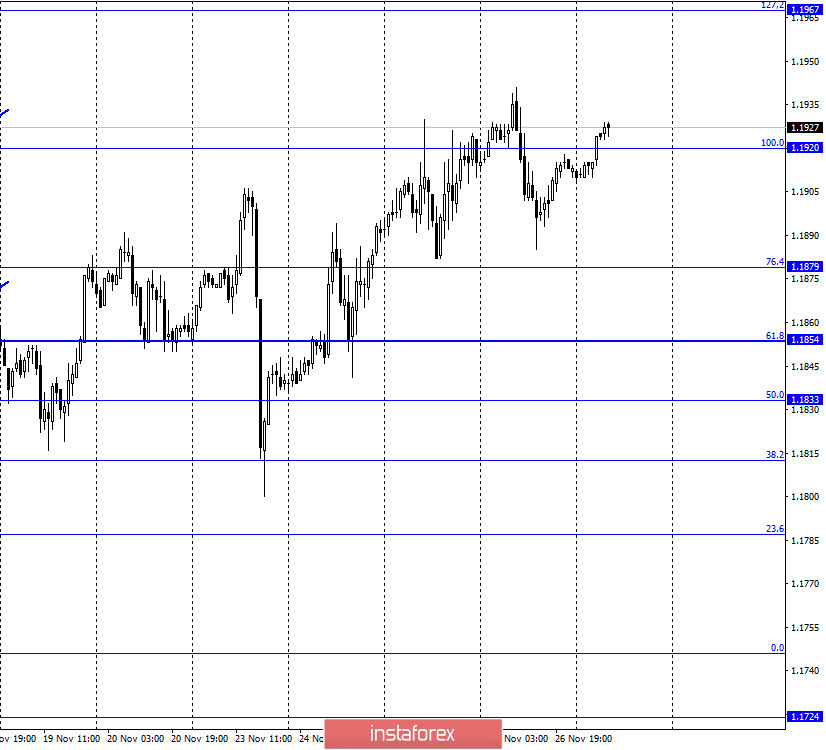

EUR/USD – 1H.

On November 26, the EUR/USD pair performed a new reversal in favor of the European currency and started a new growth process, closing above the corrective level of 100.0% (1.1920). Thus, the growth can be continued in the direction of the corrective level of 127.2% (1.1967). There were very few reports and news yesterday. The European Central Bank protocol was perhaps the most interesting event. However, as was the case with the Fed minutes a little earlier, traders did not learn anything new from it. And even more so, this information could not lead to the growth of the euro currency, which leaves more questions unanswered about its weak growth. Earlier, Christine Lagarde said in several speeches that the European economy may face new problems at the end of 2020 due to an increase in the number of diseases, due to the "lockdowns" introduced in November, and which may be extended in December. Moreover, doctors in many countries of the world are also talking about the third wave that can sweep the world. Thus, Lagarde noted the fact of creating a vaccine against coronavirus but urged not to rejoice ahead of time. Approximately the same was said in the protocol. The EU economy, according to ECB members, will recover long and hard after the crisis. Thus, the European economy will need an additional stimulus in almost any case. However, all this information, although very interesting, did not cause a strong reaction from traders. Like the Fed minutes. The euro/dollar pair continues to trade rather inactive, as can be seen from the 4-hour chart.

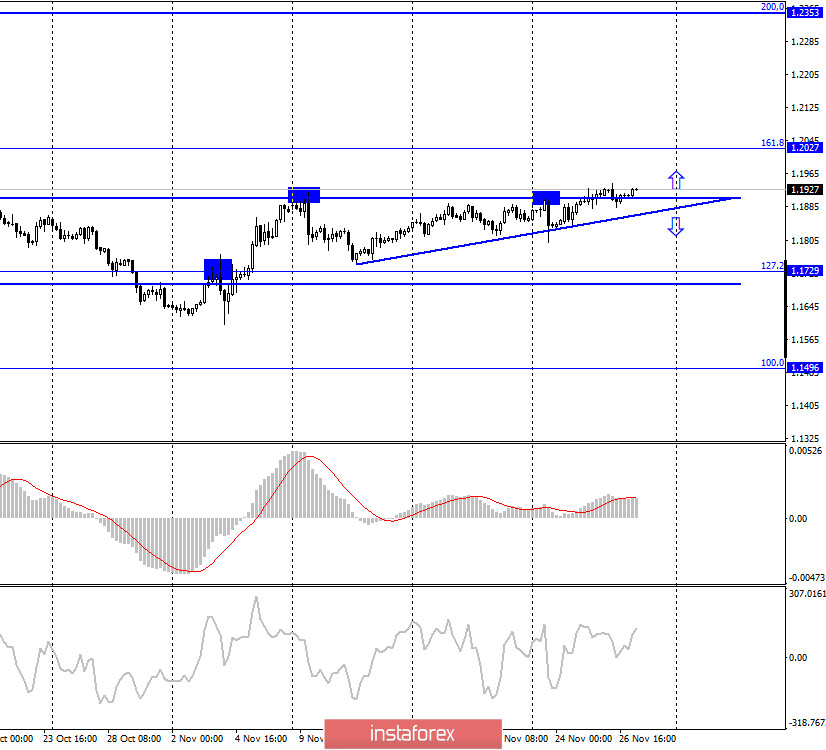

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes were fixed above the upper border of the side corridor. Thus, the growth process can now be continued towards the next corrective level of 161.8% (1.2027). Today, the divergence is not observed in any indicator. The pair finally has a chance to start building a new trend.

