Outlook on November 30:

Analytical overview of major pairs on the H1 TF:

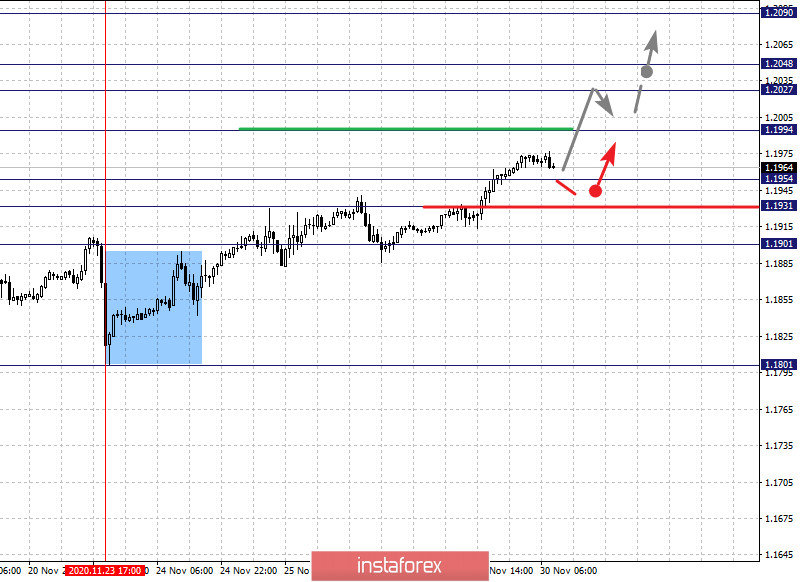

The key levels for the euro/dollar pair are 1.2090, 1.2048, 1.2027, 1.1994, 1.1954, 1.1931 and 1.1901. The ascending trend from November 23 is being followed here. Now, the upward movement is expected to resume after breaking through the level of 1.1994. In this case, the target is 1.2027. On the other hand, there is a short-term growth and consolidation in the range of 1.2027 - 1.2048. As a potential value for the top, the level of 1.2090 is considered. A downward pullback is expected upon reaching this level.

A short-term decline, in turn, is possible in the range of 1.1954 - 1.1931. If the last value breaks down, a deep correction will occur. The target here is 1.1901, which is the key support level for the top.

The main trend is the local upward trend of November 23

Trading recommendations:

Buy: 1.1995 Take profit: 1.2027

Buy: 1.2028 Take profit: 1.2047

Sell: 1.1954 Take profit: 1.1932

Sell: 1.1929 Take profit: 1.1901

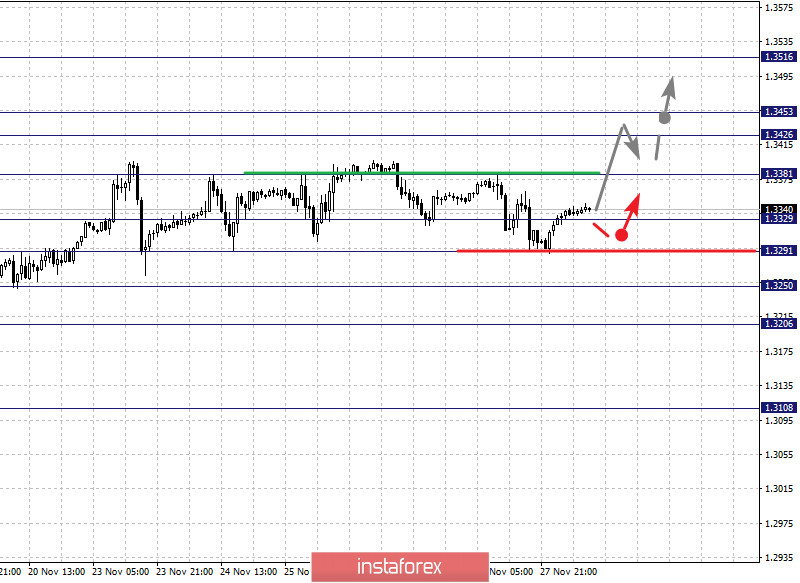

The key levels for the pound/dollar pair are 1.3516, 1.3453, 1.3426, 1.3381, 1.3329, 1.3291, 1.3250 and 1.3206. Here, we are following the rising trend from November 13. The pair is expected to continue rising after the level of 1.3381 breaks down. In this case, the target is 1.3426. Meanwhile, price consolidation is in the range of 1.3426 - 1.3453. As a potential value for the top, we consider the level 1.3516. A downward pullback is expected upon reaching this level.

