Past review for the EUR/USD pair

There was almost no activity for the EUR/USD pair yesterday, since American traders, which are the key players in the market, were not around as they celebrated Thanksgiving.

Trading volumes declined, resulting in a daily activity of only 55 points.

For the economic calendar, the only data that were published was in Europe, which the market mostly ignored. Initially, a report on the EU lending market was released, where consumer lending in October remained at 3.1%, but the aggregate money supply increased from 10.4% to 10.5%.

Market participants paid special attention to the publication of the ECB's minutes of their last meeting. According to it, the regulator does not plan to sit without action while facing the second wave of pandemic.

There is no new information from the minutes, since the ECB already announced during their October meeting that they plan to act in December with new measures – they initially talked about buying bonds and subsidizing loans to banks.

What happened on the trading chart?

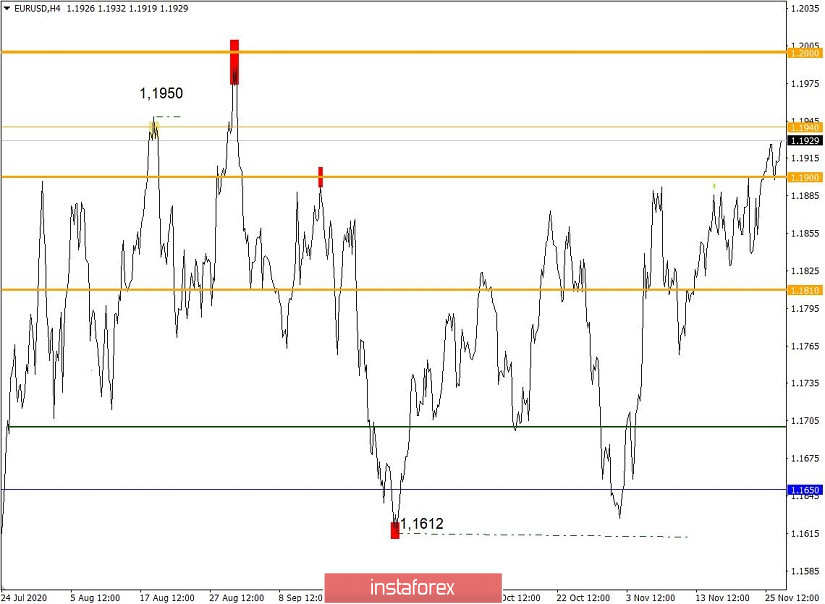

The quote of the EUR/USD pair reached the level of 1.1940 during the inertial growth, which was followed by a pullback in the direction of the level of 1.1900. As a result, the quote remains above the level of 1.1900, showing low activity.

Past review for the GBP/USD pair

Similarly to the entire market, the pound was subject to low activity yesterday due to the same reason – absence of key players (American traders).

The economic calendar was also empty. Statistics from the UK and the US were not released, so the market followed technical analysis.

What happened on the trading chart?

It is noteworthy that the quote of GBP/USD pair has been moving in a sideways channel of variable limits for a week, particularly in the price levels of 1.3300/1.3400. The price rebound from the set boundaries has developed a natural basis in the market. Yesterday, the quotes was seen approaching the level of 1.3400, where a slowdown occurred, followed by a rebound.

During the rebound pattern, we had the opportunity to earn on the sale of the pound against the US dollar, which is around 50 points.

Trading recommendations for EUR/USD pair on Nov 28

Considering the economic calendar, the preliminary inflation data in France is the only data that was released, where they record an increase of 0.2%, but this is not the overall figure for the EU. Therefore, the market ignored this.

We have a shorter trading day today due to the continuation of Thanksgiving. Thus, this could also affect trading volumes.

Technically, the quote is above the level of 1.1900, which gives hope to buyers for further growth. It should be recalled that the price of the euro extremely strengthened this month (more than 300 points), and the quote moves within the upper limit of the 17-week sideways channel. This means that the coordinates of 1.2000 serve as a critical point for buyers. A price consolidation above the level of 1.1950 can set a local move towards 1.2000, but it is suggested to be cautious, since a reversal may occur.

At the same time, it is not excluded that the quote may go into a stagnation stage, which will be expressed in an amplitude of 1.1890/1.1840.

Trading recommendations for GBP/USD pair on Nov 28

Statistics for the UK and the US is not observed today in terms of the economic calendar.

From a technical viewpoint, the situation has not changed. The quote is still within the variable range of 1.3300/1.3400.

The tactics associated with the price levels of 1.3300 and 1.3400 remain unchanged. It is possible to open a deal, following the natural basis of the rebound from the border area, and working on the breakdown of a particular border.

It should be considered that speculators are attentive to a long price movement along the sideways course, which can eventually lead to high activity at the time of exiting the sideways movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română