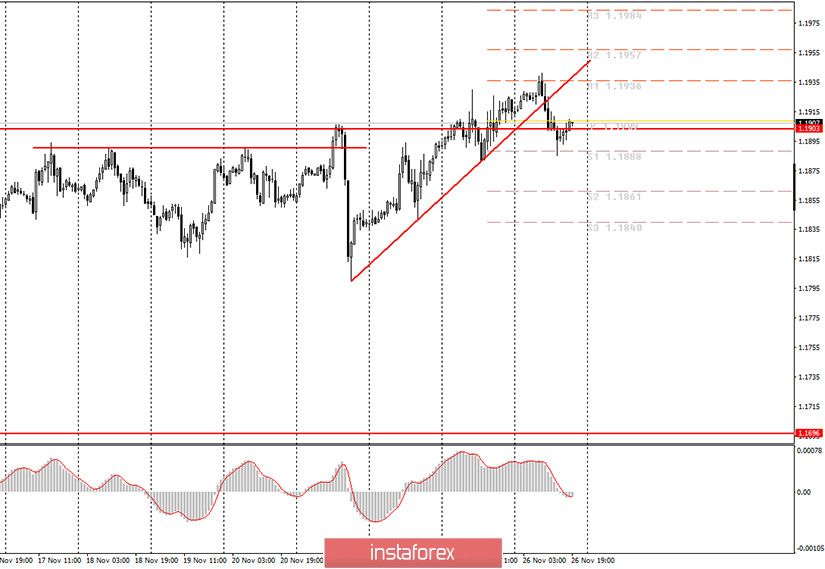

Hourly chart of the EUR/USD pair

Following our morning review, the EUR/USD pair fell and began a round of either a downward movement, or a downward correction. We have warned novice traders that virtually, any downward pullback will result in the upward trend line being broken. And so it happened. Therefore, the upward trend has now formally changed to a downward one. In fact, the price can move in any direction. Simply because the trendline was weak enough to support bull traders. Traders still managed to get the pair out of the 1.1700-1.1900 horizontal channel, so now there are chances for the upward movement to continue. At the same time, take note of the fact that the euro is very reluctant to rise in price. Having barely overcome the 1.1903 level, the pair managed to go up another 30 points, no more, afterwards it immediately began to correct. In total, the pair went up 140 points from the last local low.

No important macroeconomic reports from the European Union and the United States on Thursday. In general, no news that could stir up the markets. Donald Trump continues to amuse the public with his statements in the United States. The US president reiterated the Democrats' election fraud and his own victory, which he would have received without problems if it had not been for the rigging of Joe Biden's team. However, no one has paid attention to these statements for a long time. Meanwhile, the lockdown in Germany has been extended. Other countries may follow Germany's example. The coronavirus situation is also very difficult in America, but the authorities of this country have long decided not to introduce total quarantine. Therefore, the US economy should feel relatively stable in the near future. But will this help the dollar?

Only secondary reports are set for release on Friday in both America and the EU. Novice traders are not recommended to pay attention to this. Therefore, if we do not receive any unexpected information during the day, the fundamental background will be empty tomorrow. Based on this, we see no reason to strengthen the pair's movement. Most likely, the trades will be held with volatility of 50-60 points and the absence of a pronounced movement in one direction.

Possible scenarios for November 27:

1) Long positions have formally become relevant. Buyers managed to take the pair above the 1.1903 level. However, the current upward trend is no longer supported by the trendline, although it was extremely weak. The MACD indicator has discharged to zero, so it can now produce a strong buy signal, but traders no longer have an upward trend line at their disposal. Thus, the technical picture is ambiguous and novice traders can open positions only fully aware of the increased risks. Targets for a possible upward movement are 1.1936 and 1.1957.

2) Trading for a fall at this time remains more relevant. The price has settled below the trend line. Therefore, after a slight upward correction, you can try to try to sell the euro while aiming for 1.1888 and 1.1861. It is a paradoxical situation when both short and long positions can be formally considered.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română