On the other hand, a short-term decline is expected in the range of 1.3329 - 1.3291. In case that the last value breaks down, a deep correction will occur. The target here is 1.3250, which is a key upward support level. If this target breaks down, it will lead to the development of a downward trend. In this case, the potential target is 1.3206.

The main trend is the upward trend from November 13

Trading recommendations:

Buy: 1.3381 Take profit: 1.3426

Buy: 1.3454 Take profit: 1.3516

Sell: 1.3329 Take profit: 1.3292

Sell: 1.3289 Take profit: 1.3250

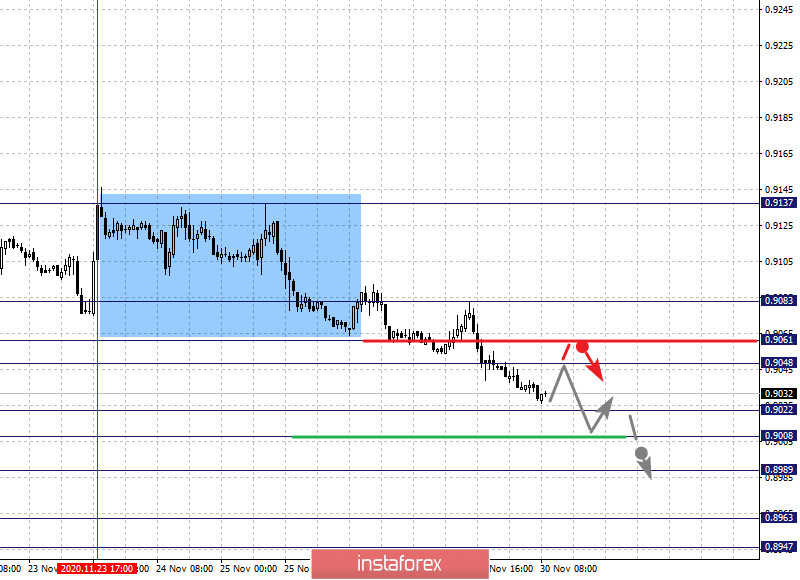

The key levels for the dollar/franc pair are 0.9083, 0.9061, 0.9048, 0.9022, 0.9008, 0.8989, 0.8963 and 0.8947. The formation of the downward trend from November 23 is being followed here. Therefore, a short-term decline is expected in the range of 0.9022 - 0.9008. In case that the last value breaks down, the pair can further move towards the level of 0.8989. Upon reaching which, price consolidation and upward pullback can be expected. In turn, the breakdown of the level of 0.8989 should be accompanied by a strong decline. Here, the potential target is 0.8947. Upon reaching which, consolidation is expected in the range of 0.8947 - 0.8963, as well as a pullback into the correction.

A short-term growth is possible in the range of 0.9048 - 0.9061. In case of breakdown of the last value, it will lead to a deep correction. The target is 0.9083, which is a key support for the downward trend.

