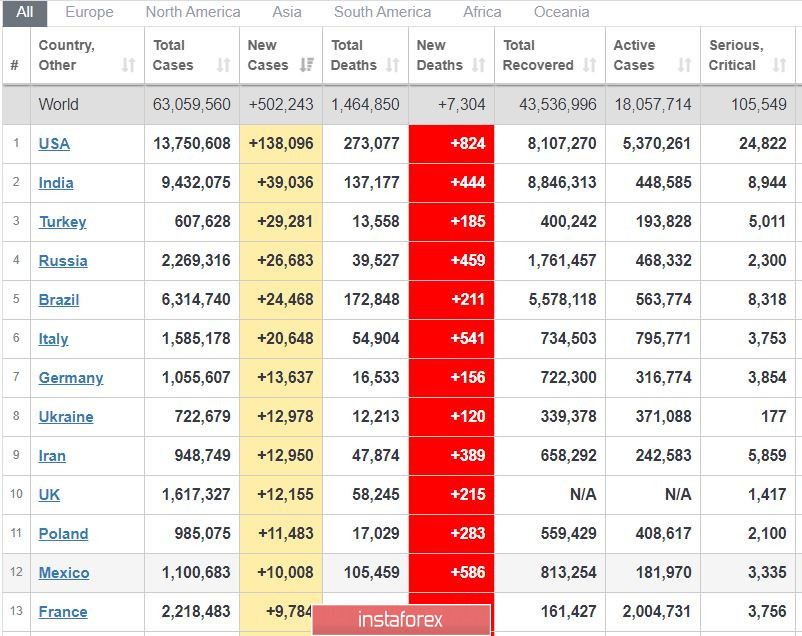

It seems that the growth in global COVID-19 incidence has stopped. The latest data only to 502,000, which is about 20-25% below the highest daily rate.

In the United States, new cases have dropped to 138,000 which is 30% below the highest record.

In Europe, although the situation is bad in Turkey, there are signs of stabilization in other countries. The Czech Republic even started to ease its quarantine restrictions.

A new wave of growth is forming in the US market, but it will not be as large and fast as wanted. Because of this, it is best to wait for a strong pullback before starting to sell.

Two important reports are also scheduled to come out in the US this week, and these are ISM indices and employment reports.

EUR / USD - The weekly candle closed very bullish, so the euro is likely to rise further.

Open long positions from 1.1920.

Open short positions from highs (but risky), or from the level of 1.1880.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română