EUR/USD – Daily.

On the daily chart, the EUR/USD pair quotes performed a new consolidation above the corrective level of 261.8% (1.1822), which increases the chances of further growth. However, this level remains weak. Last time, the growth of quotes was interrupted several times around the level of 1.1960.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair, but in the long term. In the short term, a drop is preferable.

Overview of fundamentals:

On November 26, America and the European Union did not have a single economic report. Thus, the information background was extremely weak.

News calendar for the United States and the European Union:

On November 26, the economic event calendars in America and the European Union are empty again. The information background will be almost zero today, so trading activity is likely to remain weak.

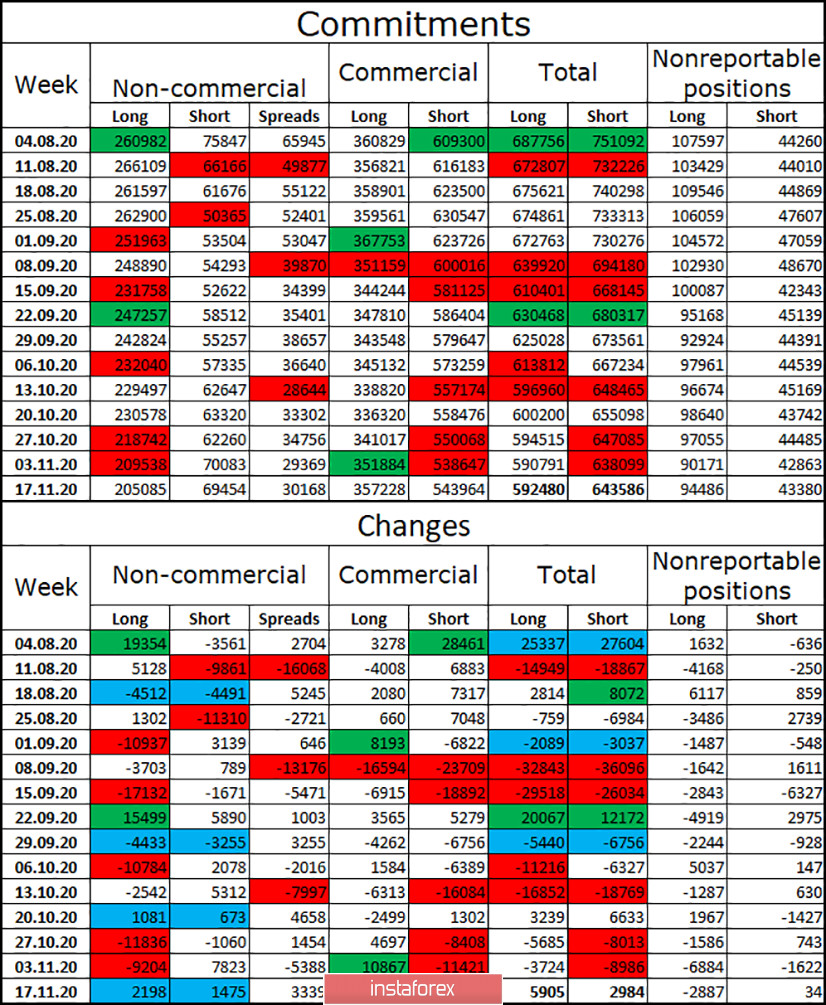

COT (Commitments of Traders) report:

The penultimate COT report was released with some delay, so here I will analyze the changes in two reports at once. Fortunately, there are almost no changes. As well as the price changes of the euro/dollar pair in the last few months, which is visible on the 4-hour chart. Over the last two reporting weeks, the number of long contracts in the hands of the "Non-commercial" category of traders decreased by 4.5 thousand, and the number of short contracts - by 0.5 thousand. During the last reporting week, speculators opened approximately the same number of long and short contracts. Thus, in general, the changes are insignificant. The mood of speculators became a little more "bearish", but again slightly. There are even fewer changes in other categories of traders. The most important thing I would like to note is that the mood of major players is not becoming more "bullish", which means that the COT report does not indicate a resumption of the upward trend now.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with a target of 1.1920, if the rebound from the level of 161.8% (1.2027) on the 4-hour chart is completed. Purchases of the pair had to be opened by fixing quotes above the side corridor on the 4-hour chart with the target level of 1.2027. However, it may take several days for the pair to reach their destination.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română