The main trend is the downward trend from November 23

Trading recommendations:

Buy : 0.9048 Take profit: 0.9060

Buy : 0.9063 Take profit: 0.9081

Sell: 0.9022 Take profit: 0.9009

Sell: 0.9007 Take profit: 0.8990

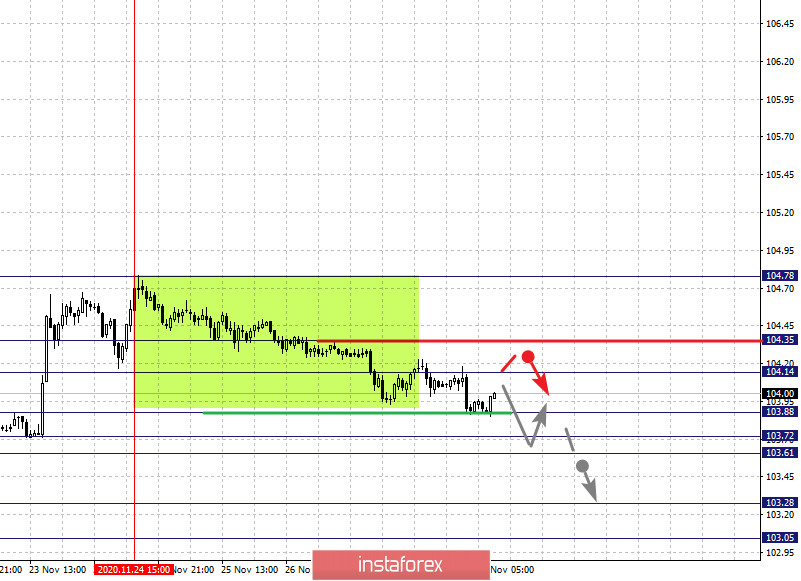

The key levels for the dollar/yen are 104.78, 104.35, 104.14, 103.88, 103.72, 103.61, 103.28 and 103.05. Here, the price is forming a potential downward trend from November 24. The price is expected to decline after breaking through the level of 103.88. In this case, the target is 103.72 and price consolidation is expected near this level. If the price passes the noise range 103.72 - 103.61, it will lead to a strong decline. Here, the target is 103.28. For the potential value for the bottom, we consider the level of 103.05. Upon reaching which, price consolidation and upward pullback is expected.

Meanwhile, a short-term increase is possible in the range of 104.14 - 104.35. A breakdown of the last value will favor the development of an upward trend. Here, the potential target is 104.78.

The main trend is the formation of the downward trend from November 24

Trading recommendations:

Buy: 104.14 Take profit: 104.35

Buy : 104.37 Take profit: 104.76

Sell: 103.86 Take profit: 103.72

Sell: 103.60 Take profit: 103.30

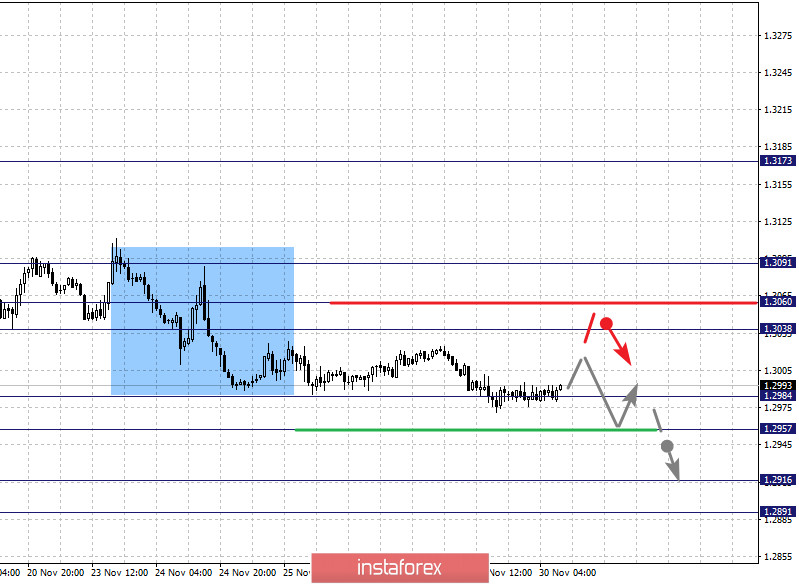

The key levels for the USD/CAD pair are 1.3091, 1.3060, 1.3038, 1.2984, 1.2957, 1.2916 and 1.2891. The continuation of the downward trend from November 13 is being followed here. Now, a short-term decline is expected in the range of 1.2984 - 1.2957. In case that the last value breaks down, it will lead to a strong decline. The target here will be 1.2916. For the potential value for the bottom, we consider the level of 1.2891. Upon reaching which, price consolidation and upward pullback are expected.

A short-term growth, on the other hand, is likely in the range of 1.3038 - 1.3060. In case that the last value breaks down, a deep correction will occur. Here, the target is 1.3091, which is a key downward support level.

The main trend is the downward trend of November 13

Trading recommendations:

Buy: 1.3038 Take profit: 1.3058

Buy : 1.3061 Take profit: 1.3090

Sell: 1.2982 Take profit: 1.2958

Sell: 1.2955 Take profit: 1.2917

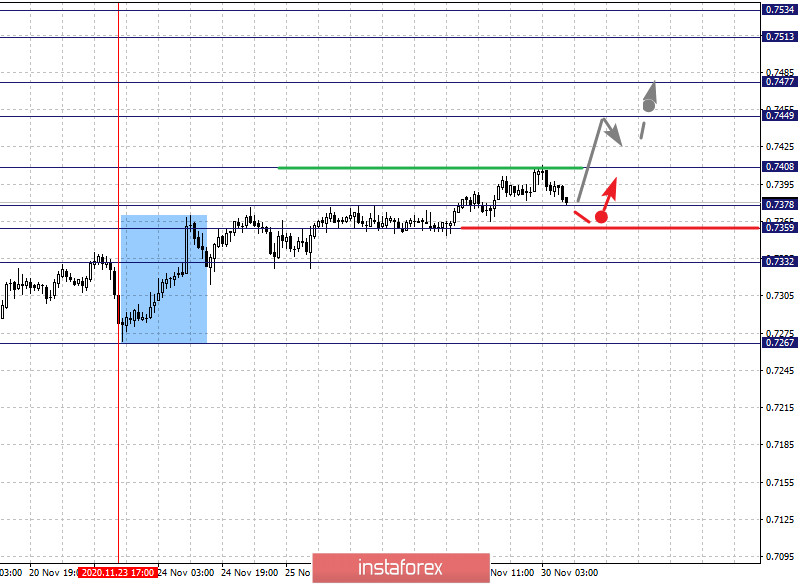

The key levels for the AUD/USD pair are 0.7534, 0.7513, 0.7477, 0.7449, 0.7408, 0.7378, 0.7359 and 0.7332. Here, we are following the local bullish pattern from November 23. In this regard, the pair is expected to continue rising after breaking the level of 0.7408. In this case, the target is 0.7449. On the other hand, there is a short-term growth and consolidation in the range of 0.7449 - 0.7477. If the last value breaks down, it will lead to a strong growth. Here, the next target is 0.7513. For the upward potential value, we consider the level of 0.7534. Price consolidation and downward pullback is expected after this level is reached.

In turn, a short-term decline is expected in the range of 0.7378 - 0.7359. The last value being broken will lead to a deep correction. Here, the target is 0.7332, which is a key support for the top.

The main trend is the local upward trend of November 23

Trading recommendations:

Buy: 0.7410 Take profit: 0.7449

Buy: 0.7452 Take profit: 0.7476

Sell : 0.7378 Take profit : 0.7360

Sell: 0.7357 Take profit: 0.7332

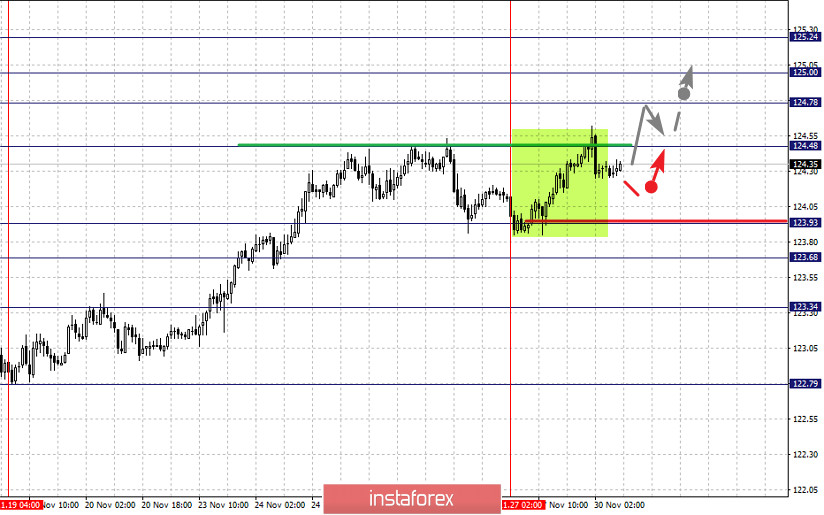

The key levels for the euro/yen pair are 125.24, 125.00, 124.78, 124.48, 123.93, 123.68 and 123.34.The upward course from November 19 is closely monitored here. Thus, we expect the pair to further rise after the breakdown of the level of 124.48. In this case, the target is 124.78. On the other hand, there is a short-term growth and consolidation in the range of 124.78 - 125.00. For the upward potential value, we consider the level 125.24. A downward pullback is expected upon reaching this level.

A short-term decline is likely in the range of 123.93 - 123.68. If the last value breaks down, it will lead to a deep correction. The target is 123.34, which is the upward key support level.

The main trend is the upward trend of November 19

Trading recommendations:

Buy: 124.50 Take profit: 124.78

Buy: 124.80 Take profit: 125.00

Sell: 123.92 Take profit: 123.69

Sell: 123.67 Take profit: 123.36

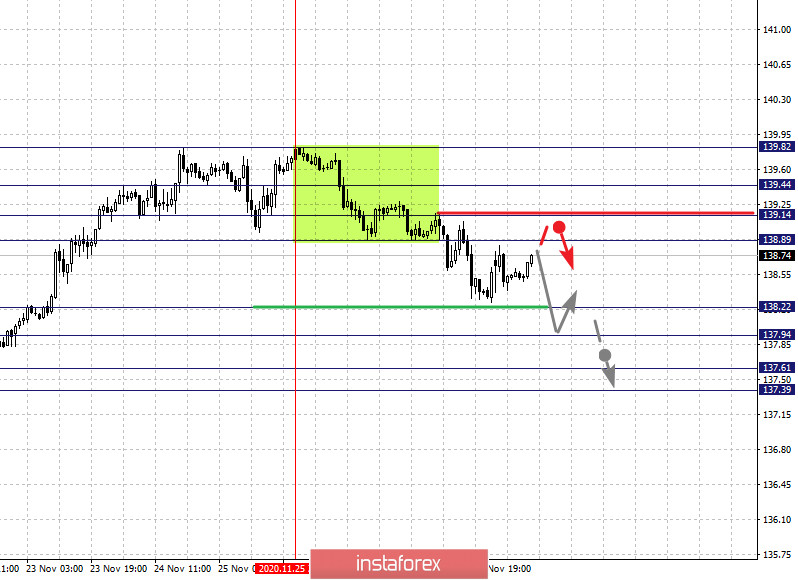

The key levels for the pound/yen pair are 139.82, 139.44, 139.14, 138.89, 138.22, 137.94, 137.61 and 137.39. The development of the downward trend from November 25 is being followed here. Against this background, a short-term decline is expected in the range of 138.22 - 137.94. If the last value breaks down, a strong decline will occur. Here, the target is 137.61. For the potential value for the bottom, we consider the level 137.39. Upon reaching which, an upward pullback is likely.

A short-term growth, in turn, is possible in the range of 138.86 - 139.14. If the last value breaks down, it will lead to a deep correction. Here, the target is 138.44, which is a key support for the downward trend.

The main trend is the formation of a downward trend from November 25

Trading recommendations:

Buy: 138.89 Take profit: 139.13

Buy: 139.16 Take profit: 139.44

Sell: 138.22 Take profit: 137.95

Sell: 137.92 Take profit: 137.61

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română